Biodiesel – fuelling the future

Trucks powered by biodiesel in the US functioned below -20°F (-20°C) during the record cold temperatures recorded in February 2021. This could open the door to a wider adoption of biodiesel in heavy duty on-road freight vehicles.

- Heavy duty vehicles which run on 100% biodiesel (B100) functioned without issue during the recent cold weather in the US where temperatures fell as far as -30°F (-34°C) in Hastings, NE (CNN Weather).

- The vehicles, produced by the Archer-Daniels-Midland Company (NYSE:ADM), were developed to show how biodiesel is an alternative fuel for the trucking industry.

- ADM’s pilot programme launched in 2020 uses a specialist biodiesel system known as the Vector System, developed by Optimus Technologies, that adapts conventional diesel engines to run on B100 (100% biodiesel fuel). Most diesel engines run on B20 (20% biodiesel).

- The programme operates five trucks owned by ADM. Each vehicle has a life expectancy of 160,000 – 180,000 miles and could reduce CO2 emissions by up to 500,000 pounds (226 metric tons).

What is biodiesel?

Biodiesel is a clean burning fuel that is produced through the esterification (the chemical reaction between an alcohol and an acid to create an ester) of plant or animal fats. Common raw materials: rapeseed, palm, soybean and sunflower oils and chicken and fish fats.

Biodiesel is blended into petroleum diesel to lower emissions released from burning the fuel or is used unblended in adapted engines such as the ADM ones.

The amount of biodiesel in fuel is identified by the diesel specification:

- B100: Unblended biodiesel – 100% biodiesel

- B2, B5, B20: Diesel blend containing 2%, 5% and 20% biodiesel, respectively

While biodiesel’s primary use is for transportation, it does also function as cooking oil and can provide an alternative energy source for central heating in homes and commercial buildings.

As of 9 Mar 2021, the price of biodiesel was at a 52-week high of US$ 1,270/t, approximately 3x more expensive vs. WTI crude’s price of US$ 471/t ($65/bbl). This equates to a RBOB (Reformulated Gasoline Blendstock for Oxygenate Blending) – internal-combustion engine – gasoline price of US$ 630.77/t (US$ 2.05/g). (Platts, 2021).

Biodiesel is trading at a premium to crude, which affects its attractiveness as a viable investment opportunity, however given the ongoing climate change concerns, both policy changes and incipient economies of scale the investment opportunity will become attractive.

The biodiesel market

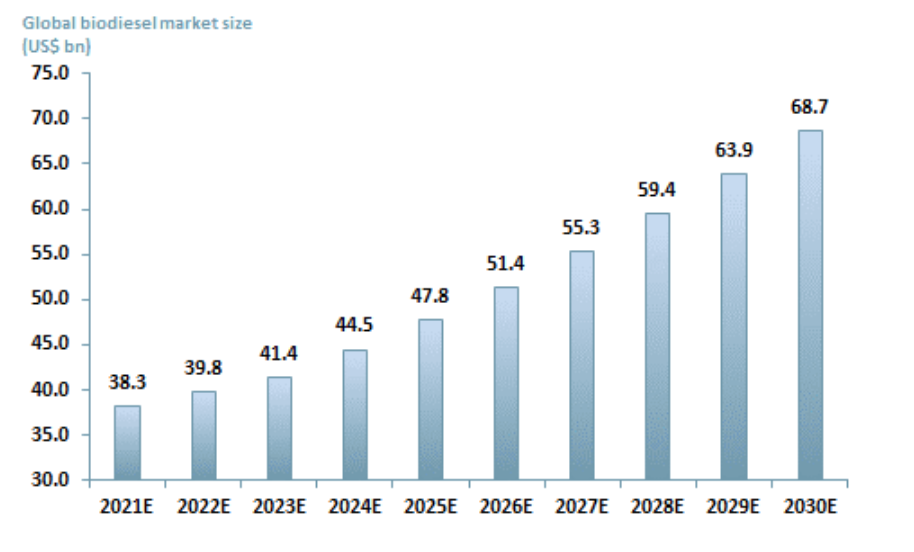

In exhibit 1 we estimate that the sector will reach US$ 68.7bn by 2030E, up from US$36.8 in 2020A – a CAGR of 6.4%.

Initially the growth rate of the biodiesel market will be dampened by rising commodity prices at this point in the commodity price cycle (soybean, palm oil, corn, etc.). We have assumed that later there will be an acceleration in biodiesel market growth driven by:

- Policy – global tighter emissions rules and the looming Paris Agreement goal to limit global temperature rise to 1.5°C by 2030

- Politics – the Biden Climate Plan, if signed into law.

- Technology and economies of scale – advancements in technology will trigger an uptake in B100 fuels

As a result, overall we have a higher CAGR of 6.4% compared to other market participants.

Exhibit 1 – Global biodiesel market value growth 2021E – 2030E

Source: ACF Equity Research Estimates

Covid-19 reduced the production of biodiesel for the first time in 20 years as a result of lower fuel demand and lower fossil fuel prices. Production fell to 143.9bn litres (0.1439 toe) in 2020A from 162.8bn litres (0.1628 toe) in 2019, a 12% decrease (IEA, 2020).

