Steel industry stalling green transition

Green steel raw materials, such as direct reduced iron (DRI) and other green technology metals are in short supply. Covid-19 lockdowns between 2020 and 2021 have exacerbated a more general raw materials supply shortage.

C-19 has affected raw material supply by disrupting labour across the globe, in turn severely reducing productivity and so production of all feed stock raw materials for the steel industry.

Raw materials production has suffered a short term acute impact from C-19, but we expect green metals and DRI supply to remain in structural deficit for several years post covid. As a result of the structural raw materials (commodities) deficits, raw materials prices will continue their overall upward trajectory.

The DRI and green technology metals supply deficit may be a temporary cause for concern for investors, but there is larger issue that overshadows the steel and other metals foundry industry – its carbon footprint.

In this ACF analytical blog we focus on investment opportunities in iron ore production in the steel industry and what steel making companies are doing to improve their carbon footprint.

Green technology alternatives for iron production processes exist. We expect these green steel technologies to grow their production market share more rapidly than the steel industry expects.

The steel industry has recently woken up to sustainability and is scrambling to meet net-zero emission targets by 2050.

DRI – a green raw material for steel makers?

- The current raw material shortage could limit the growth of DRI. DRI accounts for ~5% of metallics used in the global steelmaking process (98% of iron ore is used in steel making).

- DRI is produced from the direct reduction of iron ore using natural gases such as carbon monoxide (CO), which is poisonous. However, newer technology enables DRI production using hydrogen – i.e. creating a potential for green steel.

- Hydrogen-based DRI is a major decarbonization lever for steelmakers – especially in the EU where a number of companies have plans to introduce DRI.

- Growing the DRI industry will require a significant shift in the steel manufacturing process as well as an upgrade of existing infrastructure – increasing the use of lower-quality sources of iron (e.g. scrap metal) for use in electric arc furnaces.

Raw material supply chain stretching

Mining and processing facilities forced to shut down due to lockdown restrictions were unable to maintain normal operations with labour shortages causing the most disruption.

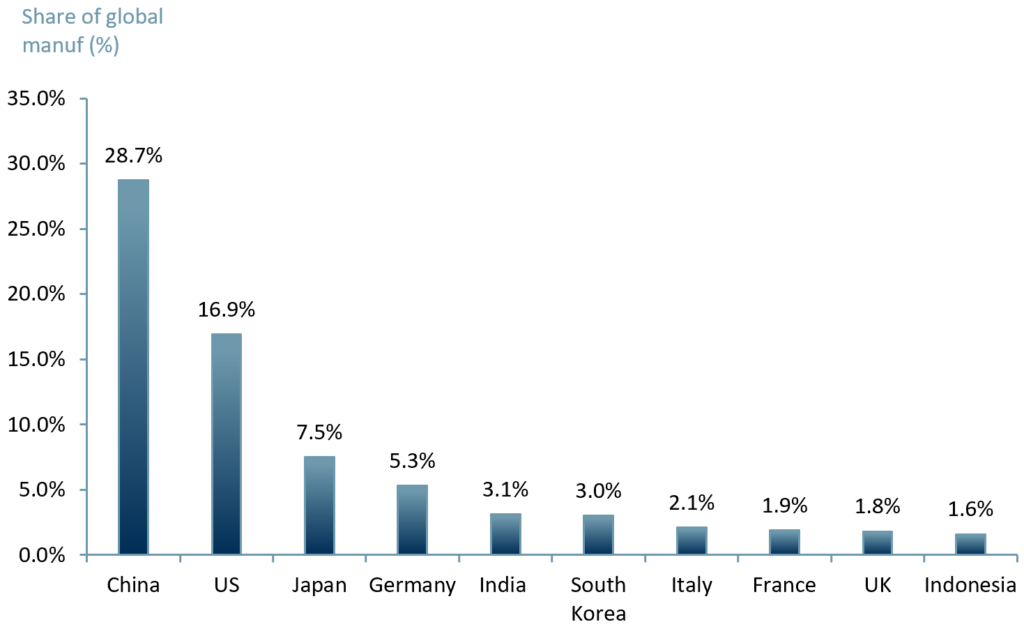

China and the US are the top processers of raw materials (exhibit 1). At the start of the pandemic China (starting with Wuhan) closed its doors for 76 days.

As a result of the new Delta variant, Beijing and other cities are currently facing lockdown restrictions again.

