Urine – liquid gold fertiliser

Research around plant fertilisers has shown that urine could be a viable alternative to harmful synthetic plant fertilisers.

Toopi Organics, a start-up with a lab in the south of France near Bordeaux, has been collecting urine since 2019 and investigating how it can be used as a sustainable fertiliser for plants.

- In 2018, Michael Roes (co-founder of Toopi Organics) was on the receiving end of a frustrated portaloo manager describing how expensive and difficult it was to dispose of all the urine collected from the portaloos.

- Given that urine has many useful chemical elements used in fertilisers – Nitrogen (N), Phosphorus (P), Potassium (K) – the obvious solution was to recycle urine to produce plant fertiliser.

- However, the problem was that vast amounts of urine are needed because urine only contains 1/5th of the amount of nitrogen and less than 5% of phosphorous and potassium compared to a bottled fertiliser.

- In order to compete with industrial products Roes decided to use bacteria – azotobacter chroococcum (assists with the assimilation of nitrogen) and lactobacillus plantarum (assists with absorption of nutrients and water) – that make it easier for plants to access the nutrients.

- This ‘super-charged urine’ was tested by the National School of Agricultural Engineering in Bordeaux and results indicated that the Toopi fertiliser helped corn plants grow 60-100% more compared to commercial fertilisers.

- Toopi Organics is leading this ‘PEEVOLUTION’ and aims to eventually process 1-2m litres of urine per year.

The use of urine for commercial use dates back to the first century AD when Roman’s used urine in tanning and imposed the Roman Pee Tax. Soaking the hide in urine helped dissolve fatty tissues, which were then subsequently removed, producing a softer wool product.

Finding alternative uses for waste products is not a new phenomenon. We have seen this with plastics, paper, cardboard and even food waste. So why not urine?

The ammonia that is generated in current commercial fertiliser manufacture extracts nitrogen from the atmosphere, via the Haber Process. The Haber Process is very energy intensive – using up approximately 1-2% of global energy as a result of current fertiliser production.

In addition, the nitrogen from these synthetic fertilisers flows into waterways feeding algal blooms thereby creating aquatic dead zones. Algal blooms are stretches of algae that use up the oxygen in the water causing significant harm or death to marine life.

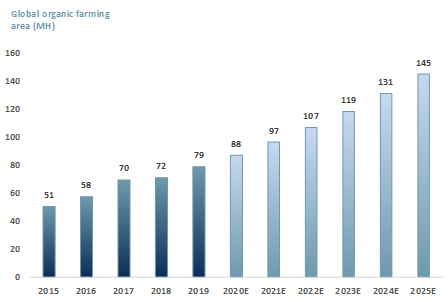

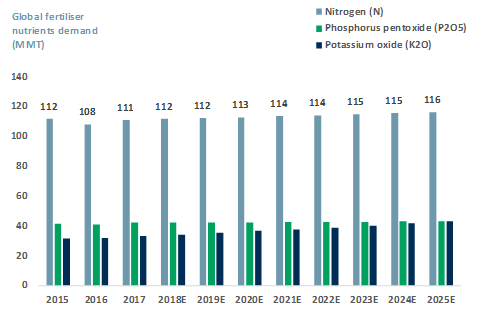

Even though the organic farming sector is global, the demand for Haber Process fertilisers continues to increase. In Exhibit 1 and 2 below we show our forecasts for organic farming land area and Nitrogen demand. Our forecasts suggest that the global organic farming land area will reach 145m ha by 2025E, a CAGR of 11%. In Exhibit 2 we estimate demand for Nitrogen in fertilizers will reach 116m metric tons (MMT) by 2025E, a CAGR of 0.6%.

Exhibit 1 – Global organic farming area, 2015-2025E

Sources: ACF Equity Research; FiBL; IFOAM

Sources: ACF Equity Research; FiBL; IFOAM

Exhibit 2 – Global demand for fertiliser nutrients, 2015-2025E

Sources: ACF Equity Research; International Fertilizer Industry Association

Sources: ACF Equity Research; International Fertilizer Industry Association

Given the continued concerns around climate change, Toopi Organics is precisely the type of start-up that retail investors would be interested in. The millennial generation (1981-96) of investors are coming of age and increasingly taking control of their own investment portfolios.

The millennials are also spearheading the drive towards ESG (CSR with metrics and a bit more), an investment filtering system.

Even though the market was hit by Covid-19 with about two-thirds of companies laying off employees or cutting work hours; the pandemic has created an opportunity for start-ups to get involved in niche markets. e.g. Toopi Organics, or R-Zero Systems providing hospital grade disinfection to the hospitality industry.

Sars-CoV-2 and the need for sustainable business practices is shifting investor focus. By also having an ESG policy as part of a company’s core business activities, this provides an opportunity for small and mid-cap companies to gain the financing they need; in particular for R&D in niche areas.

By YE 20 we forecast that ESG funds available will reach $25.2trn, up from $17.5trn in 2018 and that the share of retail investors in the ESG market will reach 33% of total ESG funds in 20E, up from 25% in 18A.

Author: Renas Sidahmed – Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See Renas’s profile