Winners and losers of the property sector pandemic

There is an opportunity for UK listed commercial property companies and it is simpler than any opportunity for residential listed property companies. This is not what you might expect.

The UK’s housing market (read residential property companies and residential REITs) has been a bureaucratic nightmare for years. The housing algorithm is considered skewed by a government approved housing target.

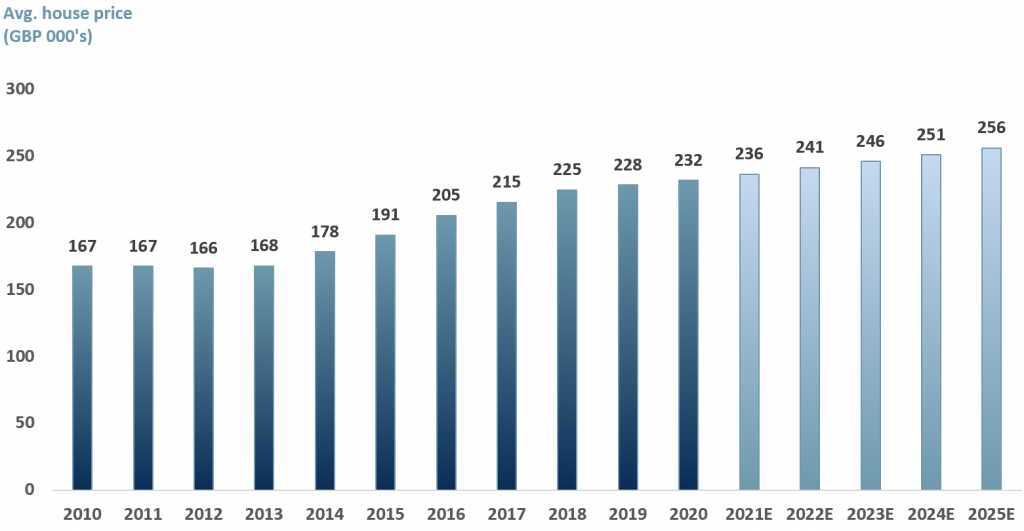

As a result, in part because of the housing shortage, prices have increased over the years (see Exhibit 1 below). Based on a CAGR of 2.0% we forecast that the average UK house price will reach GBP 256,000 by 2025.

Exhibit 1 – UK average house price, 2010-2025E

Sources: ACF Equity Research; Office for National Statistics (UK)

Sources: ACF Equity Research; Office for National Statistics (UK)

- The UK Housing Algorithm is still a work in progress, but regions are concerned about inequalities.

- London and the South East are faced with higher average house price targets and prices rise faster in the South East due to its relative desirability for service jobs and international transport links.

- Land is also more scarce in the South East due to its greater urbanisation and ever sprawling suburbia. These factors constrict supply and drive demand leading to a significant market price disequilibrium – read as ‘expensive homes’.

- In the North, building targets are expected to be slashed. This would cause huge economic constraints for local housing sectors.

- The Ministry of Housing is open to refining the algorithm. However, simply ‘reworking’ the formula to get a desirable outcome does not address the underlying shortage and affordability issues.

A good algorithm is based on science and art. While having the appropriate weighting of specific variables is key, applying those weights effectively and without bias, is an art.

We don’t think the UK government is using good algorithms. The data suggests UK government algorithms are flawed and there is no evidence the property algorithm is any more likely to give anyone any comfort any time soon. A short list below should remind investors what they are up against in UK residential property investing.

- The Covid-19 track and trace app faced extreme delays to launch – six months after lockdown.

- In early 2020 police forces went ahead with implementing facial recognition software, which has proven to wrongly identify people 98% of the time, according to Wired.

- Crime prediction software continues to be used even though the software is considered to be biased by various parties in a way that disadvantages lower-income and BAME communities.

- The A-level exam scoring algorithm was used even though it heavily skewed and did not help students from disadvantaged backgrounds compared to those in public schools.

