The Reputation Exchange (REPX) is a fintech neobank / egaming company that is disrupting traditional banking by combining payment technology and the passion of billions of worldwide fans with Social Media. For sports teams, celebrities, esports leagues and brands, REPX creates the opportunity to monetize their fan bases with unique co-branded prepaid cards, debit cards and secure esports online payment catering for hundreds of millions of online fans and followers. To date, REPX has developed a large and committed portfolio of partners and iconic global brands with over 400m social media fans and followers.

The Reputation Exchange

Value range – 10/03/2021

| Intrinsic Price € | 16.47 |

| Value Range Low € | 15.65 |

| Value Range High € | 17.29 |

| Implied MCAP € (m) | 62.13 |

| Implied EV € (m) | 62.00 |

| CSE | REPX |

| Financial YE | 31-Dec |

| Currency | EUR |

Business Activity

Fintech

Key metrics

| Close Price € | 11.25 |

| MCAP € (m) | 42.40 |

| Net Debt (cash) € (m) | -€0.1 |

| EV € (m) | 42.3 |

| 52 Wk Hi € | NM |

| 52 Wk Lo € | NM |

Key ratios

| Net Debt / Shareholder Equity % | -0.21% |

Fintech Sector Research

Egaming Sector Research

Analyst Team

+44 20 7419 7928

financials@acfequityresearch.com

egaming@acfequityresearch.com

Fintec / Esports – Business Model De-risking – Valuation Raised

The Reputation Exchange (REPX) is a fintech/esports company with a strongly differentiated social engagement neobank model using affiliate marketing. With branded prepaid cards assigned to top sporting and influencer brands planned for roll-out in the next 21 months. Since our last note REPX has received: LSE standard list sign-off, conditional US OTCQX ticker approval, its first patent approval for the singing card and increased its number of cards in production by 2023, and has launched AC Milan’s Italy REPX PayFan card in Dec 21. We have recast our revenue and cost development expectations. Our subs win assumptions are highly conservative, revenue growth modest and cost assumptions aggressive. Compared to peers our valuation is modest.

Partner social selling model delivers lower SACs, higher profitability;

Partnership subscriber reach currently ~360.3m;

Three products launched, more planned in the next two years;

REPX two chip card system

The two-chip card system used by REPX conveys additional features to all its cards.

The second chip provides additional data protection for the user whilst allowing innovative marketing incentives to be provided by vendors.

REPX cards can be supplied without specifically predefined features. The feature selection can be left to the user to bespoke, according to need and preference.

Competitive Positioning

While there are a number of neo and challenger banks (the largest include nuBank, Chime, N26, Monzo and Revolut) that offer prepaid cards and other services, REPX has a particularly innovative and fortified positioned due to its social engagement model.

Through REPX’s co-branded prepaid cards in partnership with the world’s most iconic sports teams, fashion houses, celebrities and cities, REPX engages with a multitude of followers and fans.

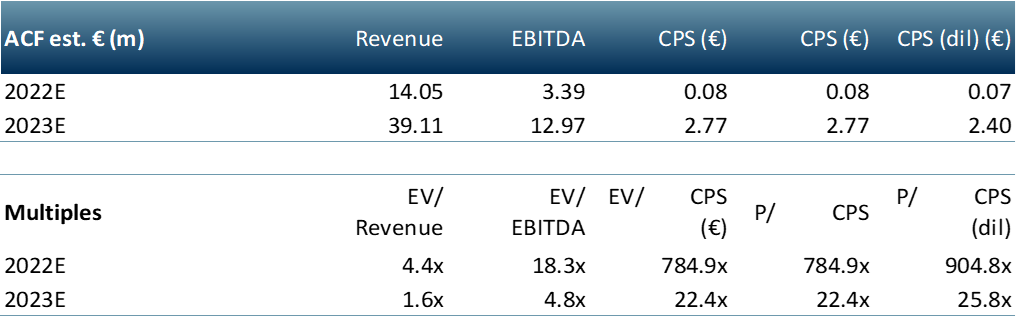

REPX Valuation Estimates – 2022E to 2023E

+178%

Revenue 2023E €39.11m up 178% vs. €14.05m 2022E

+283%

EBITDA 2023E €12.97m up 283% vs. €3.39m 2022E

+285%

Net Income 2023E €9.93m up 285% vs. €2.58m 2022E

+499%

Net Cash from Operations 2023E €9.55m up 499% vs. €1.74m 2022E

If you are a company who would like to discuss working with us call +44 20 7419 7928 or email Christopher Nicholson at cnicholson@acfequityresearch.com