Mining M&A

Mining mergers and acquisitions (M&A) continues to increase in volume and value in 2023. Demand for basic materials is growing, this is a primary M&A driver. Cash-rich miners use acquisition to fund resource, reserve and production base expansion. A secondary and possibly equally important M&A driver is sustainability. We explore the factors fueling mining M&A activity, from the green energy transition to the need for reserve replacement.

- Green energy transition: The metals and mining industry is central to the global transition to carbon net zero. The emphasis in recent years on reaching net zero has increased demand for many metals including copper, nickel, lithium and cobalt that are central to enabling the practical transition to a net zero global economy.

- Accelerating demand growth for critical metals is in general outpacing supply expansion (a slow process in mining) has intensified M&A activity.

- Decarbonization efforts: Mining companies are actively working towards reducing their carbon footprint and divesting from high carbon-emitting commodities such as coal. (For example, major mining player Vale (NYSE:VALE, MCAP~US$60.9bn and energy transition business Kibo Energy (KIBO.L)).

- VALE plans to become carbon-neutral by 2050.) Mining companies adopting a more sustainable approach are adding ‘green’ investors to their investor base. Mining companies are also expanding the proportion of base metals in their portfolios, largely by M&A, to create greener operations.

- New entrants: Automakers and chemical suppliers are beginning to take or consider a vertical approach to their businesses. As part of their vertical integration strategies automakers and chemical suppliers are entering the mining sector to secure their own stable supply of essential critical minerals [link to blog: https://acfequityresearch.com/ev-battery-vertical-integration-the-automakers-solution/].

- Automakers such as General Motors (NYSE:GM, MCAP ~US$50bn), Ford (NYSE:F, MCAP ~US$51.7bn), BMW (XETRA:BMW, MCAP ~EUR70bn), Stellantis (NYSE:STLA, MCAP ~US$49.5bn) have made large investments in the direct financing of mines, emphasizing their commitment to securing essential resources for electric vehicle (EV) production.

- Reserve replacement: Miners need to replace their reserve horizons to maintain investor interest. M&A is a short cut to replacing reserves when compared to the process of prospecting, evaluating and development, which is costly, fraught with investor risk (though compensated by very high potential RoI) and time consuming. In summary…for a large mining producer, M&A is cheaper, faster and comes with less risk.

Notable mining M&A case studies 2023

Newmont Corp.’s (NYSE: NEM, MCAP ~US$33.3bn) acquisition of Newcrest Mining Ltd. (ASX:NCM, MCAP~A$23.7bn) Newmont has proposed ~US$19bn to acquire Newcrest Mining. While the deal would solidify Newmont’s position as the world’s largest gold miner, it would also increase Newmont’s exposure to copper. The consolidation showcases the industry’s trend for large companies seeking scale and critical minerals to support the green energy transition.

BHP’s (NYSE:BHP, MCAP~US$211bn) takeover of Oz Minerals (private) BHP’s US$6.4bn takeover of Oz completed in May 2023 (acquiring 100% ownership by a 49% premium to average close) was a strategic designed to develop BHP’s copper and nickel portfolio. The takeover was also in line with the growing demand for critical minerals to support the energy transition and BHP’s commitment to meet resource requirements for sustainable technologies.

Allkem Ltd’s (ASX:AKE, MCAP ~A$9.8bn) merger with Livent Corp (NYSE:LTHM, MCAP ~US$4.6bn)

Allkem Ltd and Livent announced a merger via an all-stock deal worth US$10.6bn in May 2023 to create the world’s third-largest lithium producer. The Allkem/Livent merger capitalizes on the increasing demand for lithium, a key component for electric vehicle batteries, and positions the combined entity as a significant player.

