VRFB + Vanadium miners – a winning combination

The market for Vanadium Redox Flow Batteries (VRFB) appears to be growing rapidly as their energy storage capacity improves. VRFB commercial viability is linked both to the price and reliable supply of vanadium. Explorers and miners understand this and seem, in places, to be considering more vertically integrated business.

These dynamics should make for a powerful investment case for both VRFB and vanadium miners, but there is a risk.

Capacity of VRFB large scale energy storage is growing and with it, so is demand

VRB Energy initiated the construction of a 100MW / 500MWh VRFB system in Hubei-China 2H21. The project is part of China’s national CO2 neutral strategy.

- VRB energy’s 100MW VRFB system will be pared with 1GW of solar and wind power. The entire project is estimated to cost around RMB 9.32bn (US$ 1.44bn). Phase 1 requires an investment of ~RMB4.32bn (US$ 667m) .

- China’s national Carbon Neutral and Carbon Peak Strategy incorporates a bigger VRFB plant rated at 200MW output and 800MWh capacity. The plant is being built by Rongke Power in Dalian Province.

- In the UK, a hybrid battery storage system of 50MW has been developed, as part of the £41m Energy Superhub Oxford (ESO) project. The system combines lithium-ion and vanadium redox flow battery systems and is expected to save 10k tonnes of CO2 per year. (Soci, 2021)

A criticism often levelled at VFRB as large scale energy storage technology when compared to lithium-ion batteries, is that there is just not enough vanadium. We do not agree that this is the biggest risk.

Background to Vanadium Supply for VRFBs

Vanadium occurs in deposits of phosphate rock, titaniferous magnetite, and uraniferous sandstone and siltstone. (USGS, 2020) In 2020, approximately 90% of global vanadium was recovered from magnetite and titano-magnetite ores. (Bushveld Minerals, 2020)

World resources of vanadium were estimated to exceed 63m MT, reserves at 22m MT and production globally was estimated at 73k MT in 2019 (source USGS). Vanadium crustal abundance is estimated at 138 ppm and has a production supply risk estimate of 6.7 (Royal Society of Chemistry).

In contrast, lithium world resources were estimated at 80m MT, with reserves of 17m MT and production ex-US (minimal contribution) 77k MT in 2019 (source USGS). Lithium crustal abundance is estimated at 16 ppm and has a production supply risk estimate of 6.7 (Royal Society of Chemistry).

In terms of volume of production the difference of 4k MT more lithium than vanadium is a relatively small gap. This gap seems particularly small when considering that Li-ion is in much higher usage in batteries than vanadium.

In our view, vanadium is a far better solution for batteries combined with renewable power generation to establish grid stability.

