Biotech M&A Strong Year Ahead in 2023

Dealmaking is essential to biotech companies to support the costs of new drug developments. Dealmaking provides capital injections for commercialization of therapies and exits for capital for earlier investors – ACF estimates a pickup in M&A deals for 2023. Many of today’s blockbuster drugs such as Keytruda (cancer treatment), Opdivo (cancer drug) and Enbrel (anti-inflammatory), are the result of M&A deals.

Large and mega cap drug companies long-ago off-loaded a large element of drug development risk on to smaller focused entities, that essentially do a better job and are more transparent for investors. if a small cap biotech project does not work, there is no hiding and investors will very quickly redirect capital away from that particular project.

- In 2018 and 2019, M&A deals hit record highs. Following the start of the COVID pandemic, deals reduced through to 2022.

- Large pharma companies often look to small biotech firms for new molecules or drug candidates. The deals made are usually focused on primary markets such as cancer, rare diseases and immune system disorders.

- Pharma M&A deals do not come cheap, often at a premium of more than 100% (our expectation for a good M&A deal in many sectors is a 40% premium – healthcare and mining are different).

- These 100%+ M&A premiums are, in part, a result of investors struggling to assign operational value to both large and mega cap pharma and biotech therapy research companies prior to M&A. The result of this poor market pricing prior to M&A is that a great deal of value is passed to the acquirer rather than the original biotech investors.

- Patent expirations are causing big pharma to experience significant revenue losses.

Patent expirations to boost M&A deals in 2023

In 2023, ACF expects a rebound in M&A deals primarily due to big pharma having to compensate for revenue losses from patent expirations. A patent is only valid for 20 years (there are abilities to extend around 5 years in a number of markets), It takes on average ~10-15 years to develop a drug to commercialisation – leaving just 5-10 years of patent protected revenues.

(AI and other techniques in drug and therapy development look as if they might reduce the average time to commercialization to say, 7-10 years).

Several blockbuster drugs in recent years have gone-off patent and face generic competition. For example, Lipitor, the cholesterol-lowering drug made by Pfizer (NYSE:PFE) lost its patent protection in 2011, which led to significant revenue reduction. In 1Q12, PFE revenues fell by 19% and the s/p fell by 15%+.

Humira, AbbVie’s (NYSE:ABBV) an inflammation from arthritis and Chron’s disease therapy, is facing the effects of patent expiration. In 2018 the actual patent expired, and in 2023 protection covering Humira’s formulation and method use in the US will also expire. Once proection completely expires, biosimilar versions of the drug will enter the market leading to a significant reduction in the price (sometimes as much as 90% within 12-18 months) of the drug and therefore, a decline in revenues for AbbVie.

As patent expiration picks up across big pharma, filling the revenue gap will require inorganic growth (read acquisition of biotech drug developers). Our proposition is evidenced by a flurry of deals completed at the beginning of this year. Companies such as AstraZeneca (Nasdaq:AZN), Ipsen (IPN.PA) and Chiesi (private) contributed to a total value of ~$3.7bn in biotech deals announcements in the early days of January 2023.

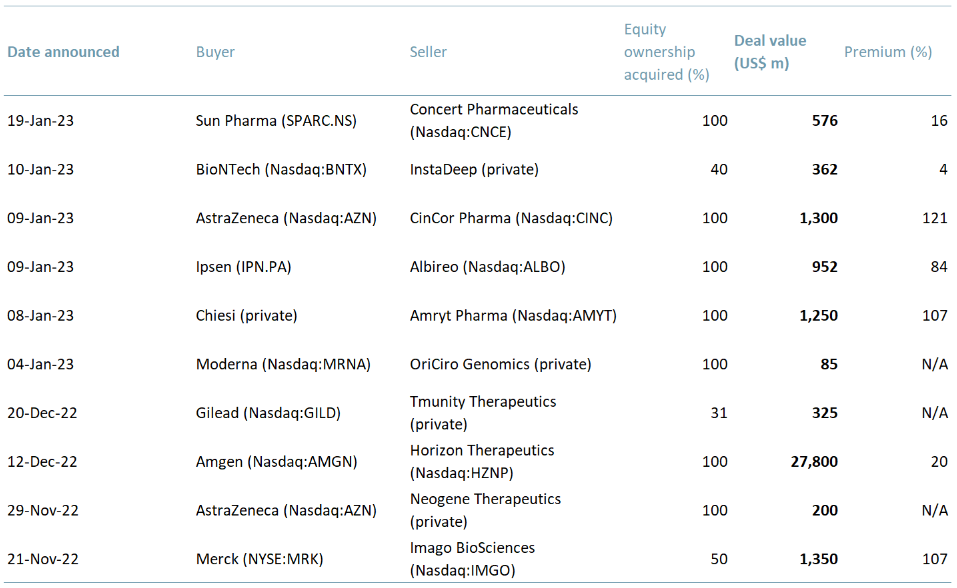

In exhibit 1 below, we highlight the 10 latest major biotech M&A deals made or announced. Combined, they are worth ~$34bn. Given the frequency of deals that occurred in January 2023, we think the momentum bodes well for the future of biotech M&A in 2023.

Exhibit 1 – Major biotech M&A deals 2022-23

Sources: ACF Equity Research; BioPharma Dive; PwC.

A change of approach in pharma/biotech M&A – deal making is no longer limited to complete buyouts, but now includes partnerships, joint ventures, alliances and co-promotion, which are a much less risky way for big pharma to bet on new ideas. These new strategies allow big pharma to evaluate early-stage progress before making larger commitments as the probability of R&D or therapy success rises.

While the stage is set for a solid 2023 for pharma/biotech M&A, there remain some concerns that could derail progress made so far this year.

Risks to our outlook – Uncertainties including the rising interest rate environment, geopolitical tensions and pricing statutes captured in the US’s Inflation Reduction Act 2022 (US federal law aimed at curbing inflation) could play a part in slowing dealmaking. Subdued equity markets, reduced IPO appetite and falling valuations, often considered triggers for a spinoff or de-consolidation market have created a ‘buyer’s market’.

As is often the way in markets, those companies with access to cash and liquidity will be best placed to take advantage of the current M&A environment, both as acquirors or targets.

Authors: Garvit Bhandari, Renas Sidahmed, Christopher Nicholson – are analysts at ACF Equity Research See their profiles here