The race for critical minerals is heating up and demand is likely to increase as the world begins to prioritise achieving the net zero goals. In October of 2022, US President Joe Biden announced a $2.8bn grant from the Department of Energy to fund critical minerals projects across 12 states.

- Critical minerals – rare earth elements, nickel, lithium, and cobalt – are key for the clean energy transition and for improving technologies like batteries, electric vehicles, wind turbines, and solar panels.

- Biden’s American Battery Materials Initiative is an effort to secure a reliable and sustainable domestic supply of critical minerals for the use in electric vehicles (EVs). Biden’s plan is to make half of all new vehicles electric by 2030E.

- As a result of the president Biden’s efforts, EV sales have increased more than 3x since 2020 (to 800,000+ EVs in 2022 up from 308,000 EVs in 2020).

- The IEA estimates that demand for critical minerals could increase by as much as 6x by 2040E – creating a need for governments to secure a reliable and sustainable supply of these minerals.

Against this backdrop, governments across the world including the US, European Union, Canada and others are paying increasing attention to critical minerals supply security and considering how to secure supplies in the face of uncertainties supply of other countries with conflicting global agendas.

China’s dominance

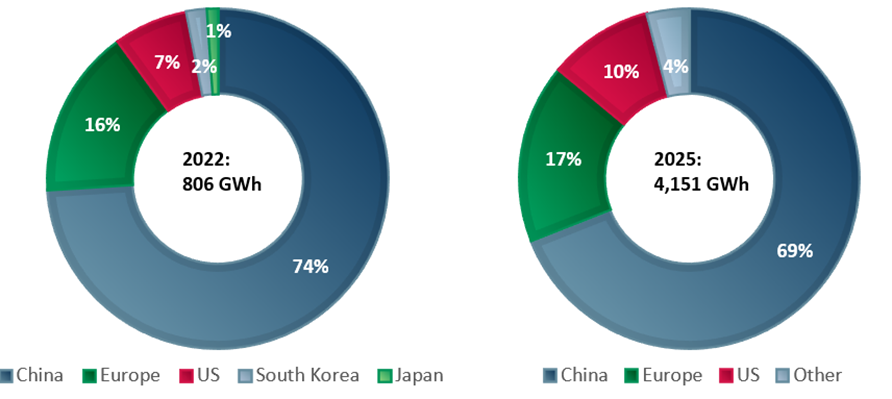

China currently dominates the Li-ion battery supply chain controlling more than 50% of battery-grade metals refining capacity. China is estimated to account for 74% of battery manufacturing capacity in 2022E, compared to just 16% for Europe and 7% for the US (exhibit 1).

China also dominates processing capacity for the majority of critical minerals for the battery supply chain. China processes and refines 59% of lithium, 68% of nickel, 73% of cobalt and 93% of Manganese (Benchmark Mineral Intelligence).

Chinese companies have taken a long term strategic approach by investing heavily in mining assets globally in an effort to secure and control future supply. However, China’s success has stimulated competition (and strategic fear).

Exhibit 1: China’s domination of the Li-ion battery manufacturing capacity is declining 2022E & 2025E

Sources: ACF Equity Research; BloombergNEF.

Sources: ACF Equity Research; BloombergNEF.

Broadening the critical minerals supply chain

US cognizance of its dependence on China for critical minerals stimulated the White House’s US$2.8bn funding plan. The aim is to decrease the US’ reliance on foreign imports of critical minerals. The funding is designed to support US domestic critical minerals projects focused on the EV battery supply chain.

Twenty [20] companies have won the grant including US-based lithium producers Albemarle (NYSE:ALB) and Piedmont Lithium (NASDAQ:PLL).

The federal grant comes with a matching system. The grant recipients will add to the grant using private capex. The White House estimates that this could lead to more than $9bn in investments related to the domestic production of EV batteries.

The European Union (EU) is also dependent on critical metals foreign imports and recognises the same strategic supply issues as the US. The EU is 98% dependent on China for the supply of critical minerals, which makes the EU’s domestic European industry even more vulnerable than US industrial sectors.

Like the US, the EU has introduced a supporting policy. The European Critical Raw Material Act, launched in 2022 is designed to boost domestic supply of rare earth elements, lithium, and other critical minerals. The EU estimates that its rare earths demand will increase 5x by the end 2030E.

The participants in the race for critical minerals have a different view of what is expected at the finish line.

Producers – the resource-rich countries that enjoy the production advantage (China, Australia, Canada and Indonesia), focus on maintaining market dominance and growing their downstream related industries (refining and processing to add additional value and convey price and margin control).

Consumers – countries such as the US, EU, UK and Japan, with high-levels of import dependence, are focussing on developing their domestic production capabilities and increasing market share.

ACF View: Decoupling from China will take a decade. In the shorter term if the US and EU can implement a mix of industrial policies and investment subsidies, this may stimulate a change in direction from the producer states, which in turn could ease economic and so political tensions.

The key will be to ensure that US/EU policies stimulate corporates to invest and scale up rapidly in both exploration and refining and processing capacity. Showing intent must be combined with the development of visible physical assets and infrastructure in order to effect shorter and mid-term supply security change.