Could the mental health fallout of the pandemic spur growth in the healthcare sector?

Charles Cathlin, the chief executive of TruGenomix – a private biotech company, spent the better half of the lockdown months trying to galvanise investors about the potential of his company to transform the treatment of post-traumatic stress disorder (PTSD).

PTSD is a condition mostly associated with war veterans, but it is likely to affect the frontline health workers treating Covid-19 patients.

TruGenomix is leveraging its technology (TruGenomix-1) to displace the traditional way of detecting PTSD by using precision genomics instead.

TruGenomix-1 detects PTSD via a blood test using a “biochemical fight or flight” response. This measures the levels of cortisol in the body released from the adrenal glands and causes the brain to understand that there is something going on that is potentially life threatening.

The technology is still in its clinical stage, but it could be influential in the detection and treatment of PTSD.

TruGenomix raised USD 2 million in convertible notes and the company is now valued at $9m.

Cathlin is optimistic that investors will see the benefits of funding healthcare start-ups in particular ones that focus on mental health.

“If Covid was an earthquake, the mental fallout is going to be a tsunami.” – Tshaka Cunnigham, TruGenomix’s chief scientific officer.

Global healthcare funding to private companies reached $18.1bn in 2Q20, up 20% from 2Q19. 57% of that $18.1bn was allocated to healthcare sector companies.

TruGenomix is just one example of how the potential mental fallout amid Covid-19 could spur growth in the mental health sector, a potential long-run “gold mine” for investors.

Even though mental health still remains a challenge for biomedical research, it presents a huge potential for technological advancement and innovative detection and treatment.

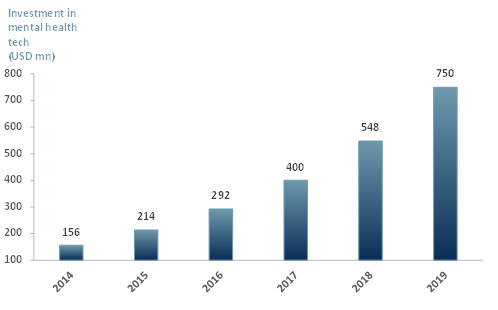

Venture Capital (VC) investment in mental health technology reached $750m in 2019 up from $156m in 2014. However, the sector only accounted for about 15% of the overall investment in the digital health market. (Octopus Ventures, 2019)

Exhibit 1 shows the growth in investment from venture capital funds, representing a 36.89% CAGR. Over the last 6 years there has been an upward trend in investments, reinforcing investors’ outlook of the growth potential of the sector.

Exhibit 1 – Venture Capital investment in mental health technology, 2014 – 2019

Sources: ACF Equity Research; Octopus Ventures; Pitchbook

We are yet to see the full extent of the mental health fallout relating to Covid-19 and in our view the sector is likely to see increased investor interest.

Investors are no longer only concerned about business operations and potential margins. Covid has forced everyone (including investors) to focus on the importance of healthcare and having an overall good ecosystem.

Investors want to see sustainable business activities as outlined in an ESG policy. Without an ESG policy, small and mid-cap companies are at risk of missing out of $25.2trn in funds in 2020E.