ESG Indices – We Call For Rigour and Simplicity

ESG indices need to be simpler to understand and accessible to smaller companies. ESG indices are experiencing downgrades and as a result, fund managers and investors are looking for ‘greener’ alternatives. Article 9 funds (otherwise known as the Sustainable Finance Disclosure Regulation (SFDR) funds) often use ESG indices as a benchmark to determine which companies meet required sustainability standards, i.e. which ones are sustainable investments. As a result of these downgrades, these Article 9 funds are finding it challenging to meet their sustainability goals.

Article 9

To address this issue, Article 9 funds are now developing their own in-house sustainability criteria to avoid relying solely on ESG indices. This enables the funds to have greater control over sustainability standards that are used to evaluate companies in their portfolio and can result in more accurate and consistent assessments.

Rigorous does need to mean complex. Because of the failure of complex indices, there is a growing trend of more rigorous, standardized and simpler ESG ratings methodologies, which can improve the reliability and accuracy of ESG indices. This could help improve investor confidence in the benchmarks and ultimately lead to a better alignment between Article 9 and ESG indices.

As of January 2023, the European Union (EU) has implemented a product-level taxonomy disclosure under the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation article. The disclosure requirements will, it is to be sincerely hoped, set out clear criteria for what qualifies as a sustainable investment and what does not.

Currently companies are required to disclose, in their year-end reporting accounts, the proportion of turnover, OPEX and CAPEX that is derived from activities aligned with taxonomy criteria, i.e. ‘climate change mitigation & adaptation, sustainable use and protection of water & marine resources, the transition to a circular economy, pollution prevention & control, and protection & restoration of biodiversity & ecosystems’ (EU Taxonomy).

ESG indices downgrades

Environmental, social, and governance (ESG) indices have gained significant popularity over the past few years as investors increase focus on sustainable investing. A problem for portfolio managers making investment decisions is that ESG index benchmarks are inconsistent and complex, this is the underlying problem in our view that has subsequently lead to company reporting problems, leading to index under-performance and index downgrades – which opens up questions as to their reliability as investment tools.

ESG indices are undergoing downgrades because they lack transparency – they are complex to construct, interpret and for companies to deliver. The rating systems are often proprietary and opaque and investors are unable to understand how ranking is attained. This erodes confidence in ESG indices, increasing the probability of error because of lack of market oversight, which in turn leads to downgrades.

