Is producing a non-profit Covid-19 vaccine a smart decision for AstraZeneca and the industry

AZN’s market-cap breached the £100bn break-out line thanks to the Covid-crisis, the British pharma giant promised that during the pandemic it won’t make profit on the vaccine, but maybe it should.

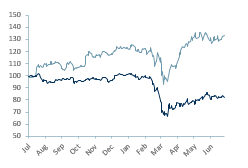

AZN.L relative 12m share price performance (lighter line) vs. FTSE 100

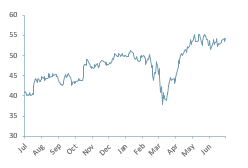

AZN.L absolute 12m share price performance

- Drug company AstraZeneca (AZN.L), which partnered with scientists at Oxford University for the development of a vaccine for covid-19 is already manufacturing this potential product before the completion of clinical trials.

- AZN closed a $750m (£595m) deal on Thursday with two health organisations: Coalition for Epidemic Preparedness Innovations (CEPI) and GAVI vaccines alliance, backed by Bill and Melinda Gates.

- Regardless of the trial’s outcome and the financial risks involved, Pascal Soriot, AZN CEO, confirmed that the firm has taken the decision to start manufacturing the vaccine AZD1222 so that it can meet demand in the case that it proves effective. AZN expects clinical trial results to confirm the efficacity of the vaccine by the end of August.

- AstraZeneca claims it could be able to supply 2bn doses of the vaccine by September if it passes clinical trials and is approved by the regulators for use.

- AZN’s licensing agreement with SII (Serum Institute of India) includes sending 1bn doses to low and middle-income countries. Some 400 million of those doses are planned to be ready the end of 2020.

- To help speed up the production of this potential vaccine Oxford Biomedica, AstraZeneca’s newest partner has signed a five-year collaboration agreement with UK’s Vaccines Manufacturing and Innovation Centre (VMIC).

It is evident that governments around the world have put aside billions of dollars for a Covid-19 vaccine. Due to the nature of the pandemic the vaccine can be classed as a ‘public good’ on a global scale.

Governments are economically inefficient at spending money, and they invariably create a deadweight loss with subsidies. This is a price worth paying to manage or halt a pandemic, but whatever can be done to reduce the deadweight loss, should be done.

AstraZeneca has said it will deliver the vaccine on a non-profit basis during the pandemic, but maybe it should be encouraged to gain some margin within certain limits.

The profit incentive is important as it drives efficiency (in this case speed to market). This in turn sends positive signals to other companies in the race and competition leads to better outcomes.

Cutting time to market will also preserve government funds, leading to less deadweight loss and the possible return of capital to the private sector through the usual economic mechanisms. As the private sector over time and on average makes better use of capital than governments, this would lead to an improved outcome for all.

AZN’s share price development and breakout valuation above 100bn Mcap, which cannot be attributed to the profit potential of a Covid vaccine, also demonstrates renewed investor interest in the healthcare sector, essentially a reinvigoration in the minds of investors that had become jaded with many failures and delays to delivery in the sector over the last 20 years.

The opportunities for healthcare sector companies and healthcare investors will continue to grow – according to a report from Research and Markets in Dublin on 23rd of January the global healthcare market is expected to exceed the $2 trillion mark in 2020, and that’s an estimate based on data before any pandemic effect.