African Textile industry – growing or stagnating?

Africa has a rich history of textile production from Egypt’s fine cotton, to Ghana’s Kente cloth (multicoloured fabric originally sourced from silk, but now from cotton and rayon – less expensive) and to Nigeria’s Aso Oke (hand-woven cloth made from cotton, silk or a blend). Is there an opportunity for the African textile industry to become a competitive threat to India and China?

The African textile industry has historically been a mix of traditional craft-based production and modern, large scale manufacturing. While the industry is still very much present, it does face competition from cheaper imports, i.e. Asia (particularly India) and China driving a decline in textile mills in Africa.

The African Growth and Opportunity Act (AGOA) signed in 2000, is a trade program initiated by the US to foster economic relations and promote trade between the US and eligible sub-Saharan African (SSA) countries. Originally set to expire in 2008, the AGOA has been extended multiple times with the most recent extension ensuring the program runs until 2025.

AGOA delivers a competitive advantage for SSA’s apparel exporters to the US. (The AGOA covers both textile as well as non-textile goods (US Custom and Border protection, 2023)).

AGOA – Mauritius and Madagascar

As of 2022 there were ~35 countries eligible for AGOA. These include Mauritius and Madagascar, where companies such as CIEL Textiles (a cluster of CIEL Group, SEM:CIEL) operates. To be eligible, countries must meet certain criteria such as the establishment of a market-based economy, respect for human rights, adherence to the rule of law and must show efforts to combat corruption.

Mauritius exports to the US

- In 2022, Mauritius exports to the US totalled $285m.

- Apparel ranked 2nd in AGOA exports to US ($77m/85%). (Main export is diamonds, 3rd is sugar products.)

