Biogas – France is serious

TotalEnergies LSE: $TTE launched its 18th biogas production unit in France, with a capacity of up to 160 gigawatt hours (GWh). The demand for biogas is rapidly growing.

- Unit1 also known as BioBéarn from Mourenx, SW France, is producing biomethane from organic waste. The first cubic meter of biomethane – “renewable natural gas” – has entered the natural gas transmission network operated by Téréga.

- To produce 160 GWh of biomethane would require 220k metric tons of organic waste. The biogas produced could cover the average annual consumption of 32k people.

- BioBéarn unit’s targeted biomethane production for 2023 is ~69 GWh. According to Olivier Guerrini, TTE’s VP, this unit’s production will enable the company’s total production capacity to rise to 700 GWh. TTE’s goal is to reach 20k GWh by 2030.

Biogas is set to steal the spotlight from fossil fuel gas, becoming the new gas for energy preference for France. The interest in biogas is resurfacing due to current gas shortages and price hikes driven by geopolitical tensions.

The major producers of biogas are Europe and N America, with over 60% of biogas production capacity. Out of the existing ~ 20k European biogas plants – most built for on-site electricity generation and co‑generation – 500 plants are focused on biogas upgrading. (OIES, 2019).

The “upgrading” process for biogas production facilities consists of removing all CO2 and other contaminants to create a ‘pure’ biomethane. This “purified” gas is then integrated into the natural gas network. Prior to purification the methane component of biogas represents up to 75% by volume, the rest being mostly CO2. (IEA, 2019). Once purified the CO2 content of biogas is reduced to 2-5% by volume.

