Company Statement:Coeptis Therapeutics Holdings, Inc. (NASDAQ: COEP), together with its subsidiaries (including Coeptis Therapeutics, Inc. and Coeptis Pharmaceuticals, Inc., (collectively “Coeptis”), is a biopharmaceutical company developing innovative cell therapy platforms for patients with cancer. Coeptis was founded in 2017 and is headquartered in Wexford, PA.

Coeptis Therapeutics

Friday, 18 August 2023

| Intrinsic Price ($) | 8.43 |

| Value Range Low ($) | 8.22 |

| Value Range High ($) | 8.64 |

| Implied MCAP (m) | 256.12 |

| Implied EV (m) | 256.01 |

| Nasdaq | COEP |

| Financial YE | 31-Dec |

| Currency | USD |

Business Activity

Healthcare

Key metrics

| Close Price ($) | 1.06 |

| MCAP (m) | 26.65 |

| Net Debt (Cash) (m) | -1.82 |

| EV (m) | 24.83 |

| 52 Wk Hi | 21.42 |

| 52 Wk Lo | 1.01 |

Key ratios

| (Net Cash) /Shareholder

Equity % |

6.81% |

Healthcare Sector Research

Nasdaq Market Index

Analyst Team

+44 20 7419 7928

healthcare@acfequityresearch.com

Company Overview

Coeptis Therapeutics Inc. (NASDAQ: COEP) is now a Phase 1 clinical stage biopharmaceutical Corp focused on fighting cancer via a pipeline of potentially novel products targeting CD38+ related unmet need and solid tumor cancers. The up list to Nasdaq via the SPAC Bull Horn Holdings (BHSE) is a key milestone leaving COEP with 19,516,839 shares in issue, better liquidity and greater access to capital needed to advance its pipeline. We assess that there are multiple value drivers within COEP, including its two lead candidates (GEAR-NK and CD38+-Diagnostic) along with its IP rights to its solid tumor targeting SNAP-CAR platform (‘universal wrench’)…To read more download note

We have modelled 3 NPVs for Coeptis Therapeutics, based upon its two core therapies and single diagnostics product. SNAP-CAR accounts for 48% of our total Coeptis Therapeutics NPV.

COEP price chart (lighter line) showing share consolidation spike followed by De-SPAC redemptions on Nasdaq up list

Investment Case

Coeptis Therapeutics Inc. (NASDAQ: COEP) post the Deverra deal is now a P1 clinical stage biotech company fighting cancer using novel approaches and combinations (‘universal wrench’ technology platform) with potential for accelerated product development. The deal comes with 2 patented indications in P1 clinical stage trials (NCT04901416, NCT04900454) via Deverra’s DVX201 and an exclusive license. The deal cuts COEP’s risk profile.

Deverra Transaction was slated for 3Q23E (milestone hit on time). The exclusive license deal transforms COEP jumping it to P1 clinical. The deal adds a flexible effector cell generation platform to COEP’s flexible CAT platform, that if it works would create a significant multiplier effect in terms of the possible CAR-T/Effector Cell combinations that could be developed to address a wider range of oncological conditions. The Deverra platform has applications beyond classical oncology in virology.

Selected specific risks associated with COEP:

- COEP potential inability to maintain Nasdaq listing;

- Product/platform integration risk;

- Retention of key staff;

- Inability to create an economically viable model from license deal.

The risks above are over and above any usual deal risks and may not turn out to be exhaustive.

Uplisting to Nasdaq in 4Q22A: Under the (SPAC) Bull Horn deal, COEP was valued at USD 175m. Post Deverra COEP is more likely to receive capital to advance its product portfolio (CD38-GEAR-NK therapy and CD38-Diagnostic).

VyGen-Bio partnership – CD38-targeted products offer superior treatment options for CD38+ cancers – COEP has an existing partnership with VyGen-Bio – two technology assets targeting CD38+ cancers – CD38-GEAR-NK and CD38-Diagnostics. CD38-GEAR-NK is a cell therapy designed to protect CD38+ NK cells from destruction by anti-CD38 mAbs, a side effect of some cancer treatments….To read more download note

Operational Strategy

Coeptis Therapeutics’ strategy revolves around developing and expanding its product portfolio with an eye toward licensing and partnership with large cap pharma. COEP intends to expand its portfolio by seeking strategic partners which have novel, early-stage, and preclinical assets in a variety of therapeutic areas, including oncology and autoimmune disease.

Collaborations for Product Development: COEP has partnered with VyGen-Bio Inc to co-develop two early-stage product candidates and with the University of Pittsburgh, which gives COEP the option to license three CAR-T technologies. …To read more download note

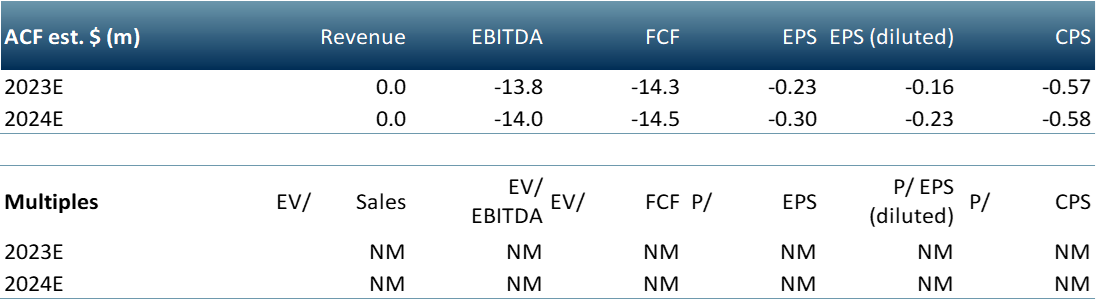

Coeptis Therapeutics Inc. Financials 2028E – 2031E

Revenue (m) vs EBITDA (m) 2028E

Revenue (m) vs EBITDA (m) 2029E

Revenue(m) vs EBITDA (m) 2030E

Revenue (m) vs EBITDA (m) 2031E

Coeptis Therapeutics Inc. Catalysts

➢ Positive Deverra deal updates

➢ Research news

➢ Positive pre-clinical results

➢ Further licensing announcements

➢ Initiation of IND studies for SNAP-CAR and GEAR-NK

Asset One

CD38-GEAR-NK

Asset Two

CD38 Diagnostic

Asset Three

SNAP-CAR