Renewable Energy – Raising EVA for all sectors

Macquarie confirmed ~£3.1bn financing for UK green / renewable energy projects in Oct 2020, which supports the UK’s renewable energy sector and will help internationalise it.

- Macquarie Group, an Australian based infrastructure investment bank, ~£3.1bn ‘renewable energy’ investment is part of its acquisition agreement in 2017 of Green Investment Group ((GIG).

- GIG is a renewable energy and green infrastructure developer.

According to Mark Dooley, global head of the GIG, the UK is among the utmost “investable [renewable] energy and infrastructure markets in the world”. - Since Macquarie’s GIG’s acquisition, corporate interest in what GIG can offer has risen:

- Tesco (TSCO:LSE) is working to install solar systems at many of its UK sites;

- On 10 Dec 2020, Amazon (NasdaqGS:AMZN) confirmed construction of 26 new wind and solar projects, which include the UK as a prime location, bringing total to 127 projects.

- In what we see as welcome reinvigorated political support for renewable energy infrastructure, the UK government recently announced GBP 12bn funding and GBP 10bn in government guarantees for a new state renewable energy infrastructure bank. The government backed bank is similar in function and role to GIG.

Covid-19 not only shifted public health priorities it also moved general health of the planet up the agenda of the general voting public.

Those few months of clearer skies, as a result of tight lockdown measures during the pandemic in 2020, reminded the general populous of many countries that they wanted to prioritise improving their environment.

This recent ‘clear skies’ experience has led to a swell in both public awareness and support for renewable energy technologies. Where there is public support so political will often follows. Both are needed to improve the global environment and renewable energy is one of the keys.

This change in popular focus has had a very positive impact on the renewable energy sector. Investors have noticed and see the renewed popular interest in renewable energy translating to superior returns.

1Q20A renewable energy use was up 1.5% vs. 1Q19A. The share of electricity generation by renewables in the global energy mix 1Q20A also rose by ~2% vs. 1Q19A (IEA, 2020).

There are several notable drives for the growth in renewable energy use.

These growth drivers include greater adoption of solar energy [panels] by households, the emergence of more wind farms backed by renewable energy financing programs run by businesses such as Macquarie’s GIG and other ‘green’ investment banks, and the prioritisation of renewable energy generation capacity by emerging economies.

Emerging economies see renewable energy as both environmentally useful and strategically essential because it provides energy independence from third party entities, e.g. fossil fuel countries and producers.

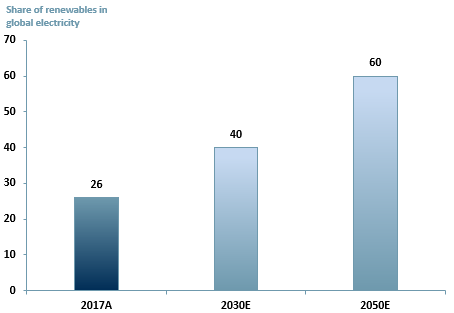

As a result of the coalescence of the drivers described above, we project accelerated renewable energy growth that will deliver 40% of global electricity generation by 2030 and, perhaps optimistically, will account for 60% for global electricity generation by 2050, as per exhibit 1 below.

Exhibit 1 – Projected global share of renewables in electricity generation between 2017A and 2050E

Source: ACF Equity Research, IRENA, 2020.

We see the refreshed commitment to renewable energy as a significant and exciting accelerated driver of sustainable economic growth, leading to improved economic value add (EVA) across all sectors, as well as delivering improved standards of living, quality of life and economic well-being across the globe.

Renewable energy is not the whole solution to the environmental and climate crisis, but it is so important that without it we cannot hope to succeed in this challenge as a species. The total investment return potential to the world might be as significant as oil, IT and healthcare combined.