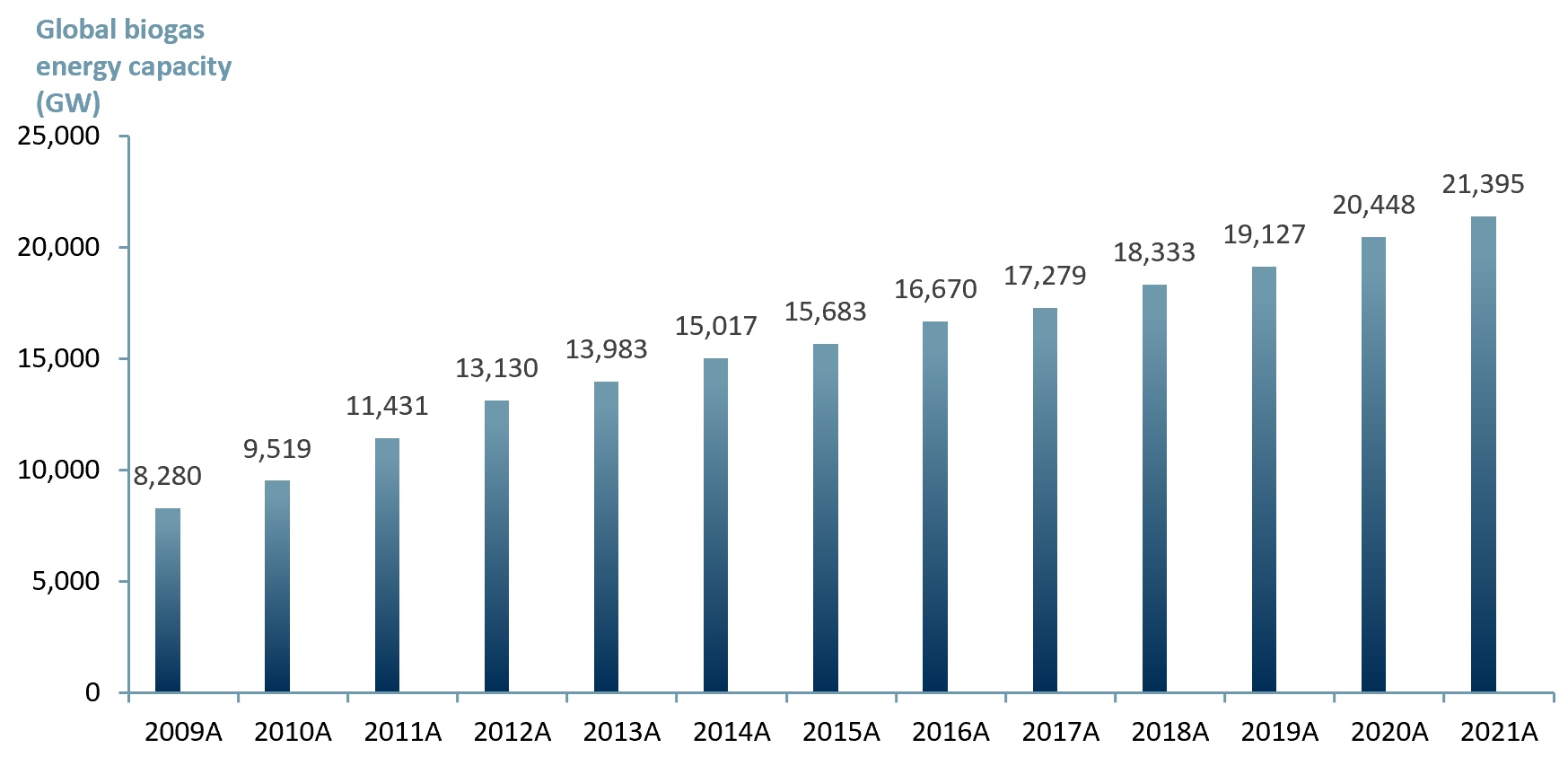

Global biogas production in 2019 was ~400k GWh (35m of tonnes of oil equivalent (Mtoe)). (WBA, 2021). While the installed capacity of biogas energy worldwide was 19GW. By 2021 the later reached 21GW as shown in Exhibit 1 below. (IRENA, 2022)

Exhibit 1 – Biogas energy capacity worldwide from 2009 to 2021

Sources: ACF Equity research graphics; IRENA.

An IEA projection on biogas production for direct consumption shows a 2-fold increase by 2040 to over 870k GWh (75 Mtoe). This growth could be triggered by centralised plants that are fed by organic waste sources (agricultural and municipal solids). (IEA, 2019)

According to Biogas World, there are ~ 2691 biogas projects worldwide. Over 30 of these projects are in the development phases. (Energy Global, 2022)

The global biogas plant market is expected to reach US$ 6.52bn in 2028E, up from US$ 3.51bn in 2021A. The global biogas market is forecasted to touch US$ 37.02bn by 2028E from US$ 25.61bn in 2021A. (Fortune Insight, 2020)

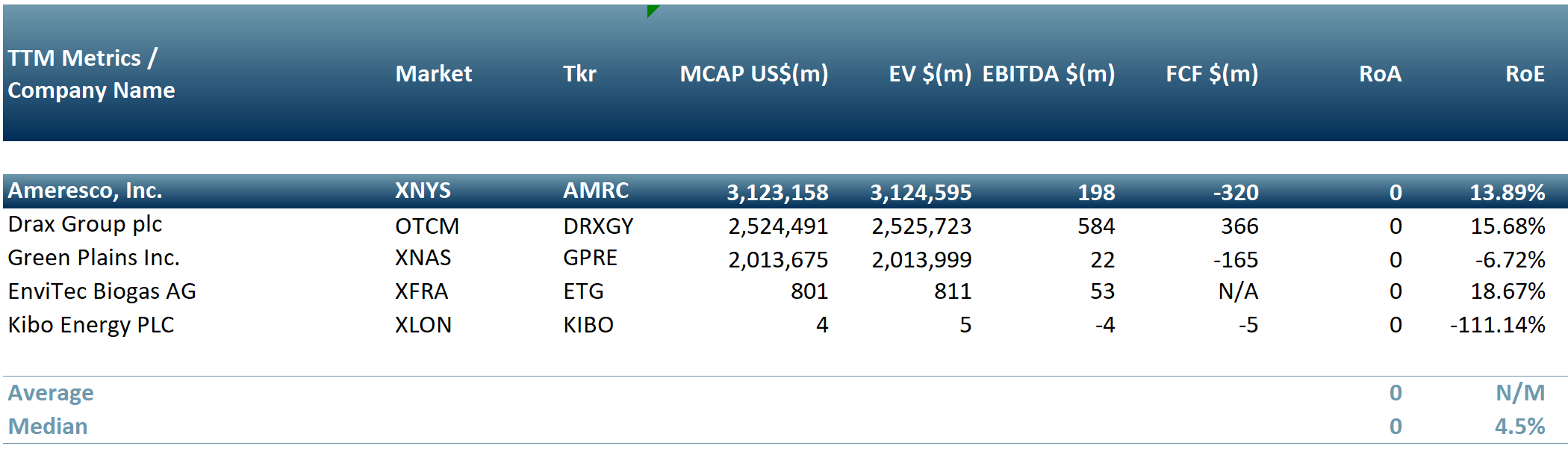

In Exhibit 1 below we provide a selection of companies that have a biogas production focus: EnviTec Biogas AG (DE: $ETG), Ameresco, Inc. (NYSE: $AMRC), Drax Group plc (LSE: $DRX), Green Plains Inc. (NASDAQ: $GPRE), Evonik Industries AG (DE: $EVK) and Kibo Energy ($KIBO.L : AIM)

Exhibit 2. Peer group table of biogas production companies

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

Innovative technologies along with the integration of AI applied to current and future biogas plants could:

- Significantly improve production, consistency and reliability of sustainable biomethane;

- Accelerate plant upgrades;

- Speed integration within the gas network. (Energy EU, 2022)

Supporting governmental policies for biogas injection into the natural gas grids would also be welcomed. Effective policy support would speed the transition to biogas away from natural gas, reducing reliance on natural gas energy imports, thereby de-militarising natural gas energy supply.