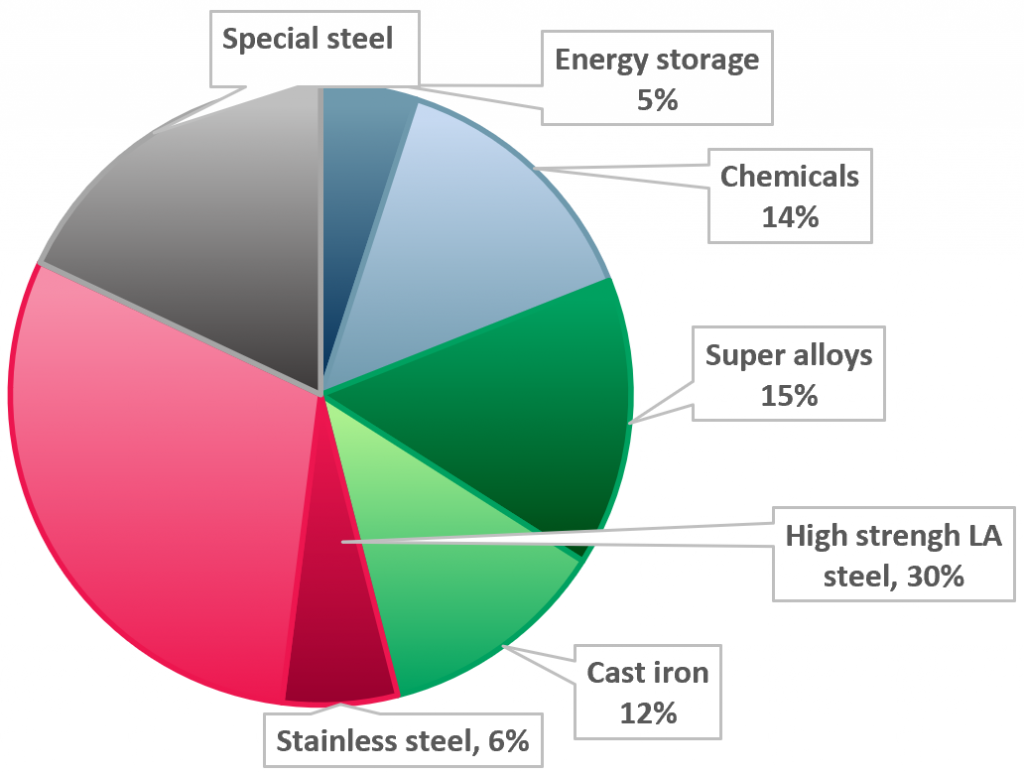

Vanadium end-use reliable statistics are relatively hard to come by but the consensus appears to be that energy storage (e.g. VRFBs et al) accounts for about 5% of consumption (remaining consumption is assigned to chemicals ~15%, super alloys ~15% and iron and steel production ~65%).

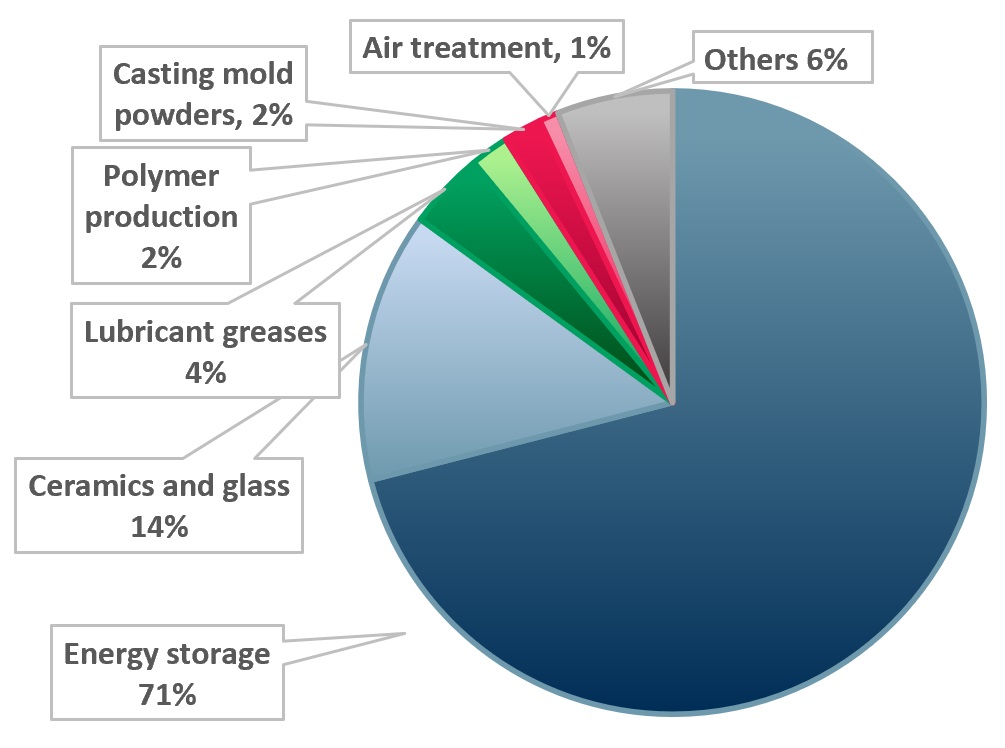

In exhibit 1 below we breakdown lithium end-use consumption, which in contrast to vanadium, is dominated by energy storage (71%).

In short, we do not consider vanadium any more supply constrained than lithium in terms of production and potential battery usage.

Exhibit 1 – Global lithium usage by application 2020

Sources: ACF Equity Research Graphics; lithium by end use US Geological Survey 2021.

Exhibit 2 – Global vanadium usage by application 2017

Sources: ACF Equity Research Graphics; vanadium by end-use after VERAM 2017.

ACF view:

The power sector is faced with an almost ‘compulsory’ transition towards net zero emissions (decarbonisation) due to climate change. The best way to achieve this target currently appears to be by integrating renewable energy generation alongside energy storage systems (ESS) such as VRFB (to achieve stable grid power availability.

ESS cover a wide range of devices categorised by:

- Type of storage – electrochemical, gravitational, etc., and

- Storage capacity – the hours of power provided upon discharge.

Vanadium redox flow batteries appear to be an ideal long duration ESS he recharging capacity of VRFBs does not diminish with charging cycles, they are far less of a risk to the environment, are highly recyclable, do not pose a fire hazard and current estimates suggest they can last up to 30 years.

It is these characteristics that are driving global demand growth for vanadium redox flow batteries.

