ACF Outlook 2023

Looking forward to 2023, at the very least there are pockets of opportunity. It is also possible that markets will recover dramatically and quickly in 2023 – we note how quickly non-democratic regimes can respond when focused and how quickly incumbent leadership can be swept away or policies changed.

Russia may decide it has had enough of the Ukraine conflict and look for a way out. Iran may lose control of protestors and may change policies dramatically and surprisingly.

China reversed its zero tolerance covid policies over approximately 5 days triggering reignition of its economic growth, which certainly if it takes hold will support growth in the global economy.

There are early signs that inflation has peaked in the US, UK and the rest of Europe, which could lead to an early revision of interest rate strategy and policies around the hyper-developed economies.

If none of these changes occur and China’s actions take a long time to take effect, investors will continue to face a difficult and challenging macroeconomic environment. However, even in these difficult circumstances there are pockets of opportunity in the uncertainty.

Below, we share our macro perspective on the year ahead and offer you insights into the trends we assess are likely to outperform global markets in 2023 even if it is another difficult year overall.

Highlights:

- The US dollar will weaken after almost two years of strength.

- Oil prices could move higher as the US stops draining down its oil reserves. Chinese oil demand will normalize while Russian oil supply contracts further.

- The mining sector will make a strong comeback as the Chinese economy bounces back.

- The healthcare sector remains poorly valued and could continue to see M&A deals at huge premiums.

- The renewables sector will benefit from the energy transition away from fossil fuels and favorable policy tailwinds.

- Inflation in Europe will show to have peaked and there will be a drive for central banks to cut interest rates.

ACF’s outlook for 2023

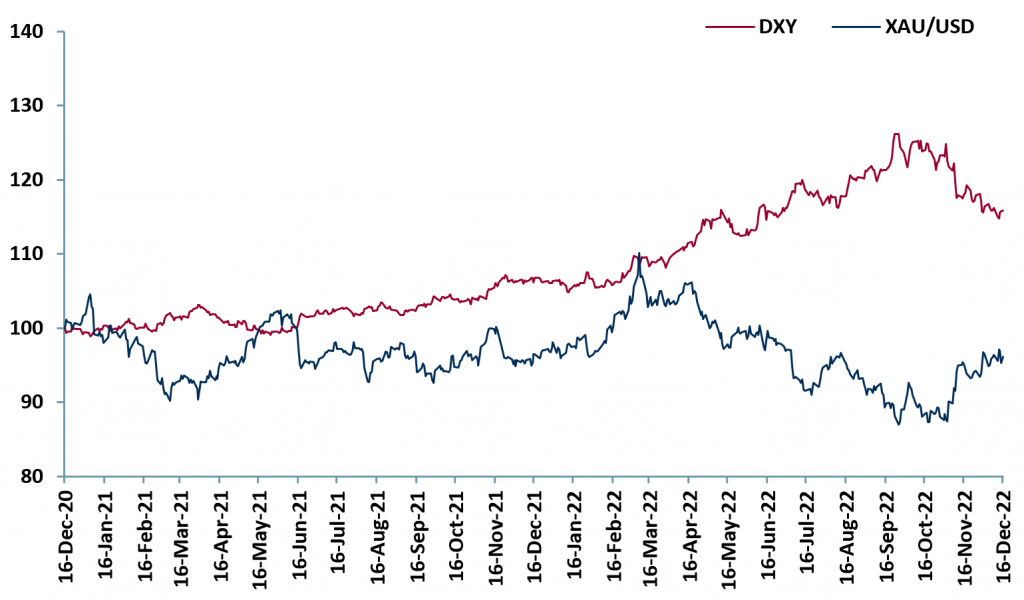

Gold & the fading US dollar dominance – A weaker dollar will be the main driver for the gold price moving into 2023. Dollar dominance is poised to fade in 2023 with the aggressive US hiking cycle sufficiently priced in. The US Federal Reserve has indicated that it will lower the pace of interest rate hikes in 2023 (subject to inflation data pointing to peak or near peak rates, which it seems to be doing in the US – there are also early hints in Europe that peak inflation has been reached).

The ongoing geopolitical tensions (i.e. the Russian-Ukraine war, Iran and Sino-US trade relations) should continue to make gold a valuable hedge. The dollar is likely to be subdued particularly as falling inflation (in the US) and slower growth takes hold. In addition, increasing consumer demand for jewelry as portable wealth in a less stable world should also increase demand for physical gold and support prices.