Although restrictions were lifted in the US, the US remains #1 for the most Covid cases globally, and Covid cases in the US continue to rise.

Exhibit 1 – Top 10 countries by share of global raw material manufacturing output 2019A

Sources: ACF Equity Research Graphics; UN Statistics Division; Note: Output measured on value-added basis in USD

Sources: ACF Equity Research Graphics; UN Statistics Division; Note: Output measured on value-added basis in USD

Although raw materials exports from China for June 2021 grew by 32% y/y, customs officials are not as optimistic about July’s data and warn of uncertainties.

While the US has consistently recorded a trade deficit for the past 25+ years, it expanded to a record US$75.7bn in June, up 6.7% m/m. While there has been a surge in US consumer demand (consumption of raw materials), US exports only rose by 0.6%.

As European economies reopen, they too are facing the consequences of raw materials shortages.

In the UK, for example, as construction begins to ramp up, a steel shortage has become evident.

The suggestion is that the UK steel shortage (and so by inference raw materials shortage) is not limited to the UK. Richard Warren, Head of Policy for UK Steel, said recently that the steel shortage is a “global phenomenon”.

Diversifying production processes in the steel industry may alleviate the structural raw materials deficit over time, but it won’t solve today’s immediate supply issues.

Nevertheless, if the steel industry moves towards green hydrogen-based DRI feed stocks, the sector will become more sustainable. Green hydrogen DRI is also a potential future solution for alleviating steel industry bottlenecks.

Pig Iron vs. DRI

Pig Iron (Fe), more commonly known as crude iron, is formed from smelting (melting) iron ore or scrap in a blast/metallurgical furnace. The blast furnace energy comes from carbon based fuels.

Pig iron, the solid metal form, is a moulded cast made from the molten material found in the blast furnace. Pig iron is the ‘raw material’ used for iron and steel making.

Blast furnaces are considered emissions and energy inefficient relative to alternative processes, as they require coke – fuel containing a high carbon content made from heating coal or oil.

Coke made from oil as a raw material is referred to as petcoke and comes in four structures or grades – blast furnaces can use fuel grade petcoke, which is sponge coke or shot coke. The steel industry also consumes electrodes produced from petcoke of a type referred to as needle coke or acicular coke.

Petcoke has 80% more carbon in it and a higher energy content than coal as a raw material, but it emits 30-80% more CO2 than coal per kg.

The use of the blast furnace process for iron and steel production is a significant issue for climate change. Globally, the iron and steel industry accounts for ~5% of CO2 emissions, which is more than the total % of global CO2 emissions from the UK, France and Germany combined in 2019.

According to the IEA, for the steel industry to align itself with the IEA Sustainable Development Scenario, carbon emission levels must fall by an average of 2.5% p.a. over this decade.

DRI – also known as sponge iron, has a more energy (and potentially emissions) efficient production process. DRI uses electricity as its source of heat for iron purification/extraction.

DRI is so-called because it is a process that removes oxygen from solid state iron (e.g. pellets, furnace dust, etc.). Unlike a blast furnace, no melting is involved in making DRI.

In the DRI process, the iron oxides are reduced into metallic iron at temperatures below iron’s melting point, i.e. 1,200 °C (2,190 °F). The reducing agents can be the gases hydrogen (H2) and CO.

DRI or sponge iron is usually created using electric arc furnaces (EAF). DRI produces raw material iron using 100% scrap/waste/obsolescent metal, instead of iron ore.

EAFs can use coke for energy, but for DRI they use electricity transmitted through graphite electrodes to create an electric arc (an electrical breakdown of a gas that produces an electrical discharge). DRI is considered more efficient because it does not use coke directly and ‘recycles’ scrap metal.

However, from a CO2 emissions perspective, it is important that the electricity generated for an EAF iron and steel making process and the hydrogen used as a reducing agent are green.

The current DRI process is reliant upon electricity from coal-fired power plants. Coal fired electricity generation globally accounted for ~30% of CO2 emissions in 2019 – IEA.

The EU is the second largest global steel producer (after China) at 7.4% and accounts for ~22% of steel related CO2 emissions (World Steel Association).

A steel making green metals/tech shift

Several companies have already started exploring using hydrogen as an alternative source of fuel for producing steel, and at the heart of this initiative is DRI.

Swedish $SSAB, LKAB (govt. owned) and Vattenfall (govt. owned) have built a pilot DRI plant that will begin trials in 2021. SSAB, LKAB and Vattenfall are using ‘green’ hydrogen gas instead of coal in their DRI pilot plant.

