EVs Part 1: Manganese-rich EV battery chemistries to fuel demand for the metal

Electric vehicle (EV) sales are projected to account for nearly 75% of the total automotive market by 2040E (BloombergNEF, 2023). Manganese, while not talked about as much as the other EV battery ingredients such as lithium, nickel and cobalt, is a candidate that could see a surge in demand because of new battery chemistries and increasing EV sales. Furthermore, continuing discussion about the adoption of cobalt free batteries puts alternatives such as manganese in the spotlight.

Cobalt costs US$30,000/t versus US$1,000/t for manganese sulphate. A significant proportion of Cobalt production is also associated with unethical procurement. Cobalt production is dominated by the Democratic Republic of Congo, which has been linked to human rights abuses against workers, child labour and environmental destruction. Manganese, on the other hand, is abundant, safe and stable and has attracted less concern over its ethics of production.

Two of the most prominent battery chemistries currently in production that contain manganese are Lithium Manganese Oxide (LMO) and Lithium Nickel Manganese Cobalt Oxide (NMC). NMC remains the dominant battery chemistry of the two with a market share of 60% (IEA, 2023). In LMO batteries, manganese accounts for 61% of the material used in the cathode, whereas manganese only accounts for 10% to 30% of the total cathode material in NMC batteries.

Alternative cathode chemistries, such as Lithium Manganese Nickel Oxide (LMNO), or Nickel Manganese-based cathodes (NMX), with similar structures to NMC are increasing in popularity as end-users (e.g. electric vehicle battery producers) look to cut cobalt out of their supply chains. These batteries are cobalt free – the amount of manganese used varies between original equipment manufacturers (OEMs).

Demand drivers

As battery technology evolves and new chemistries are commercialized, the demand for manganese could continue to rise (and the demand for cobalt could decrease) given its potential to improve energy density at lower cost. Key manufacturers, including Tesla (Nasdaq:TSLA) and Volkswagen (VOW.DE), are already considering the use of manganese-intensive batteries which would also use less nickel and zero cobalt.

Other automobile manufacturers are examining manganese-intensive forms of battery chemistry. For example, General Motors (NYSE:GM) has invested in Element25 (ASX:E25), which is building a manganese refinery in Louisiana, USA. Furthermore, GM has also invested in Silicon Valley-based Mitra Chem (private), which is developing Lithium Manganese Iron Phosphate (LMFP) cathodes.

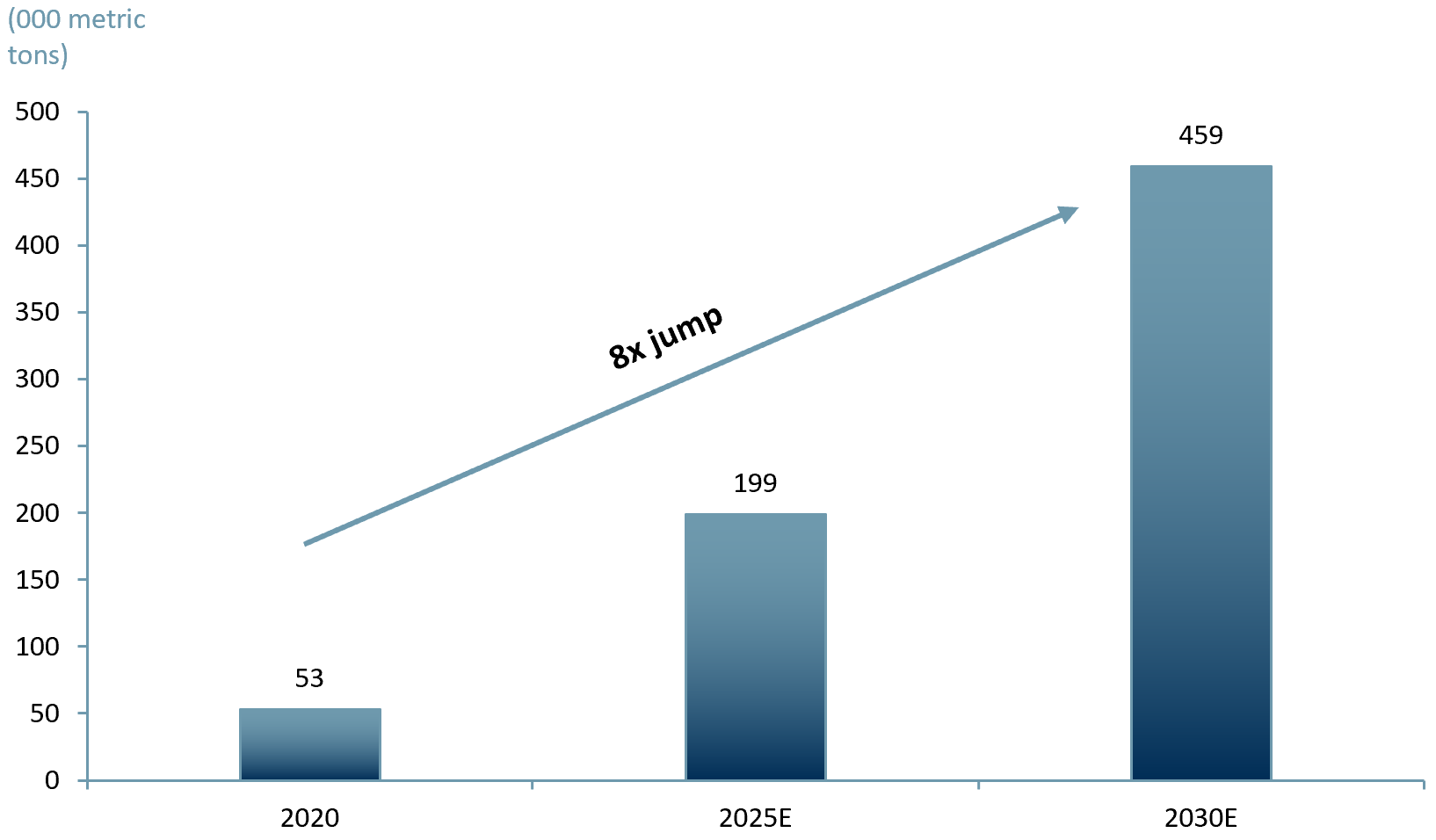

According to Benchmark Minerals (2023), demand for manganese from the battery sector is expected to increase 8x by 2030E, to 450k tons from 53k tons.

Exhibit 1 – Manganese demand set to accelerate from 2020-2030

Sources: ACF Equity Research Graphics; Benchmark Minerals.

Sources: ACF Equity Research Graphics; Benchmark Minerals.

Managing the supply chain

Manufacturers are taking an interest in manganese because it is more affordable and appears more ethical than cobalt and could help lower battery costs. However, the majority of manganese is refined in China. China produces over 90% (Manganese X, January 2024) of the world’s High-Purity Manganese Sulphate Monohydrate (HPMSM), the most common battery-grade manganese suitable for Li-ion battery production.

Given the concentration of supply in China, it is important for Western OEMs to manage supply chain risks. Expanding domestic manganese refining capacities could be a solution, albeit one that will require significant private investment and favourable government policies. China has developed a reputation for supply control that could also create speculative price bubbles in manganese. Cobalt prices, it could be argued, are destined to decline in this scenario.