Exhibit 1 – US Dollar Index (DXY) vs Gold Spot Price (XAU/USD) Dec 2020 – Dec 2022

Sources: ACF Equity Research Graphics; Investing.com.

Sources: ACF Equity Research Graphics; Investing.com.

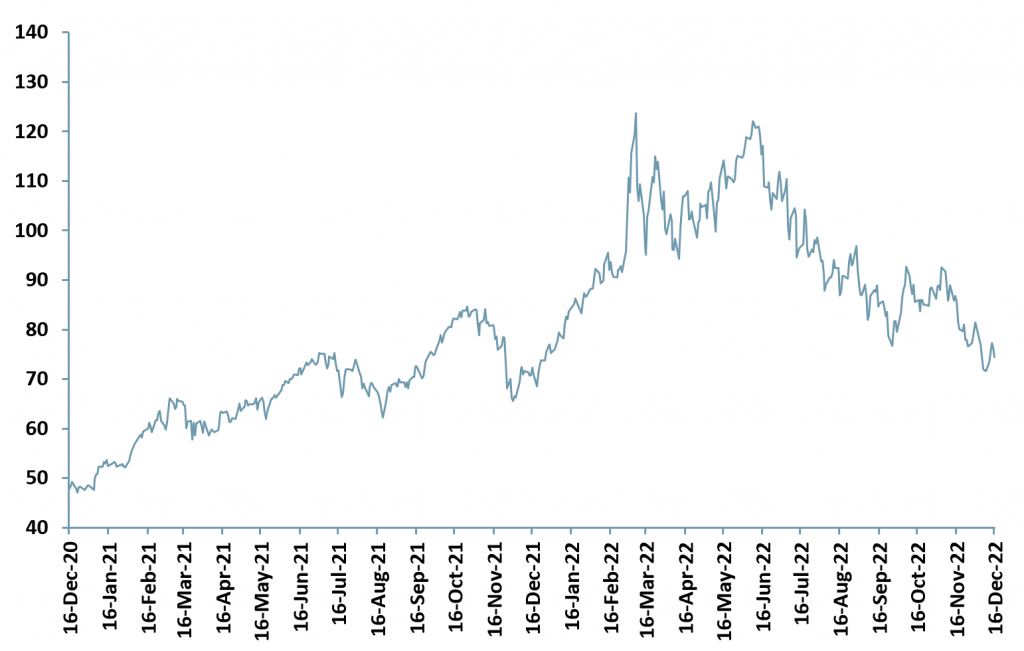

Oil – We forecast that crude oil will move back towards $100 per barrel as China relaxes its Covid restrictions. The US will likely stop draining its strategic petroleum reserves, helping to push oil prices higher. Further structural support for oil prices, at least in the short and mid-term, comes from less developed countries continuing to invest in and grow their economies leading to rises in global living standards – renewables are increasingly important but for now, the only real volume energy sources for many countries, particularly for transportation (the heart of physical trade), are fossil fuels.

Renewable energy is a long way from being entirely on stream meaning investment in renewables will increase. We are seeing increased capital injected into the renewables sector at the same time that demand for capital for fossil fuels is accelerating. Both statements can and have to be true.

Oil supply remains subject to high demand because the renewables sector is not yet producing at the rate required to meet the current global demand for energy, let alone any growth in global energy demand. The electric vehicle (EV) revolution is still nascent. As a result, ACF’s outlook is that both renewables and fossil fuels can attract significant capital in 2023 and provide attractive returns for investors.

Exhibit 2 – WTI Crude Oil price Dec 2020 – Dec 2022

Sources: ACF Equity Research Graphics; Macrotrends.

Sources: ACF Equity Research Graphics; Macrotrends.

Mining – As China’s economy reopens, mining companies will benefit, in particular those that mine rare and high value metals, i.e. specialty metals such as titanium, titanium alloys, cobalt, nickel, steel, zirconium and zirconium-based alloys.

China currently dominates broad areas of the supply chain from metals mining to turning the raw materials into finished goods other economies want and need. Though we expect China’s dominance to begin to recede, it will take time.

Mining companies that have finalized their feasibility studies (FS) and definitive feasibility studies (DFS) are at a greater timing advantage in our 2023 scenario when it comes to raising capital. Therefore, the mining sector could bounce back in 2023 driven by market expectations that by 2024 China’s economy will be back to full capacity. Markets prefer to travel than to arrive – expect 2024 to be priced in during 2023.