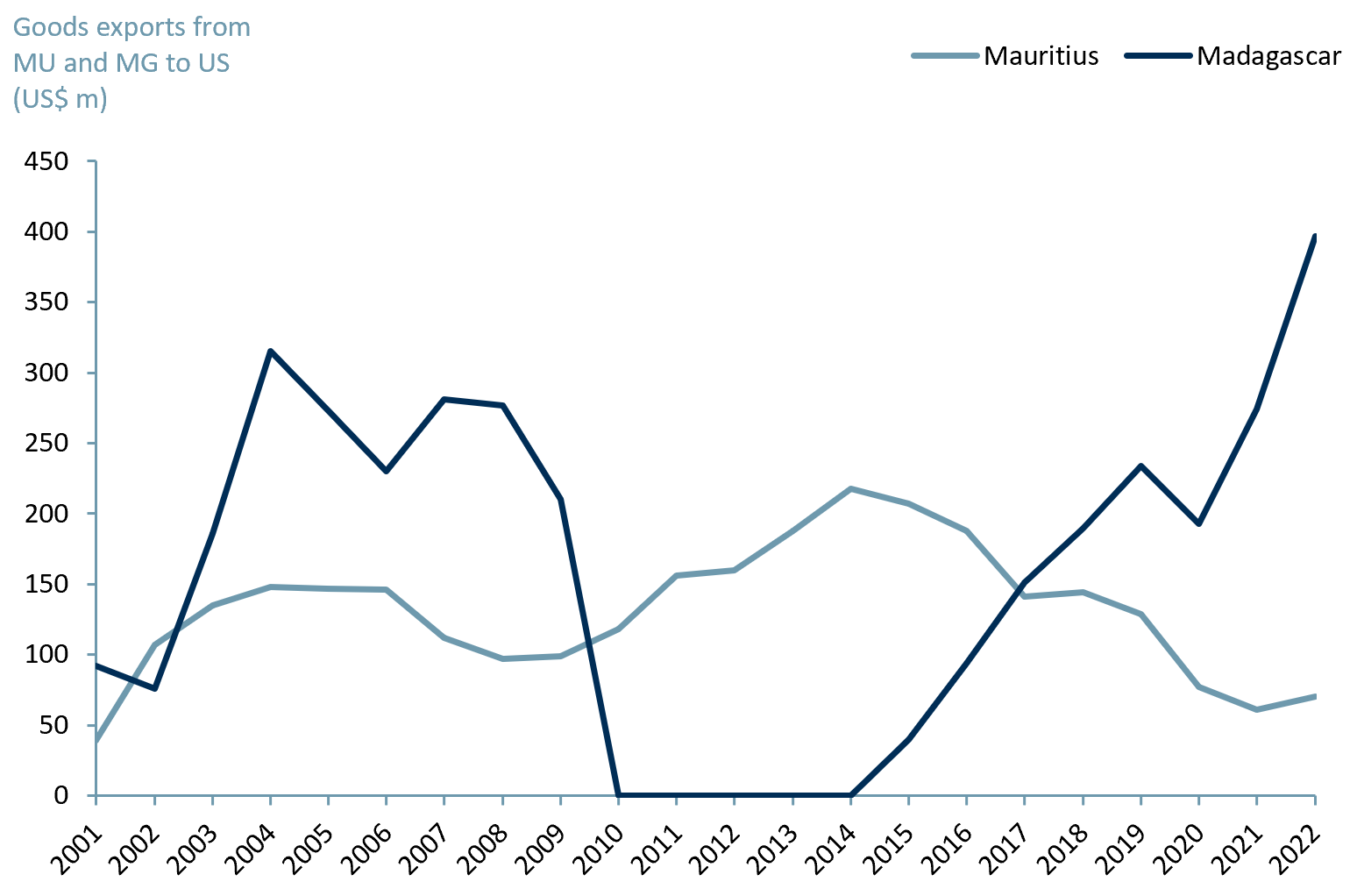

- Since it began exporting to the US In 2000. In 2005 Mauritius experienced an export downturn after global quotas were abolished under the Multi-Fiber Agreement (MFA) – international trade agreement on textiles and clothing from 1974-2004.

Madagascar exports to the US

- In 2022, Madagascar exports to the US totalled $911m.

- Apparel ranked 1st in AGOA exports to US ($412m/95%). (2nd ranked is minerals & metals, 3rd is agricultural products.)

- Madagascar is the 2nd largest Africa region apparel exporter to the US, following Kenya. In 2009 exports declined significantly after Madagascar was suspended from AGOA. Madagascar has since been reinstated.

Exhibit 1 – Apparel exports from Mauritius & Madagascar to US under AGOA, 2000-2022

Sources: ACF Equity Research graphics; AGOA; USITC Dataweb database.

Sources: ACF Equity Research graphics; AGOA; USITC Dataweb database.

The sustainability of the African textile industry – 4IR technology

The Fourth Industrial Revolution (4IR) is a buzzword used to describe the rapid tech advancement of the 21st century characterized by the integration of physical, digital, and biological technologies. Within the textile sector, this revolution has introduced cutting-edge innovations and reshaped, but nevertheless integrated, traditional practices.

While 4IR presents opportunities for the textile industry, from enhanced sustainability to personalised experiences, it may have weakened the drive to: adapt and invest in workforce skills; make prudent investments; revise regulatory frameworks. Self-evidently not every company in the Africa region textiles sector is equal and not every company has invested effectively for longevity and continuing competitiveness.

Textiles are evolving with the emergence of:

- Smart Textiles and Wearables, allowing for real-time physiological monitoring and internet connectivity through embedded sensors and electronic components.

- The incorporation of the Internet of Things (IoT) facilitates enhanced health and sports performance monitoring.

- Techniques such as 3D Printing are redefining design possibilities, while Artificial Intelligence (AI) streamlines design and defect detection processes. Improving such metrics reduces costs and potentially enhances margins by expanding production capabilities including volumes. Volumes are improved by reducing down-time and the frequency printing run restarts.

- Blockchain is an important contributor to ensuring ethical and transparent supply chains – increasingly important to companies in the value chain and to investors.

- Automated machinery via Robotics and Automation enhances precision and efficiency, while Virtual and Augmented Reality (VR & AR) offer immersive retail experiences buyers both B2B and retail.

- Nanotechnology is advancing textile properties, offering features including enhanced water resistance and textile strength.

- Biotechnology can deliver pioneering sustainable textile production, utilizing bio fabrication and eco-friendly processes.

- Digital platform advancements, epitomized by e-commerce platforms, are revolutionizing sales and distribution methodologies and have the potential to enhance producer margins – though they also cut or abolish margins formerly available to entities in the middle of the value chain.

We infer that Africa has a significant growth opportunity in the sustainable textile industry because of its abundance of natural fibres, e.g. cotton.

A sustainable approach to the cultivation of natural fibres can make such fibres even more eco-friendly. At the smaller volume end of the textile production segment, African cultures have a rich history of handmade textiles that are both sustainable and in demand globally.

As consumer consciousness around sustainability increases worldwide, Africa has a potentially attractive opportunity to cater to this demand. By phasing out outdated technologies, the continent can adopt innovative, green methods for textile production.

Because the textile industry remains skilled labour-intensive (though this is much reduced), growth in African textile production could offer the dual benefit of job creation and environmental conservation. International collaborations can further enhance sustainable practices through technology transfers and financial aid.

Instead of merely exporting raw materials, value addition through local sustainable processing generally boosts economic (GDP) growth. Moreover, integrating sustainable textiles with tourism can, in our view, offer another avenue for growth.

While the potential seems apparent, challenges like water scarcity and infrastructure development need addressing. With collective efforts from governments, NGOs, international partners and global investors, Africa could have an opportunity to be at the forefront of the sustainable textile revolution.

The question for Africa is, can it grasp the opportunity before India (in particular) and China also recognise and adapt to address this growing opportunity for sales and marketing of sustainable textiles (and processes) to US and other western style markets?