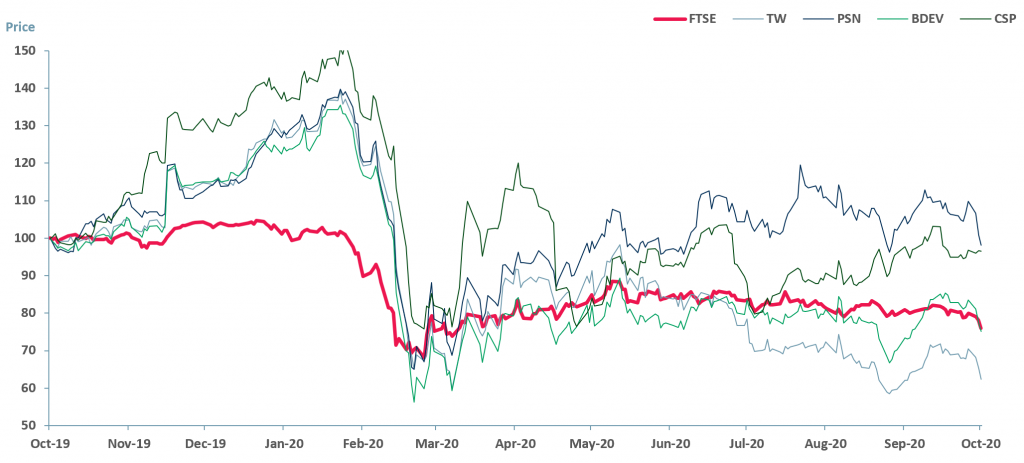

Exhibit 2 – FTSE vs. select UK residential contractors and property management companies, 28/10/2019 -28/10/2020

Source: ACF Equity Research Graphics

Notes: FTSE = black line. TW = Taylor Wimpy Plc. PSN = Persimmon Plc. BDEV = Barratt Developments Plc. CSP = Countryside Properties Plc

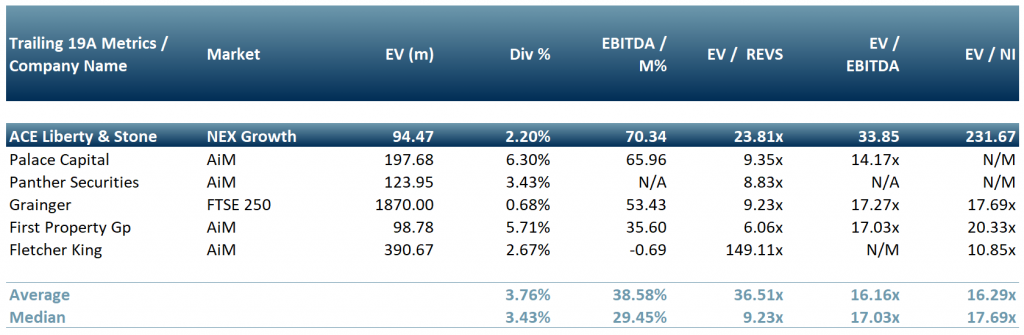

Exhibit 3 – Peer group of commercial property companies and trusts

Source: ACF Equity Research

Source: ACF Equity Research

So if the algorithm used by the government to stimulate the residential property is wrong, it suggests that the valuations of residential property developers/construction companies operating solely in the UK markets are also going to be wrong. Or that residential property companies will perform less well over the mid-term than commercial property companies.

At the moment, residential property construction companies have positive support from Covid-19. The pandemic has created an already evident drive for people to move out of cities for more living space (the desire for a garden being a key driver).

Combine the positive residential construction property driver for more space with government policy underpinned by a faulty algorithm, a negative driver, and we have a particularly complex residential construction market scenario with a lot of uncertainty.

Commercial property may look even more uncertain from an investor perspective. The Sars-CoV-2 effects on city centres and the longer term drive to online buying by consumers has put a shiver down the back of markets.

The markets are uncomfortable with commercial property because the pandemic effects lead to rental payment uncertainty and falling investment property valuations on the balance sheet. However, there are clear winners in the commercial property space.

Rental uncertainty for some players is compensated by opportunities for other players – those with a bargain hunting and change of use strategy e.g. ACE Liberty & Stone (ALSP) listed on London’s Acquis (formerly NEX) market.

In addition, government and tech employment will increase as a result of the pandemic. Government employment will increase because governments need to prop up the economy and society via job creation.

Tech employment will increase because the tech sector is benefitting from accelerated societal changes.

Both government and large tech are about the most reliable tenants in terms of rental payment one can find, irrespective of whether the commercial properties are temporarily unoccupied or not. That is good news for commercial property investors and the markets will wake up to nuance.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team. See Anda’s profile

Warning: Trying to access array offset on value of type bool in /homepages/33/d899469160/htdocs/clickandbuilds/ACF website/wp-content/themes/nimva/functions/custom_functions.php on line 1512

Warning: Trying to access array offset on value of type bool in /homepages/33/d899469160/htdocs/clickandbuilds/ACF website/wp-content/themes/nimva/functions/custom_functions.php on line 1513