The increased expenditure for renewable energy transmission infrastructure will also drive the demand for metals, in particular, copper and steel (iron ore). Demand for battery metals will continue to be driven by the EV revolution e.g. cobalt, nickel, manganese and lithium. Long Duration Energy Storage (LDES) solutions i.e. microgrid and utility scale batteries will also drive demand for metals, particularly vanadium and antimony in our view. Miners with these assets should benefit.

Healthcare – As a result of Covid, investor interest in the healthcare sector has regrown, deepened and broadened. For the 3 years prior to Covid, healthcare stocks were persistently undervalued. The real value only crystallized via M&A transactions. The longer-term background is that many investors suffered significant losses in the early years of biotech when the risks were poorly understood, these factors caused investors (institutional and retail) to leave #healthcare investing in droves.

Though improved, risks in healthcare investing are still poorly understood, there is more capital available but there are also many more healthcare companies on the market, so poor understanding is still leading to many stocks suffering ‘crippling’ undervaluation. The market reacts very well to good news from healthcare stocks, with significant overnight re-ratings, but is especially savage on the healthcare sector ‘bad news’.

This mispricing dynamic suggests very strong returns potential for investors in small and mid-cap healthcare companies that are able to get their message understood via equity research.

Lack of equity research coverage leads to underperformance and poor valuations for healthcare nano to mid-caps stocks in particular, though underperformance due to lack of investment research coverage is a common theme for all nano to mid-caps stocks, whichever the sector. If you do not agree with our research coverage perspective and underperformance it might be worth inspecting the data.

The healthcare sector remains an appealing area of growth for investors, given its inelastic demand in areas such as immunology and genomics where a lot of Research and Development (R&D) is underway. One example is how Artificial Intelligence (AI) is applied to proteomics.

AI – AI speeds up and reduces the cost of understanding how and why specific proteins interact, which is imperative for advancing cell biology and developing new drugs. AI helps healthcare company R&D projects fail fast and inexpensively. This is a good thing because AI also produces more candidates for less time and cost, thereby improving the overall probability of success for investors.

In other words, a biotech using AI drug discovery has more chances to find a successful drug candidate for the same budget and time frame, than with more traditional drug discovery processes.

Vaccines – Vaccines play an important and necessary role in human development and there is growing commercial evidence of a future for vaccines in the oncology market. This will increase competition in the healthcare sector – which means taking a broad portfolio of plays in a given area.

Outperformance and underperformance – In 2023 healthcare sector company share prices will continue to outperform very strongly on good news. However, most companies need constantly accreting share prices, so there is a mismatch here. The reason for the mismatch is that markets do not currently understand the true value of a company but the managers do, which is the trigger for huge M&A premiums, when compared to years of under-performance.

Renewables – The US Inflation Reduction Act (IRA) passed in August 2022, provides ~$370bn of funding to clean energy and EVs. The IRA will increase the US’ renewable energy generation capacity by an additional 30GW/111GWh between 2022-2030.

The US will also have to expand and re-engineer its energy grid/ transmission system, which will drive demand for metals, especially copper and steel (iron ore – long in the doldrums in the North American market). New transmission infrastructure is required – current infrastructure is not emission friendly.

The Russia-Ukraine conflict is a trigger for policy resetting in Europe. No longer will Europe be able to afford, strategically or financially, to rely on Russian fossil fuel supplies. Together with a focus on climate change this should accelerate European investment policies for renewables and push them much higher up the political and economic agenda in the region.

Once mobilized, Europe, like the US, is capable of marshalling vast financial resources along with considerable political will. Renewable energy is still a longer-term investment thesis, but in the shorter-term companies in the transition space stand to benefit significantly in 2023.

While we are talking about decades for a complete transition to renewable energy, there are companies (including small caps) that are working towards that goal. These companies stand to win and could attract a lot of low-cost capital, both through debt and equity. We particularly like the transition to fully renewable sub-segment.