The US is both the largest producer and consumer of biodiesel where its primary use is as a transportation fuel for heavy duty vehicles (HDVs). Total US production as of January 2020A was 2.5bn gallons (gal) per year vs. 2019’s 1.7bn gal/year (EIA, 2020).

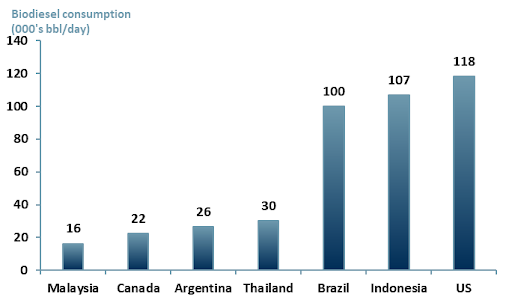

The top three leading biodiesel consumers in 2019A were the US (118k bbl/day), Indonesia (107k bbl/day) and Brazil (100k bbl/day) (exhibit 2).

Exhibit 2 – Largest biodiesel consumers by country 2019A

Sources: ACF Equity Research Graphics; US Energy Information Administration

The biodiesel investment case

A key advantage of using biodiesel is its function in reducing emissions. B100 (100% biodiesel) is estimated to reduce greenhouse gas emissions by 78% (these include the main four – carbon dioxide CO2, methane CH4, nitrous oxide N2O and hydrofluorocarbons HFC). B20 fuel is estimated to reduce CO2 emissions by 15% (Conserve Energy Future).

These reductions are significant because in 2020 the world emitted ~50bn tonnes of GHG of which CO2 accounted for 76% of the total. This is a 43% increase in emissions compared to the 35bn tonnes recorded in 1990 (CAIT Climate Data Explorer).

As with any industry, there are pros and cons. One of the barriers against further adoption of biodiesel has been the inability to use biodiesel powered vehicles in cold weather, the other is its cost.

The ADM concept vehicles have shown that vehicles powered by B100 fuel can function under cold temperatures with the assistance of a Vector System, designed by Optimus Technologies. This is a step towards wider adoption of B100 powered vehicles, especially heavy-duty vehicles.

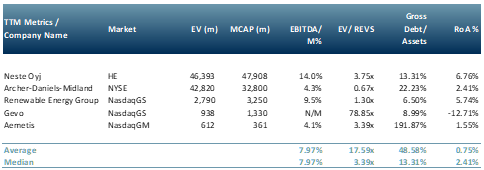

In exhibit 3 we have selected a peer group of five companies that produce biodiesel on a global scale – Neste Oyj (NESTT:HE), Archer-Daniels-Midland (NYSE:ADM), Renewable Energy Group (NasdaqGS:REGI), Gevo (NasdaqGS:GEVO) and Aemetis (NasdaqGM:AMTX).

Exhibit 3 – US biodiesel consumption 2002 – 2019

Source: ACF Equity Research Graphics

In 2019, 37% of biodiesel demand came from the EU as the area has historically promoted the use of diesel engines through subsidies and tax breaks. In the EU between 2014-2016, the diesel subsidy was ~€21bn/year (~US$24bn/y), which encouraged the popularity of diesel fuel use (Global Newswire, 2020).

In our view, biodiesel is a viable option for reducing emissions from vehicles because the option for electrification of heavy duty vehicles (HDVs) is currently limited. This is due to the short range of EVs available and the long charging times. Depending on the size of a vehicle’s battery, charging times are anywhere between 30 minutes to 12 hours.

Increasing the number of heavy duty EVs and increasing resources for R&D into EV charging, is an area in which governments create subsidies to increase the uptake of the fuel. Hydrogen Fuel Cell Vehicles (HFCVs) may also provide a competitive challenge to biodiesel as a fuel for HDVs, and the HFCV market is also likely to receive incentives and subsidies from governments.

Further efforts are needed to prove B100 fuel’s credibility as an alternative fuel source and to reduce the cost of production. On 28 Apr 2020 (when crude was at its lowest price not including the period of negative trading) biodiesel was at a premium of US$ 427/t (474% higher) compared to crude – biodiesel was trading at US$ 517/t (US$ 70/bbl) vs. WTI at $90/t (US$ 12.24/bbl).

Even though the price of oil has since recovered to >$60/bbl (US$ 65/bbl as of 11 Mar 2021), governments, in particular the US, should consider incorporating policies within their climate change agendas in order to reduce the cost of biodiesel production.

Lowering costs of production would promote biodiesel’s use and make it more easily accessible to EV manufacturers. If biodiesel is more cost competitive than traditional fossil fuels, we will see an inevitable shift in both blended and unblended biodiesel in the near-term. Biodiesel will need to follow the efficiency trajectory or solar panel technologies to get to cost parity with oil, which requires both huge volume demand and technological innovation – the potential market is big enough.

The inevitable risk for investors and entrepreneurs is that biodiesel is superseded by hydrogen and HFCVs in the HDV market, before it has a chance to deliver EVA (economic value add) back to them.

Authors: Renas Sidahmed and Sam Butcher – Renas is a Staff Analyst and part of the Sales & Strategy team and Sam is a Junior Staff Analyst at ACF Equity Research. See their profiles https://acfequityresearch.com/team/