Bavarian Nordic’s (CPH: BAVA) vaccine for monkeypox (MPXV), called Jynneos, received US Food and Drug Administration (FDA) emergency usage approval 9th August 2022. The intradermal injection protects high-risk individuals over the age of 18 from the MPXV infection.

- The Monkeypox virus (MPXV) was first discovered in 1958 in laboratory monkeys, hence the name. According to scientists in the field, the main monkeypox carriers in the wild are rodents such as squirrels, rats and dormice. Rodents are of most concern.

- Monkeypox is endemic to tropical rainforest areas in Central and West Africa. The first monkeypox zoonotic (micro-organisms that are spread between humans and animals) spill over was detected in 1970 in the Democratic Republic of Congo.

- Change – Historically, the monkeypox virus has caused small outbreaks. These MPXV outbreaks were limited to a few hundred cases. The current outbreak is in the 10s of thousands. Since 1970, the virus has emerged in other continents via human and animal vectors through international travel and exotic animal imports. There is some concern that monkeypox has the potential to become a pandemic.

- The first global monkeypox outbreak began in May 2022, with over 30,000 confirmed cases as of 8 August. (Financial Times, 2022)

- Monkeypox is typically transmitted through prolonged close physical contact with infected people (skin-to-skin, bodily fluids, or sharing infected items) or animals (bites, scratches, bodily fluids, faeces or uncooked meat consumption). These transmission conditions to not make monkeypox an obvious pandemic candidate.

- However, transmission by animals, especially rats, is driving reappraisal of MPXV’s pandemic potential.

- Despite the increase in monkeypox infections, epidemiologists seem to be signalling that a similar scenario to C19 is unlikely. According to Centre for Disease Control and Prevention (CDC) and World Health Organization (WHO), smallpox vaccines are considered ~85% effective against the MPX virus. (CDC, Nature, 2022)

Monkeypox virus (MPXV) alternative vaccines – a significant opportunity

The monkeypox virus is here to stay, much like Covid 19. All viruses evolve of course, however unlike Covid the monkeypox virus historically has mutated more slowly.

Current research indicates that the smallpox vaccine can protect against MPXV if it is administered within four days of exposure to the virus. “Vaccination after a monkeypox exposure may help prevent the disease or make it less severe”. (CDC, 2022)

In addition to Bavarian Nordic’s vaccine Jynneos, the FDA has also allowed the use of the ACAM2000 smallpox vaccine under its expanded Investigational New Drug (IND) mechanism, sometimes referred to as “compassionate use” permissions. Unlike Jynneos, the ACAM2000 vaccine is permitted for use with individuals under the age of 18.

In Europe, the Imvanex smallpox vaccine is approved for use in adults as of July 2022 by the European Medicines Agency (EMA). Bavarian Nordic also manufactures Imvanex.

According to WHO there are only 16.4m doses of smallpox vaccines available globally (total population is ~7.97bn). There is therefore, a significant opportunity for biotech companies to develop the products needed to help fight the MPXV outbreak.

Filling the MPXV vaccine gap

The Coalition for Epidemic Preparedness Innovations (CEPI) is supporting the development of a Monkeypox antibody. CEPI was founded in Davos by Norway, India, the Bill & Melinda Gates Foundation, Wellcome, and the WEF.

CEPI has provided funding of up to US$ 375,000 to the UK Medicines and Healthcare products Regulatory Agency (MHRA) and the UK Health Security Agency (UKHSA) to support the development of a Monkeypox antibody standard and assays. (CEPI, 2022)

In exhibit 1 below we have compiled a list of companies that have produced pre-clinical phase smallpox vaccines for immunisation and diagnostics for MPXV.

Approved smallpox vaccines for usage against MPXV – Emergent BioSolutions’ (NYSE: EBS) ACAM2000, Bavarian Nordic (CPH: BAVA) Jynneos, Meiji Holdings’ (PNK: MEJHY) LC16 KMB (developed in the KM Biologics lab).

- Monkeypox specific vaccine – The biopharma companies that entered this race are Tonix Pharmaceuticals (Nasdaq: $TNXP) TNX-801 and Moderna (Nasdaq: MRNA) mRNA MPX Vaccine.

- Antiviral drug treatments effective against Monkeypox – In the preclinical phase there is NanoViricides (NYSE: $NNVC). In the developed/consumption stage is Siga Technologies’ (Nasdaq: $SIGA) TPOXX and Chimerix’s (Nasdaq: CMRX) Tembexa.

- Other healthcare companies developing products to counteract the Monkeypox virus include Tomi Environmental Solutions (Nasdaq: $TOMZ). Tomi has developed the SteraMist Binary Ionisation Technology (BIT), which is an ‘environmental’ disinfectant that activates and ionizes 7.8% Hydrogen Peroxide (H2O2) to protect the environment by killing bacteria and fungal spores and inactivating viral cells by destroying their proteins, carbohydrates and lipids.

Exhibit 1 – Monkeypox products under development or available to consumers

Sources: ACF Equity Research graphics; Nature; Biopharma Reporter; Wired; CEPI; CDC.

Our view

As a result of the C19 pandemic, we understand that containing a virus pandemic is as much about testing, isolating and sterilising as it is about available treatments and vaccines. Intense testing and contact tracing system might be something all governments have to have on standby and test regularly hereon in. The CDC thinks testing and contact tracing is imperative (CDC, Nature, 2022).

The only really effective way to fight a pandemic and consign it to history is via vaccines. We are in the early stages of Monkeypox, but given the perhaps surprising speed at which C19 vaccines were produced, it might be reasonable to assume the same can be achieved for MPXV.

Access to funding and government support will play a key role along with capital markets support. Capital markets may be volatile at the moment, but the other lesson learned from the C19 pandemic and market correction, was that healthcare companies prevailed via a series of almost ‘endless’ opportunities.

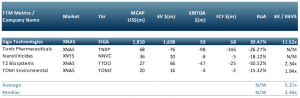

In the peer group table below we have included a list of biotech companies that have developed a vaccine or diagnostic or disinfectant for Monkeypox (MPXV):

Siga Technologies (Nasdaq: SIGA) & Tonix Pharamceuticals (Nasdaq: TNXP) developed a therapy: NanoViricides (NYSE: NNVC), developed a test: T2 Biosystems (Nasdaq: TTOO); TOMI Environmental (Nasdaq: TOMZ) developed an environmental disinfectant. Note that Siga is excluded from the median and average values in the peer group to minimise distortions.

The peer group below and the table above suggest that there are candidate investment companies for most investor risk profiles and strategies.

Exhibit 2 – Peer group of companies in the Monkeypox space

Sources: ACF Equity Research Graphics; Refinitiv.