Property integration of AI/technology

Matterport, Inc. (Nasdaq: MTTR) partnered with CompuSoluciones in June 2023 to encourage the adoption of digital twin solutions for the Latin America real estate sector.

- Matterport, Inc. (Nasdaq: MTTR) is amongst the leaders of the built world digital. It enables the transformation by focusing on digitization and datafication.

- According to a 2020 Commercial Real Estate (CRE) Innovation Report, “approx. 49% of commercial real estate executives believe that Artificial Intelligence has a great potential for significant cost savings and operational efficiencies.” (McKinsey, 2020)

- Global market size of AI in real estate is going to reach ~$1,336bn by 2029E, while the overall AI market could increase to $1,415bn by 2029E. (Maximize Market Research, Next MSC, 2023)

- The global Real Estate market size is expected to reach US$ 6.13trn by 2030E, up from US$ 3.88trn in 2022E. (Research and Markets, 2023)

ACF view:

AI integration is escalating, regardless of the industry, this much is self-evident. The real estate sector has been something of laggard in adopting AI driven efficiencies, this is changing and the sector is catching up quickly in respect of AI adoption. This is leading to an expansion of investment opportunities within the real estate sub sector often referred to as proptech.

The real estate sector is increasingly adopting AI technology in various areas of its business. We list some of the key areas of AI uptake in real estate below:

- Property Search and Recommendations – AI system deployment is accelerating for the analysis of user preferences, historical data, and market trends to provide personalized property recommendations.

- Virtual and Augmented Reality (VR/AR) technologies enable virtual tours, allowing the 3D viewing and exploration of properties remotely. Providers of 3D viewing technologies include Matterport.

- Smart Home Automation – The integration of AI with the Internet of Things (IoT) is edging the much discussed benefits of the IoT into practical mass accessible reality. The remote automation of various tasks like lighting, temperature adjustment, security systems, and appliances to optimize energy usage seems as if it might be about to happen in an integrated and attractive way for the homeowner/renter.

- Predictive Analytics – AI models are deployed to forecast property prices, rental yields, and market demand to assist investors, developers, and agents in making informed decisions. Redfin (Nasdaq: RDFN) and Zillow (Nasdaq: Z) are now using the ChatGPT engine to assist in forecasting.

- Property Management and Maintenance – AI Chatbots (link to https://acfequityresearch.com/chatbot-market-potential )and virtual assistants are proving to be extremely useful for the provision of automated notifications, thereby improving customer service and operational efficiency.

- Risk Assessment and Fraud Detection – AI algorithms now help professionals verify property titles and detect fraudulent listings. AI is also deployed to ensure compliance with legal and regulatory requirements, e.g., LexisNexis risk solutions or Rocket Companies (NYSE: RKT).

- Sustainable Energy – AI and sensor technologies married together and referred to as Smart energy management systems, are helping the property sector fulfil its ESG obligations and roles by optimizing energy consumption in buildings.

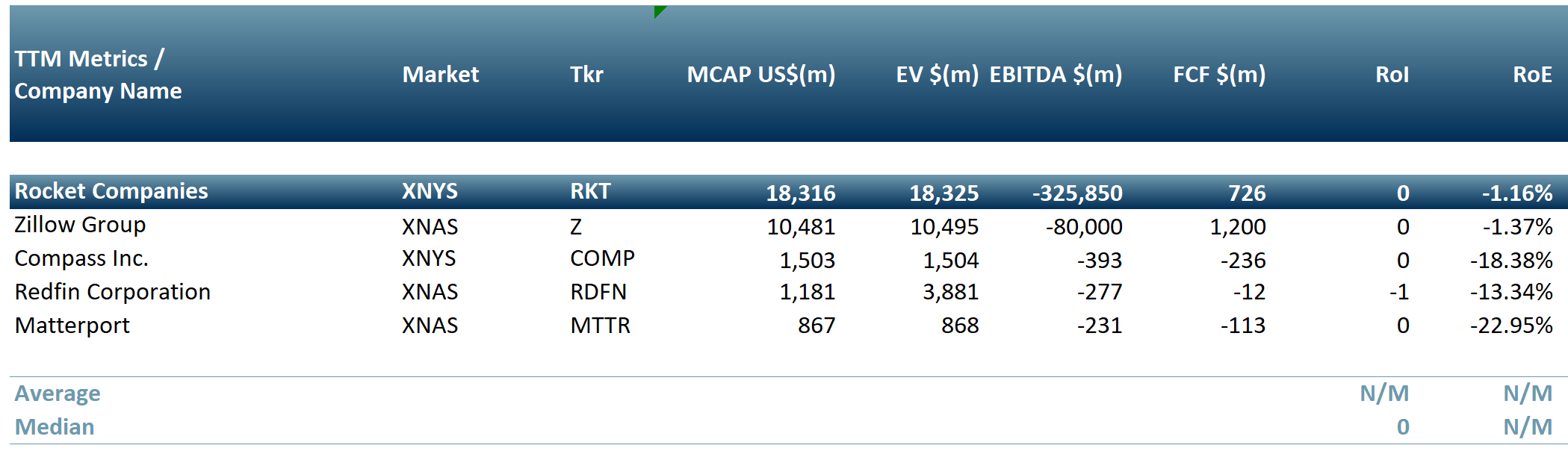

In exhibit 1 below we present some of the top proptech AI companies with a focus on innovative solutions for the real estate sector.

Exhibit 1 – Top AI companies focused on solutions for Real Estate sector as of 14 June 2023.

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

AI technology appears able to facilitate the delivery of innovative solutions that transform the way properties are bought, sold, managed and experienced. We envisage significant margin expansion for real estate companies embracing proptech and lower costs for users.