Imagin Medical is a surgical imaging company focused on advancing new methods of visualizing cancer during minimally invasive procedures. The Company believes its first product, the i/Blue™ Imaging System, with its proprietary optics and light sensors, will greatly increase the efficiency and accuracy of detecting cancer for removal, helping to reduce recurrence rates. The Company’s initial focus is bladder cancer.

Imagin Medical

Value range – 23/6/2021

| Intrinsic Price ($) | 10.12 |

| Value Range Low ($) | 9.62 |

| Value Range High ($) | 10.63 |

| Implied MCAP $ (m) | 90.77 |

| Implied EV $ (m) | 94.04 |

| AIM Index | IMEXF |

| Financial YE | 30-Sep |

| Currency | CAD |

Business Activity

Endoscopic Devices

Key metrics

| Close Price (USD) | 0.42 |

| MCAP $ (m) | $3.8 |

| Net Debt (cash) ($m) | $2.7 |

| EV ($m) | $6.5 |

| 52 Wk Hi | 1.17 |

| 52 Wk Lo | 0.02 |

Key ratios

| (Net Cash) /Shareholder Equity % | 72.28% |

| FX Rate USD/GBP | 0.78 |

Healthcare Sector Research

OTC Market Index

Analyst Team

+44 20 7419 7928

healthcare@acfequityresearch.com

Company overview

Imagin Medical Inc. (OTCQB:IMEXF, CSE:IME) is a Vancouver, Canada based early stage cancer imaging company focused on developing new tools that can visualise cancer during minimally invasive procedures. The Company’s single product, i/Blue Imaging System, is a bladder cancer medical imaging device. Its white and blue light sensors detect cancer more accurately and efficiently than white light alone. i/Blue is currently undergoing FDA approval. As such IMEXF is nil revenue. Highly conservative ACF “Indicative Valuation” assumptions include 39% US bladder cancer imaging market share only, WACC 18%, Long-run FCF margin 11%, FCF Terminal value 20x.

Global cancer imaging systems market size 2019A $7,315m

Global cancer imaging systems market size 2035E $8,795m

IMEXF (lighter line) vs. OTC market price relative

An early-stage medical device company

Imagin’s flagship proprietary product, i/Blue Imaging System, is under development to enhance the visualisation of cancerous cells (first in bladder cancer), which will allow for more accurate resection of tumours and improved ‘quality of life’. The i/Blue System utilizes the optic and light sensor technology to combine white and blue light cystoscopy with fluorescing contrast agents. This simultaneously displays white and blue light images on the surgical monitor, side-by-side and in real-time, reducing risk and improving survival probabilities.

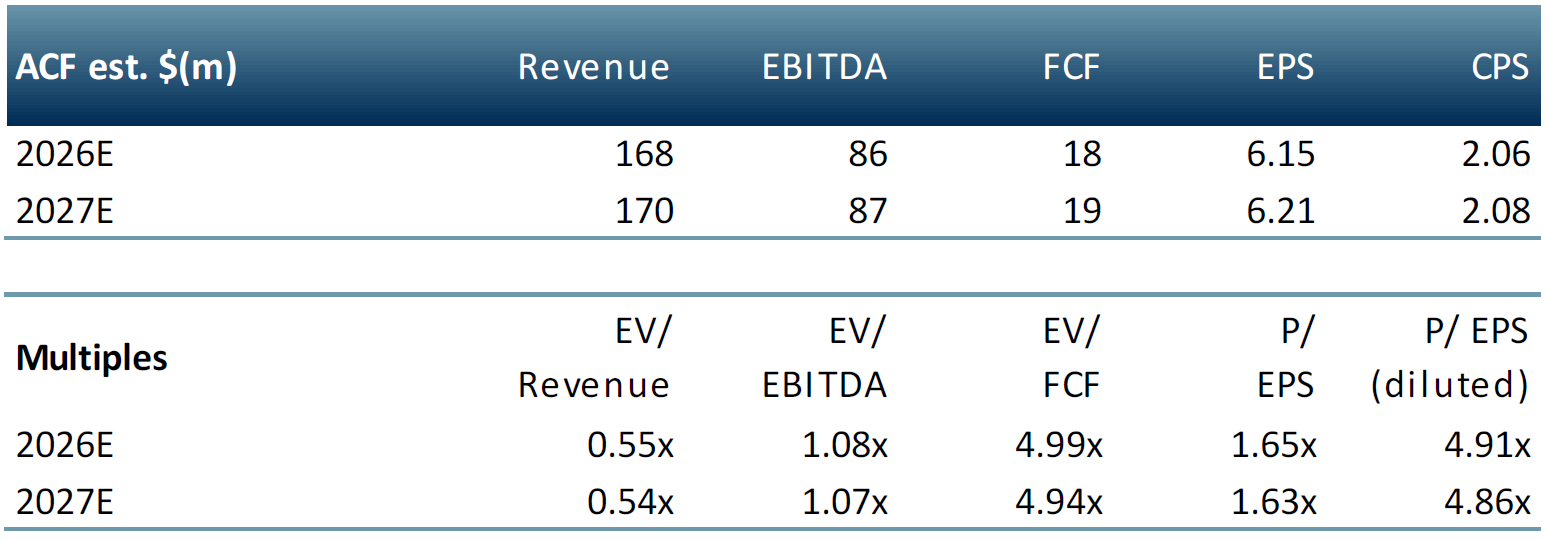

Financial Projections – Indicative Proforma

2026E vs. 2030E

+4%

Revenue 2030E $175m up 4% vs. $168m 2026E

+4%

EBITDA 2030E $89m up 4% vs. $86m 2026E

+4%

Net Income (adjusted) 2030E $57m up 4% vs. $55m 2026E

+17%

Net Cash From Operations 2030E $65m up 17% vs. $56m 2026E

➢ Convertible Loan Note tranche closed for US$ 750k 4Q20A;

➢ IMEXF is non-revenue generating;

➢ IMEXF has a single device – bladder cancer imaging technology;

➢ i/Blue Imaging is pending FDA approval;

➢ We value IMEXF device bladder cancer potential only.

Imagin Medical valuation catalysts

➢FDA approval;

➢Product Development;

➢Prototype;

➢Closing of further Convertible Loan Tranches (quasi Equity).

To see the latest Imagin Medical press releases visit their website.