As energy storage accounts for only ~5% of vanadium demand end-use as opposed to 70-85% for lithium, we believe that there is significant outperformance potential for vanadium mining companies because of the likely growth in vanadium usage in energy storage systems.

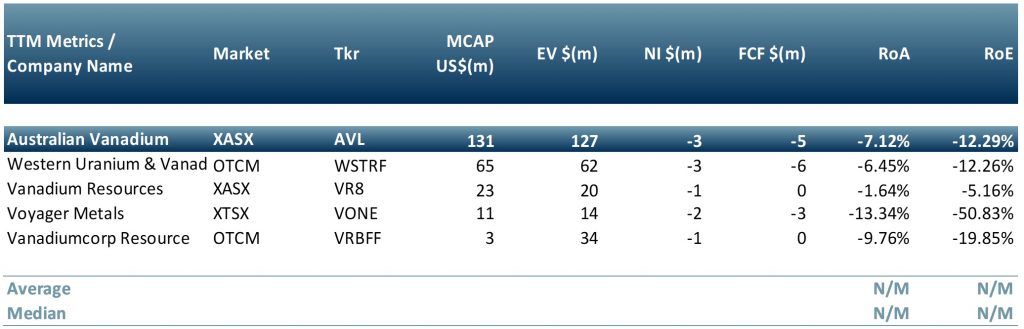

Exhibit 3 – Peer group of vanadium mining companies as of Aug 2022

Sources: ACF Equity Research Graphics; Refinitiv.

Sources: ACF Equity Research Graphics; Refinitiv.

Why we think VRFB and other ESS make up such a substantive opportunity The transport sector is the highest CO2 emitter. In the US the transport sector accounts for 27% of greenhouse gas emissions (US EPA, 2022 ).

The electrical power generation sector is the second highest global greenhouse gas emitter. In the US, and estimate 25% of emissions are caused by electrical power generation (US EPA, 2022).

Therefore any drive towards global emissions reductions will require electrification of large swathes of the global transport fleet. That electricity will need to come from renewables if the transition to a ‘global’ electric vehicle fleet is to have significant impact on emissions. Renewable power generation by return, will require large scale energy storage system technologies such as VRFBs.

Why we think vanadium explorers and miners are very significantly undervalued In the manufacturing process of rechargeable flow batteries different metals are used. The most common electrolytes solutions are vanadium and iron (ScienceDirect, 2021).

Currently, China is the world’s top vanadium producer, accounting for ~60% of global vanadium supply in 2020. China is followed by Russia (17%) and South Africa (7%). From a western perspective the concentration of production in these countries, all be it for different reasons, suggests something of a critical supply risk.

What is of additional interest is that some miners and explorers are either, considering, planning or executing a more vertically integrated strategy. We base this trend upon analytical research discussions we have had over the last three years with a range of c-suite managers at explorers and producers.

VanadiumCorp Resource Inc. (TSX-V: $VRB) (OTCBB: $APAFF) (FRANKFURT: $NWN) started the first phase of commercial development work for zero-emissions marine vessels powered by next-generation VRFB batteries in January 2021. (VanadiumCorp, 2021)

VanadiumCorp is also collaborating with the German-Australian Alliance for Electrochemical Technologies for the Storage of Renewable Energy (CENELEST) in a next-generation vanadium redox flow battery project.

VanadiumCorp’s goal appears to be to design a higher energy density vanadium electrolyte (vanadium bromide or V-Br) and VRFB advanced cell. (VanadiumCorp, 2020). Global vanadium production is on the rise and evidence is mounting that miners and explorers with vanadium properties in the west are at a strategic premium, and in our view this will become reflected in valuation.

Risks to our proposition that VRFBs plus vanadium miners are a winning combination for investors

Technological innovation is the main risk to our scenario – by way of an example a UK company, MSE International, claimed in March 2022, that it ran a lignin (wood pulp) RFB that delivered a levelized cost of energy (LCOE) over 8 hours that was equivalent to an LCOE for li-ion batteries and that over 16 hours the lignin RFB LCOE was 25% cheaper than the LCOE for li-ion batteries.

MSE expects its organic RFB (ORFB) to outperform conventional VRFBs at all durations. MSE also claims that its lignin battery will survive over 10,000 charging cycles.

Without passing any relative judgement on ORFB or VRFB at this stage, we know from decades of analytical experience that having the ‘best’ product helps but is nowhere near a guarantee of commercial success.What VRFBs already have going for them, vs. new innovation, is that grid adoption has commenced, that is a significant barrier to entry for new comers.

Authors: Christopher Nicholson and Anda Onu – Christopher is a founding executive, MD and Head of Research at ACF Equity Research. Anda is a member of ACF Equity Research’s Sales & Strategy Team. See their profiles here.

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)