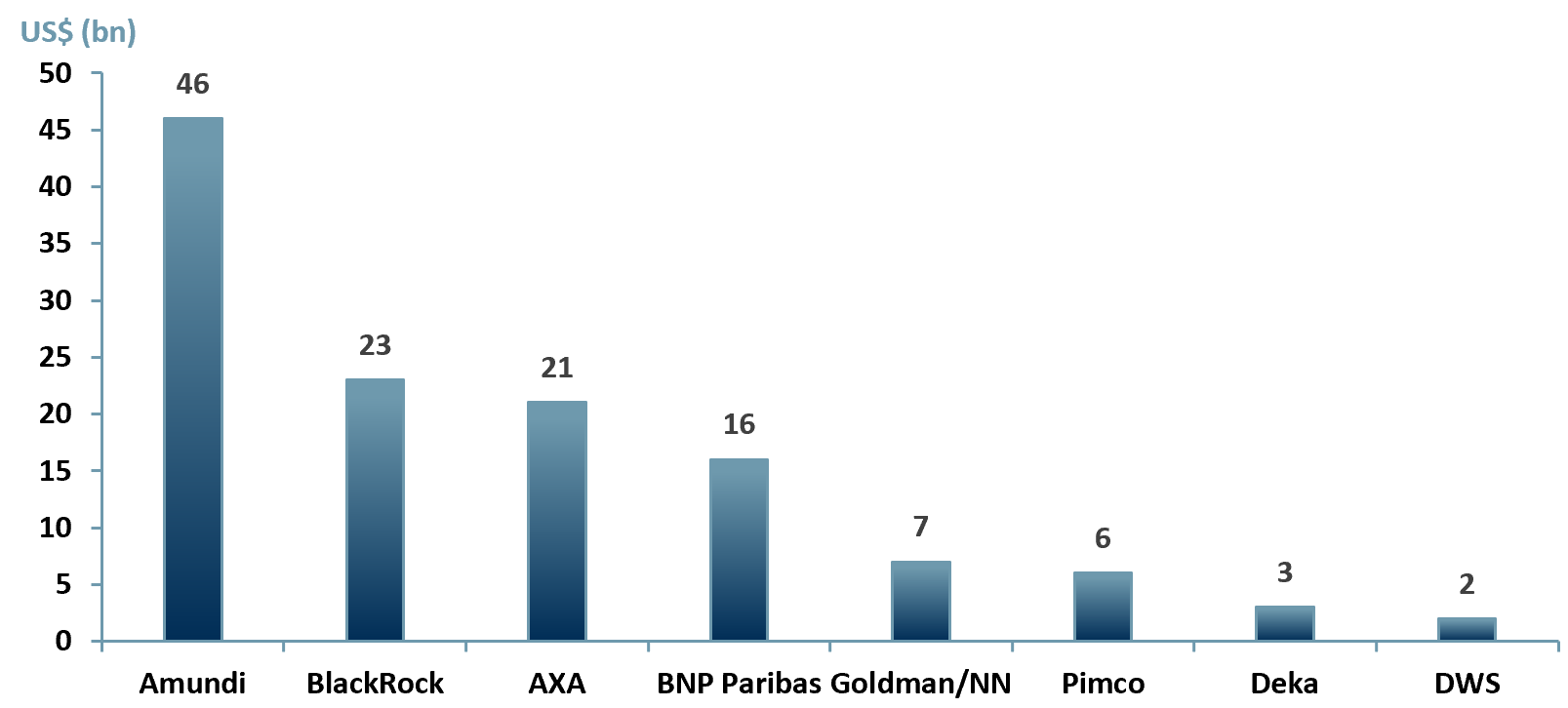

In 2022 major funds had downgraded ESG assets by $125bn+ in the EU (exhibit 1), based on the SFDR disclosure categories. The EU states that 100% of Article 9 funds must be reserved for sustainable investments. This is an admirable position but it also leads to some pressures on asset allocation, as most funds either are unable or do not wish to hold more than 10% in cash. We suspect that the 100% rule plus restrictions on cash may in some circumstances lead to less than optimal asset allocation.

Exhibit 1 – Fund managers downgrade ESG assets 2022A

Sources: ACF Equity Research Graphics; Company reports; Bloomberg; Morningstar.

Sources: ACF Equity Research Graphics; Company reports; Bloomberg; Morningstar.

Greenwashing – Regulators and other stakeholders seem increasingly to have cause to question the claims made in company ESG policies, many of which appear to be a return to the old and discredited CSR standards. ESG claims are made but metrics are not provided for scrutiny. In our view, no metrics, no ESG policy.

Companies that have previously been lauded as ESG paragons have been downgraded; this is problematic for investors. For example, in 2020, Volkswagen (VW) overstated its environmental credentials by claiming that its diesel cars emissions were lower than they actually were.

The VW scandal, also known as Dieselgate or Emissionsgate, began in 2015. The US Environmental Protection Agency (EPA) issued a violation of the Clean Air Act (US federal air quality law that controls nationwide air pollution). The EPA found that VW had intentionally programmed turbocharged direct injection (TDI) diesel engines to activate emissions controls of nitric oxide & nitrogen dioxide (NOx) during lab testing. During testing the TDIs met US standards, however in actuality (while on the road) the vehicles emitted up to 40x more NOx.

By 2020, the scandal had cost VW up to $33.3bn in fines, penalties, financial settlements and buyback costs. VW’s ESG ranking was downgraded by ratings providers and the incidence impacted the performance of several ESG indices that included VW after its valuation was hit by the scandal. VW received an MSCI ESG rating of CCC, which is the lowest.

ESG indices are also downgraded because of changes to the regulatory environment. As global governments introduce new regulations to promote sustainability, the criteria for ESG ratings is also evolving. This can make it difficult for ESG indices to keep up with the changing landscape and may result in companies being downgraded if they do not meet the new standards.

An example of changing standards is the European Union’s Taxonomy regulations to promote sustainable finance introduced in 2021. The EU taxonomy is a classification system establishing a list of environmentally sustainable activities. Companies that do not comply with these regulations may be downgraded by ESG ratings providers (e.g. Sustainalytics, MSCI ESG Research, ESGI), which could impact their inclusion in ESG indices.

ESG Ratings

Despite these challenges, ESG indices remain an important tool for investors who are looking to incorporate sustainability into their investment strategies. However, investors should be aware of the limitations and potential biases in ESG ratings:

Limitations

- Lack of quality data – main barrier and for the reasons below

- Data is self-reported – companies can choose the data they want to be publicized and offer their own views

- Data is often obtained from third-parties – it may not reflect the actual results of the company’s efforts

- Data is unaudited – omissions, unsubstantiated claims and inaccurate figures can be hard to identify and verify

Biases

- Company size – larger companies tend to be given higher ESG ratings possibly because they have higher valuations and more resources to measure their ESG profile

- Geography – the EU requires companies with 500 employees+ to publish a non-financial statement on diversity, North America does not have that disclosure requirement

- Industry – agencies assign E, S, G weights without factoring in company-specific risk resulting in a biased rating based solely on the industry

ESG due diligence

To avoid the challenges with ESG indices, mitigate risks and enhance long-term value, investors should conduct their own due diligence to ensure that the companies in the ESG index meet their own standards for sustainability or use a less complex but nevertheless rigorous approach. ESG due diligence is the process of evaluating ESG factors when assessing the risks and opportunities of an investment or business transaction.

It is an essential component of responsible investing and risk management. The process typically involves reviewing publicly available information (e.g. regulatory filings, sustainability reports, and news articles) as well as conducting interviews with key stakeholders, including management, employees, customers, and suppliers.

The purpose of ESG due diligence is to identify potential ESG risks that could affect the financial performance or reputation of the investment or business transaction. The specific ESG factors considered in the due diligence process may vary depending on the investment or business transaction and the industry involved. As with many things simplicity is the key, underpinned by rigour.

Authors: Renas Sidahmed, Christopher Nicholson – Renas is Head of ESG and a Staff Analyst and Christopher is Head of Research at ACF Equity Research See there profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)