Global Textile and Apparel Value Chain

Textile manufacturing is potentially a very attractive business investment. The cost base is often in low value currencies and revenues are often in US dollars (US$).

The tactical challenge for public companies engaged in textile manufacturing is customer base diversification. Over reliance on a small number of significant customers, though initially attractive (large reliable orders and relatively simple customer relationship management) makes textile manufacturing businesses particularly vulnerable to cyclicality.

Below, we describe some of the key themes textile manufacturing business must contend with.

The textile industry is inherently cyclical and can be subdivided into textiles and apparel. Inherent cyclicality drivers in the textile industry include fashion trends, which come and go very quickly, and seasonal variation, e.g. winter coats and summer dresses and supply chain complexity.

The textile industry is also sensitive to broader macroeconomic factors, e.g. inflation, consumer demand, disposable income levels and demographic trends.

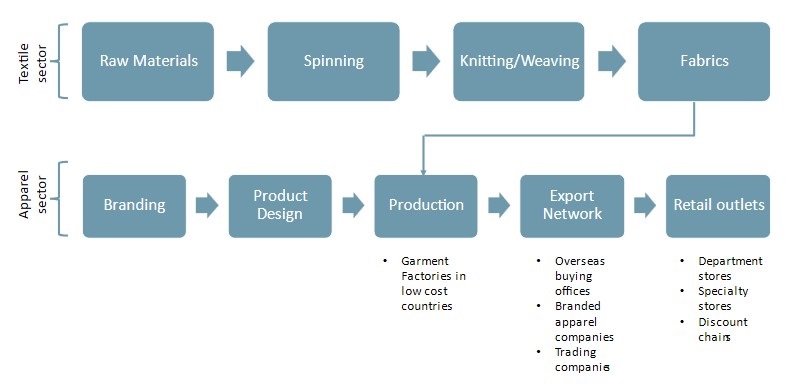

As alluded to above, the textile industry supply chain is particularly complex with multiple production and go to market steps. We provide examples of these supply chain complexities below:

- Raw materials – This includes the supply of natural fibres such as cotton, wool (which are themselves seasonal) as well as synthetic or man-made fibres.

- Spinning – The cleaned and sorted raw materials must be transported to a location where they can then be spun, a process which uses a twisting technique to form yarn from fibres.

- Knitting / Weaving – Yarn produced from natural fibres is then knitted (interlocking loops of yarn that created a flexible stretchy fabric) or weaved. Weaving creates an interlaced warp (longitudinal and right angled (crosswise) weft). Woven fabrics are less flexible than knits and lend themselves to better defined patterning, e.g. stripes.

- Mechanical / Chemical (coatings) treatment – The knitted or woven fabric then undergoes a chemical and/or mechanical processing (which includes bleaching, dyeing, and printing) to produce a textile with specific desired properties.

- Cutting and Sewing – The next step in the value chain involves cutting and sewing the textile into a finished apparel.

- Distribution – This is the final step in the value chain and mainly involves getting the product to the different retail outlets and other stores for sale to the consumer.

In order to better understand the challenges for textile manufacturers, we focus on the apparel industry below which is the most value-added part of the overall textile chain. The apparel industry is dominated by large retailers with established brands and distribution channels.

These retailers create or ‘borrow’ designs for clothing they believe are ‘on-trend’ or will sell for other reasons in the upcoming fashion or weather season. The retailers then outsource the manufacturing of their apparel designs and ideas to lowest cost of production centres (generally developing countries) to control the cost of production.

Apparel manufacturers / garment factories generally have neither the brand nor the distribution channels of their own to sell their products and so are dependent on branded retailers to generate revenues for their products.

As such, we characterize the apparel industry as a “buyer driven” value /supply chain. This implication is that that buyers have more control over the supply chain than manufacturers.

The retail clothing companies that develop and sell brand-named products have considerable control over how, when and where manufacturing will take place, and how much profit accrues at each stage of the supply / value chain.

It is observable that most of the value addition in the textile industry is created by the lead retailing companies, and as a consequence branded retailers with significant distribution retain the bulk of profits generated by the textile industry.

Exhibit 1 – Textile and apparel value chain

Sources: ACF Equity Research Graphics; OECD.

Sources: ACF Equity Research Graphics; OECD.

The key players in the apparel value chain can be broken down further into the manufacturers and the retail importers.

The manufacturers are mainly concentrated in China, South East Asia (Vietnam) and South Asia (Bangladesh, India). While the large global retailers are based in either the European Union (EU) or the United States.

China is the world’s largest exporter of clothing, having exported ~$175bn worth of garments in 2022, according to data from the General Administration of Customs China. The European Union is the second largest exporter of textiles and apparel with ~$73bn exported in 2022, according to data from the European Apparel and Textile Confederation (Euratex).

Countries such as France, Germany, and Italy are known for their high-end fashion brands which are in demand worldwide. However, the production of the apparel for most of the European premium brands is done in low-cost countries, which is then re-exported after branding to various countries at a premium price.

We expect a significant shift in the geographical centres of value in the manufacturing sub-segment as China’s standard of living continues to rise, in turn pushing manufacturing wages and so costs upwards. Our expected reduction in Chinese cost competitiveness may favour South East Asian countries (such as Vietnam) and or South Asian countries (including Bangladesh and India), both of which have slower rates of standard of living improvement.

Ultimately, there may be a significant opportunity for an Africa textile manufacturing base. Africa may find it can use technological innovation to spring board both China and the rest of Asia (in the same way that Africa missed out banking bricks and mortar branch networks and jumped straight to mobile banking).

Successful textile manufacturers will need to be capitally agile to take advantage of cost competitive geographic changes and to develop AI systems to manage complex broad customer bases in order to implement revenue and margin diversification. We assess that this will, in turn, allow textile manufacturers to secure a greater share of margins.

We infer that we are at a textile manufacturing inflection point. Current manufacturers will consider exiting the business, reviewing customer strategy and or investing heavily in new automation systems for both business/client management and production.

Authors: Garvit Bhandari and Christopher Nicholson. Garvit is a Senior Staff Analyst at ACF Equity Research, Christopher is ACF’s Head of Research. See their profiles here