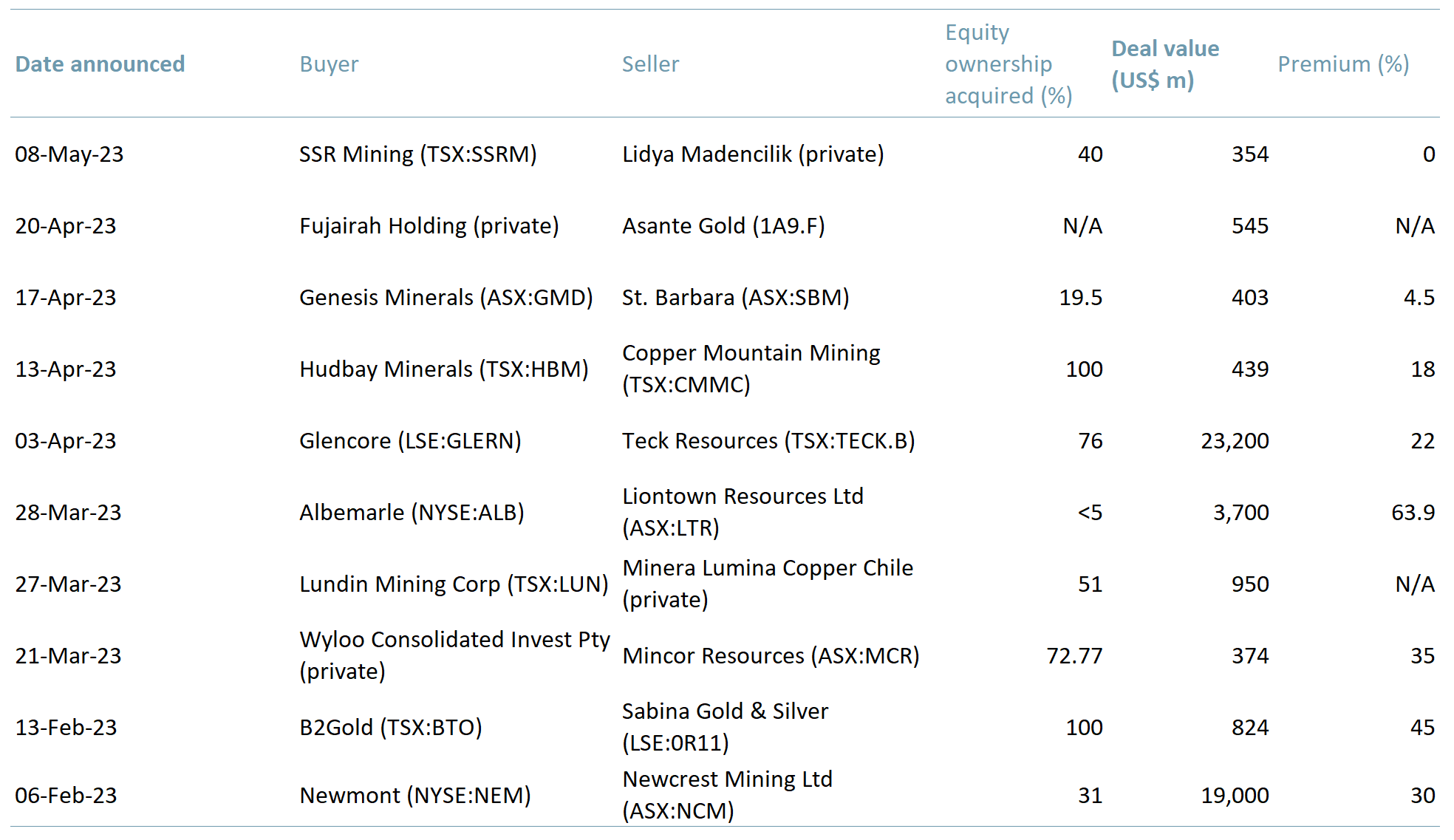

Exhibit 1 – Other major mining M&A deals 2023

Sources: ACF Equity Research; FactSet; Company reports.

Sources: ACF Equity Research; FactSet; Company reports.

Mining M&A ACF Outlook

Whilst there are some short term headwinds for mining deal making, that could see 2H23 deal making cool rapidly (macroeconomic factors including inflationary pressures and labor shortages) – the long-term prospects (and M&A drivers) for the materials sector remain bright.

We assess that what we are observing now is part of a long-run upswing trend in mining dealmaking activity. We infer that it is a long run trend for at least two key reasons:

- It is supported by the current geopolitical tensions as global governments rush to secure critical minerals/resources local supply chains;

- Perhaps most importantly, deal making is driven by the rapidly accelerating demand for raw materials required for sustainable energy technologies. The sustainability driver in particular suggests that we are entering either a very long and or a rather hot M&A cycle.

Investors should remind themselves that hot M&A cycles come with attendant significant overpayment risks – beware all cash overs with huge control premiums – note that long run average successful all cash M&A control premiums seem to run at around 40%).

In spite of hot M&A all cash deal market risk, whilst demand outpaces supply for green energy metals, M&A is a key strategy for cash-rich mining companies to bridge the gap and seize growth opportunities.

This mining M&A cycle will, in our assessment, reshape the metals and mining industry driven by decarbonization efforts, the green energy transition and technological innovation made possible by economies of scale and the need to deliver operational and risk efficiencies to justify cash premia.

Author: Garvit Bhandari – Garvit is a Senior Staff Analyst at ACF Equity Research See Garvit’s profile here