Market Drivers U3O8 – update Oct 2021 – Uranium’s (U-235) main use is as a fuel in the production of electricity by nuclear power stations. Though uranium is around 100x more common than silver, U-235 makes up only approximately 0.7% of natural uranium. The uranium market is complex, illiquid (thinly traded) and opaque. Directly or indirectly state-controlled producers account for up to 68% of global production based upon YE18A data (NEA, IAEA), down 2% vs. our 2019 analysis. The top 10 mines produce 55% of all Uranium, up 4% vs. 2019. State control of production means the majority of players do not have to follow economic logic. The primary trading instrument is yellow cake (U3O8).

Uranium Market

Commodity prices – 13/10/2021

| Uranium | |

| Current Price USD | 40.20/lb |

| Brent Crude Oil | |

| Current Price USD | 83.18/bbl. |

| WTI Crude Oil | |

| Current Price USD | 81.08/bbl. |

Metal prices – 13/10/2021

| Copper | |

| Current Price USD | 445.50/lb |

| Gold 100oz | |

| Current Price USD | 1,794.90 t/oz |

Extractives Sector

Analyst Team

+44 20 7419 7928

extractives@acfequityresearch.com

How the Uranium Market Functions

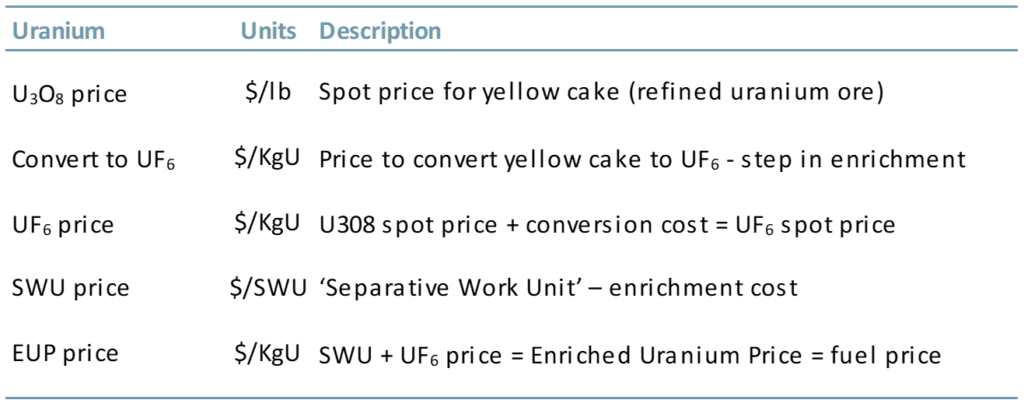

Triuranium octoxide (U3O8) or yellow cake (refined uranium ore) is the standard traded oxide of uranium. The standard traded contract unit is 250 lbs of U3O8.

The price to convert U3O8 to uranium hexaflouride (UF6), which is a step towards making uranium fuels, is implied through the pricing of UF6.

Enriched uranium (EUP), which is nuclear fuel, is priced via the cost to enrich UF6 to EUP. The cost to enrich is quoted in SWU. From the inferred UF6 spot price and the SWU spot price it is possible to infer an EUP spot price.

Unlike most commodities, uranium (U) is not traded on the open market, nor is it governed by the typical supply and demand pricing mechanism. The uranium market is comprised of a few key players, and there’s no real single market price

Uranium pricing mechanism

Uranium pricing is cyclical over the long run

Uranium spot prices vs. oil

— Spot Price — Brent — WTI

Uranium long-term prices vs. oil

— Long-term Price — WTI — Crude oil

➢No traditional spot or forward market;

➢Conversion market is a leading indicator for the production market;

➢Top 10 uranium mines account for 55% of production, up 4%;

➢Majority of the world’s 458 nuclear reactors are in 5 countries;

➢68% of supply – companies state-owned and in different countries with radically different politics to the majority of reactors;

➢Utility companies hold unknown or unknowable uranium reserves.

—SRUUF —Long-term Price

Uranium Price Squeeze Characteristics

Post-pandemic, uranium prices have begun to regain momentum, however this was not due to a surge in demand. As a result of Covid-19 lockdown restrictions, mines closed unexpectedly (which is different to planned closures due to lower prices) resulting in a squeeze on the supply of uranium. Because of the opacity of the uranium trading mechanism the market is constantly vulnerable to stock overhangs and squeezes.

The current squeeze suggests a supply-demand imbalance of ~50m lbs. Prices are expected to increase to $60/lb up from ~$40/lb. As of 30 Sep 2021, the long-term price of uranium had increased more than 25%, up to $42.5/lb from $33.6/lb on 26 Aug 2021. The spot price 30 Sep 2021 was $42.6/lb. This is on the back of Sprott Physical Uranium Trust Fund’s (OTCPK : SRUUF) accumulation of the metal in order to boost prices.

Top 3 uranium producers YE19A

% global supply

22%

Kazatomprom

Exchange: LSE; Ticker: KAP; T/U: 12,229

11%

Orano Group

Exchange: Private; T/U: 5,809

9%

Cameco

Exchange: TOR; Ticker: CCO; T/U: 4,754

Demand drivers: nuclear power, environmental factors, macroeconomic factors

Supply Drivers: global supply sources, Kazakhstan dominates supply, global inventories