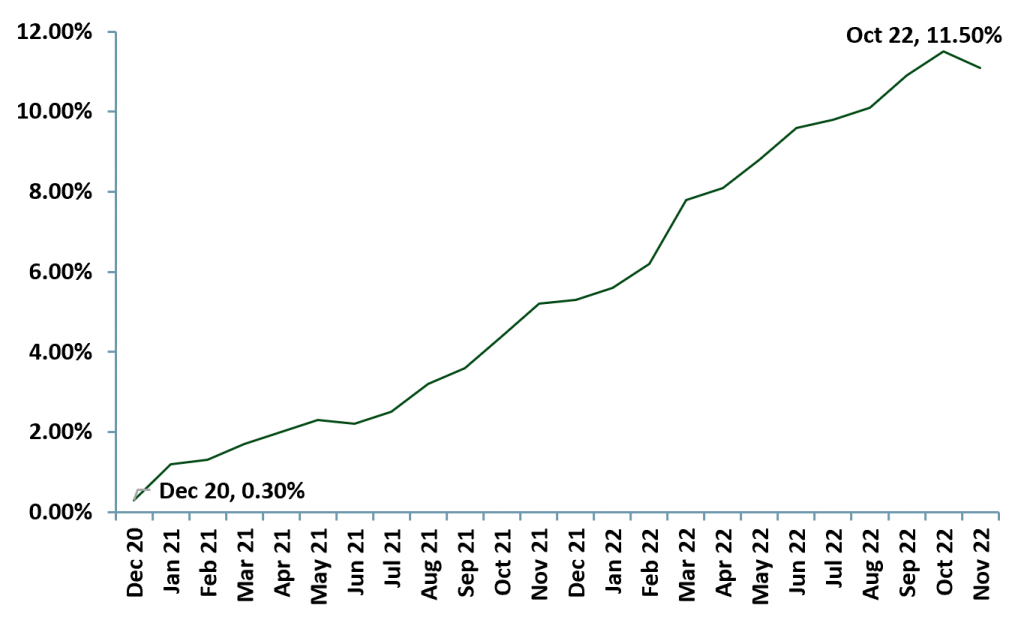

Inflation in Europe – For Europe, 2023 might still be a tough year for inflation but there are signs this December that inflation is at, or has reached, its peak.

Exhibit 3 – European Union inflation rate Dec 2020 – Dec 2022

Sources: ACF Equity Research Graphics; eurostat.

Sources: ACF Equity Research Graphics; eurostat.

In the UK for example, because it has a very flexible economy, we could see a drop in interest rates as drastically as the increase occurred.

The differing characteristic of the UK is based on its macroeconomic structure. High home ownership and mortgage burdens reduce disposable income meaning changing interest rates effects the UK economy far faster than most other European economies.

Because of this high UK home ownership and mortgage structure, there is a drive for the UK’s central bank to cut interest rates as quickly as possible.

The counter point to our UK thesis is that the current bout of inflation is supply driven, which may mean that interest rate policy is a less effective leaver than it has been in the past in the UK. In this scenario the UK would probably not have a time advantage over the other European economies.

Russia – We think Russia may well reconsider its Ukraine escapade and look for a deal as early as the spring of 2023. In our view, the main risk to this thesis is that if Ukraine does push ahead to re-take Crimea, that could split NATO – the overarching opinion in Europe is that Crimea historically has ‘always’ been a part of Russia.

Ukraine and Crimea – If Ukraine does enter Crimea and is successful, we believe that would lead to Putin’s downfall. That does not necessarily mean anything better will come in his place because we agree with others that Putin is mostly likely to be removed by groups that are more extreme than he is, i.e. parts of his current power base.

We could therefore have a more difficult Russia. This situation will continue unless Russia moves to some kind of nascent but stable democratic process – a lot has to change in Russia to put the necessary pieces in place (independent media and judiciary).

European manufacturing – We expect more companies to move manufacturing and production out of Europe because of the uncompetitive effect of rising energy prices and energy supply risk. For example, BASF (German multinational chemical company) has said that it is going to withdraw significant amounts of manufacturing capacity from Europe and relocate it. BASF’s specific reason was increasing energy (input) prices.

Our thesis is that other large-scale manufacturers will follow BASF’s example if they can, unless Russia ends up next year with a functioning democracy, which seems unlikely – therefore the risk of a manufacturing exodus remains non-negligible.

In summary, 2023 should see a weaker dollar, higher metal prices, and strengthening crude oil. We expect China to re-open driving demand for metals and oil as well as providing support for the struggling global economy. The sectors we expect to perform best in 2023 are Renewables, Mining and Healthcare.

Authors: Christopher Nicholson, Garvit Bhandari, Renas Sidahmed. Christopher is a founding executive, MD and Head of Research, Garvit is a Staff Analyst, Renas is Head of ESG and a Staff Analyst at ACF Equity Research. See their profiles here