UPDATE – The Race for Critical Minerals

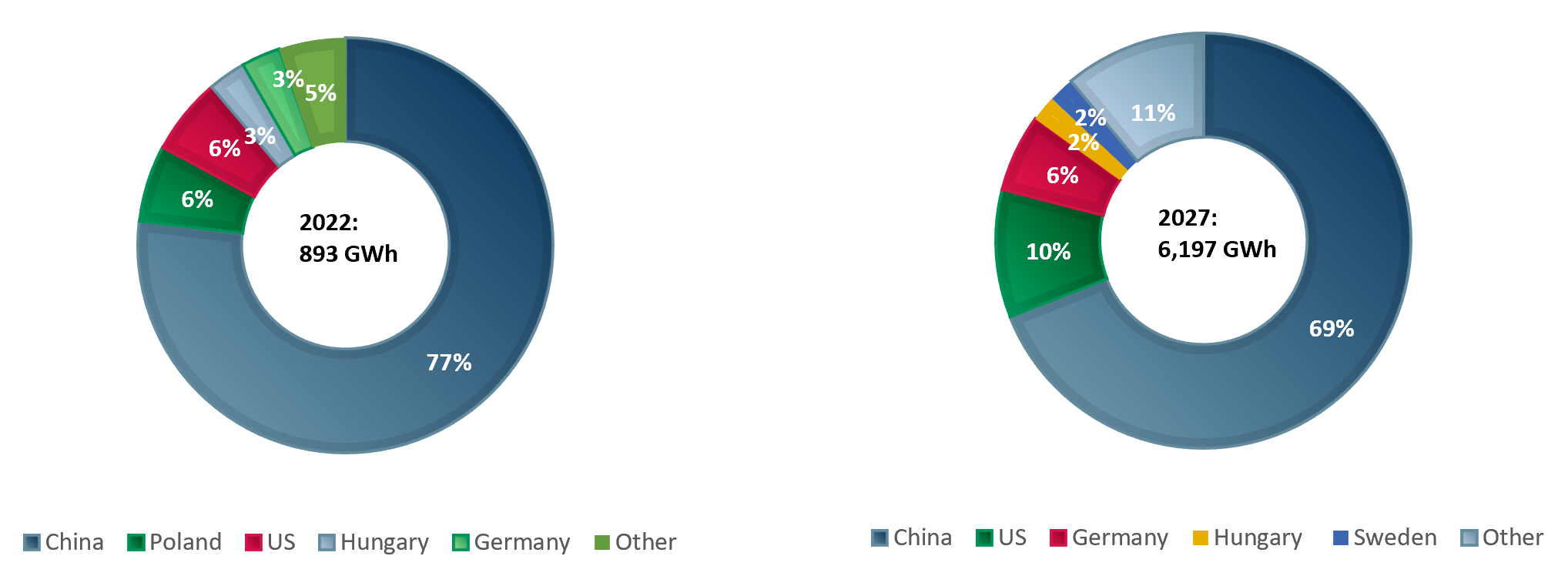

In our previous blog from February 2023, we highlighted that the race for critical minerals was heating up. China’s dominance in the Li-ion battery supply chain is set to decline as the demand for clean energy technologies increases. In 2022, China accounted for 77% of global battery cell manufacturing capacity, significantly more than the rest of the world combined. China’s contribution to battery capacity manufacturing is expected to decline to 69% by 2027E (exhibit 1).

Exhibit 1: China’s domination of the Li-ion battery manufacturing capacity is declining 2022A & 2027E

Sources: ACF Equity Research; BloombergNEF. Note: Charted by top 5 manufacturers + other.

Sources: ACF Equity Research; BloombergNEF. Note: Charted by top 5 manufacturers + other.

China’s dominance extends to the supply chain of many critical minerals, particularly graphite (Gr) and rare earth elements (REEs), where China not only produces a majority of the global supply (70%) but also controls nearly the entire supply chain. Even in Lithium (Li), where mining is concentrated in Australia, Chile and Argentina; China has significant market share in battery processing and production.

As the global electric vehicle (EV) market expands, the race for critical minerals will continue to heat up.

The global electric car market (a subset of the EV market) is projected to reach a value of US$ 256bn 2023, with the US market expected to hit $61bn. The proliferation of EVs is a key driver in the surging demand for critical minerals, necessitating a diversified and secure supply chain. As a result, western countries are increasing initiatives that diversify (away from China) and so de-risk the supply chain.

Initiatives in the US and Canada

The United States

In response to the battery and other critical metals supply chain landscape, the US Department of Energy (DOE) released its 2023 Critical Materials Assessment (CMA), focusing on reliable global access to materials crucial to clean energy technologies. The US also announced a $150m investment facility aimed at strengthening domestic critical mineral supply chains.

The 2023 CMA influences the DOE’s strategic thinking and priorities, including research, development, demonstration, and commercialization programs.

The DOE’s Critical Materials list determines corporate eligibility for tax credits under the Inflation Reduction Act. The critical minerals list includes essential materials like lithium (Li) and cobalt (Co), which are vital for clean energy technologies.

The European Union

The European Parliament’s Committee on Industry Research and Energy, adopted the Critical Raw Materials Act 2023, emphasizing the importance of securing strategic partnerships with third countries (presumably that are not China) and focusing on innovation.

The Act also proposes reducing dependency on non-EU sources by promoting the recovery of raw materials from waste and ensuring ethical extraction and processing practices in partner countries e.g. REE recycling from spent permanent magnets (watch out for our investment research on Ionic Rare Earths’ (IXR) strategy).

China’s attempt to hold strong

China’s involvement in Africa’s critical mineral sector is a key aspect of its global strategy. This partnership is critical not only for China’s own supply chain diversification and resilience but also for Africa’s economic development. China’s commitment to Africa underscores the continent’s growing importance in the global race for critical minerals.

China’s role in Africa is already significant and is backed up with investments in resource rich African countries including Democratic Republic of Congo (DRC), South Africa, and Zimbabwe.

Nevertheless, Chinese investment is coming at a cost for local communities. China has developed a reputation for poor social and environmental safeguards. Possibly as a direct response to Chinese safeguard standards, the Critical Minerals Accountability Alliance was formed in 2020. The Alliance is essentially a network or pre-existing NGOs and advocates for responsible sourcing and protection of local communities and ecosystems affected by mining activities.

Reaching the finish line

Looking ahead, global lithium-ion manufacturing is expected to increase by 8x by 2027E, reaching 8,945 GWh) (BloombergNEF). While China’s market share is projected to decrease to 69%, it will still hold a considerable lead over other countries and remains the dominant force, for now.

The US and EU countries are expected to continue to raise lithium-ion production capacity but without the supply chain initiatives this will only serve to re-tighten China’s grip on the market.

In our view, apart from the obvious investment opportunities, there is a further read through opportunity for investors – companies involved in constructing localised infrastructure that is needed to de-risk critical material supply chains, particularly in the battery sub-segment.