Swedish steel maker $SSAB says that the raw material green hydrogen gas used in the DRI pilot plant will be sourced from an electrolysis facility generated by hydropower. The only gaseous output will be water.

Green hydrogen requires catalysts such as platinum and palladium of the platinum group metals (PGM). Green metals raw materials such as PGM are also in supply deficit.

The supply of platinum and palladium is dominated by a small number of regions (South Africa, Russia, North America). In addition, only a small number of companies control the potential platinum group green metals reserves base (Norilsk Nickel (GMKN.ME), Anglo American Platinum (AMS.JO), Sibanye Stillwater (NYSE:SBSW), Impala Platinum (IMP.JO), Northam Platinum (NHM.JO), Eurasia Mining (EUA.L)).

ArcelorMittal, which currently owns the only DRI facility in Europe (Hamburg, Germany), plans to build a second DRI raw material processing facility that will run solely on hydrogen. The estimated cost of ArcelorMittal’s second DRI facility is ~€110m.

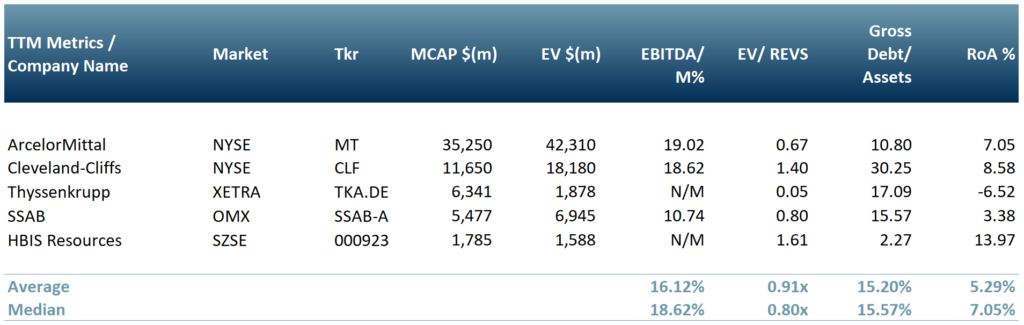

In exhibit 2, we compare five public steel producing companies that are currently planning or have DRI facilities under construction – ArcelorMittal (NYSE: MT), Cleveland-Cliffs (NYSE : $CLF), Thyssenkrupp ($TKA.DE : XETRA), SSAB AB (SSAB-A.ST : STO) and HBIS (000709.SZ).

Exhibit 2 – Peer group of steel companies moving involved DRI production

Sources: ACF Equity Research Graphics; Refinitiv; Notes: Exchange rates: (Source: XE.com) SEK vs USD: 0.1160; EUR vs USD: 1.1809; CNY vs USD: 0.1546.

Sources: ACF Equity Research Graphics; Refinitiv; Notes: Exchange rates: (Source: XE.com) SEK vs USD: 0.1160; EUR vs USD: 1.1809; CNY vs USD: 0.1546.

Closing the green steel cost gap

We infer that green steel is the future of the steel industry, both economically and from a sustainability perspective. However, producing sustainable low-emission steel products from raw materials and scrap will currently cost ~20-50% more than steel produced using grey energy and grey hydrogen.

For green steel, economies of scale over time will reduce the current ~20-50% higher production cost compared to grey steel.

In the interim, there have been suggestions from interested parties that carbon pricing could bridge the green steel increased cost gap, however, a global carbon pricing mechanism does not yet exist.

According to the World Economic Forum (WEF), using green steel in an automobile would add an additional 1% to the car’s showroom price. In contrast, using green steel in autos could reduce auto carbon emissions by ~34%.

To transition steel making plants to green steel production over the current decade could require ~$100bn in investment – the finance community is taking note of this potential.

The Net-Zero Steel Initiative (NZSI) – a conglomerate of the top financial institutions that lend to this sector (Citi, Goldman Sachs, ING, Societe Generale, Standard Chartered, UniCredit) – have come together to create a climate-aligned agreement for the steel industry.

The NZSI is designed to ensure financial institutions are aligning their portfolios with climate targets. The release of the NZSI agreement is expected at COP26 in November.

The steel industry may find, shortly after COP26, that it can only raise finance for projects designed to produce green steel with green energy and green raw materials (green metals and green hydrogen).