PLUS is a cannabis and hemp food company focused on using nature to bring balance to consumers’ lives. PLUS’s mission is to make cannabis safe and approachable – that begins with high-quality products that deliver consistent consumer experiences. PLUS is headquartered in San Mateo, CA.

Plus Products Inc

Value range – 25/8/2021

| Intrinsic Price ($) | 9.06 |

| Value Range Low ($) | 8.61 |

| Value Range High ($) | 9.52 |

| Implied MCAP $ (m) | 378.40 |

| Implied EV $ (m) | 385.49 |

| OTC Index | PLPRF |

| Financial YE | 31-Dec |

| Currency | USD |

Business Activity

Cannabis Edibles

Key metrics

| Close Price (USD) | 0.39 |

| MCAP $ (m) | $18.3 |

| Net Debt (cash) ($m) | $24.9 |

| EV ($m) | $43.2 |

| 52 Wk Hi | 1.15 |

| 52 Wk Lo | 0.27 |

Key ratios

| (Net Cash) /Shareholder Equity % | 135.95% |

| FX Rate USD/CAD | 1.26 |

Cannabis Sector

OTC Market Index

Analyst Team

+44 20 7419 7928

cannabis@acfequityresearch.com

Company overview

Plus Products Inc. (PLPRF: OTC) (PLUS: CSE) develops, manufactures and sells cannabis-edibles with operations in California and Nevada. PLPRF branded products are sold to the regulated medicinal and recreational markets. PLPRF also manufacturers hemp CBD-infused gummies, which could legally be sold to consumers and retailers in 43 states across the US. PLPRF’s ability to manufacture accurately dosed edibles at scale with exceptional food safety standards gives the Company a competitive edge. Highly conservative ACF “Indicative Valuation” assumptions include 1% US CBD market share only, WACC 19%, long-run FCF margin 20%, FCF Terminal value 8x.

Global legal cannabis market size 2035E $782,5m

North American CBD market size 2035E $383,5m

PLPRF (lighter line) vs. OTC market price relative

Investment Case

Leading cannabis edibles branded company – PLPRF operates as a leading branded player in the cannabis edibles market in California. It is #1 gummies brand in the Bay area with a market share of ~22%. PLPRF has sold ~100 million gummies since 2018. It boasts 350+ retail and delivery partners.

A December 2020 survey carried out by Brightfield Group (US CBD data aggregator) reported the following on Plus Products:

• 63% of consumers say that PLPRF is their favorite gummy brand,

• 42% have been using PLPRF products 1+ years,

• 67% of use the brand at least once/week,

• 88% plan to buy PLPRF products again.

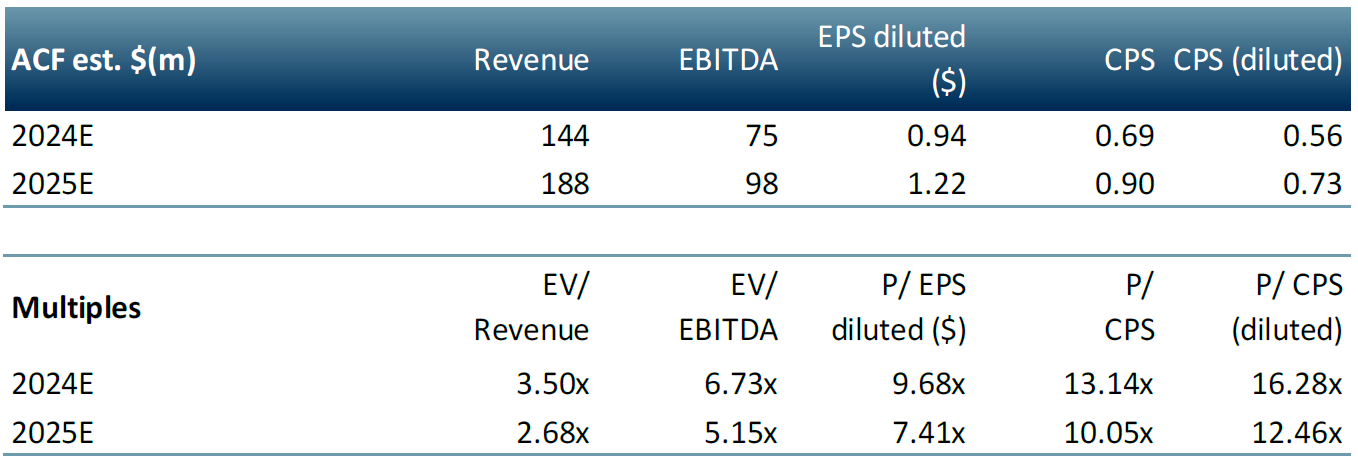

Financial Projections – Indicative Proforma

2021E vs. 2022E

+71%

Revenue 2022E $84.32m up 71% vs. $49.35m 2021E

+71%

EBITDA 2022E 43.84m up 71% vs. $25.66m 2021E

+71%

Net Income (adjusted) 2022E $28.39m up 71% vs. $16.64m 2021E

+77%

Net Cash From Operations 2022E $29.16m up 71% vs. $16.46m 2021E

➢ Revenue $2.5m 1Q21A; $15.9m in FY20A;

➢ EBIT $(2.4)m 1Q21A; $(8.3)m FY20A;

➢ Cash & cash equivalents ~$8.9m 1Q21A;

➢Medical partnerships with CannRX and TFF pharmaceuticals;

➢ Primary operations in California (largest US market).

Plus Products valuation catalysts

➢ Cannabis legalization in all US states

➢ Expansion in new jurisdictions and geographies

To see the latest Plus Products press releases visit their website.