US performance for the rest of 2023

Six mega cap US stocks have propelled US market gains so far in 2023. The six stocks have one thing in common – innovation. This investment theme is very likely to remain the dominant idea in terms of returns for 2023.

Investors, or market thinking, could be said to be divided into two clearly polarised categories this year – macro-economic fear and individual stock innovation.

There are two reasons that innovation is likely to dominate investor thoughts for the rest of this year:

Firstly, we subscribe to the idea that economic growth comes largely from innovation in hyper developed economies. Essentially growth in these markets comes from the creation of new markets. Innovation is also at the heart of neo classical (Solow-Swan) GDP growth model (Y=AF(KαL1-α), where Y is GDP, A is technological innovation, K is capital, L is labour.

Secondly, at some level technological innovation is always an investment theme, it is just a particularly hot topic at the moment after the release of AI engine ChatGPT earlier this year.

In our assessment there are three particular areas of innovation and they are interrelated at some level. These themes are computer hardware, computing software and healthcare discoveries.

The point about innovation in computing hardware (processing power) and software (e.g. AI) is that in perhaps all economies now, they touch every sector directly. Even if one disagrees with this ‘direct effect’ posit, then certainly all sectors are indirectly effected by these areas of innovation.

Specifically the S&P rally is about AI, but investors should consider any stocks with a strong innovation story as potential outperforming investment opportunities. The innovation investment theme is also underpinned by two factors – Innovation is ‘physical‘ and it is accelerating, this affects future EPS and CPS expectations. Innovation is also emotional for investors, i.e. it is also driving sentiment.

As of 30 June 2023 only Apple (NasdaqGS : AAPL), EV ~US$ 3trn, had not announced a big AI value driving project in the list below. Investors are also very emotionally excited by AI, and as is usual at these points in the cycle, many investors are also probably not doing any actual research or don’t have access to pertinent well thought out research.

Investors that are not doing their own research and or do not have access to high quality research are very likely to lose money overall, as is always the case during the hyper emotional phase of an investing trend.

At the end of May 2023 the top 20 stocks by market capitalisation accounted for ~30% of the value of the S&P 500 and 7 percentage points (pp) of the total ~7.5pp S&P gain this year.

To underline the asymmetric nature of US stock market gains further, if the top 20 positive-gain stocks are removed from the S&P list, the S&P was down (in negative territory) for 2023 at the end of May by ~1.5% i.e., remove the AI buzz driven tech rally (with the exception of Apple) and the S&P 500 has performed negatively in 2023).

Exhibit 1 – Watch out for the narrowing of the breadth of returns

Sources: ACF Equity Research; Refinitiv.

The analysis of the performance of the US rally also describes a period of returns breadth narrowing. At such times the market is inevitably facing higher risk. Investors are dependent on the few rather than the many for returns in this rally, that means risk is highly concentrated.

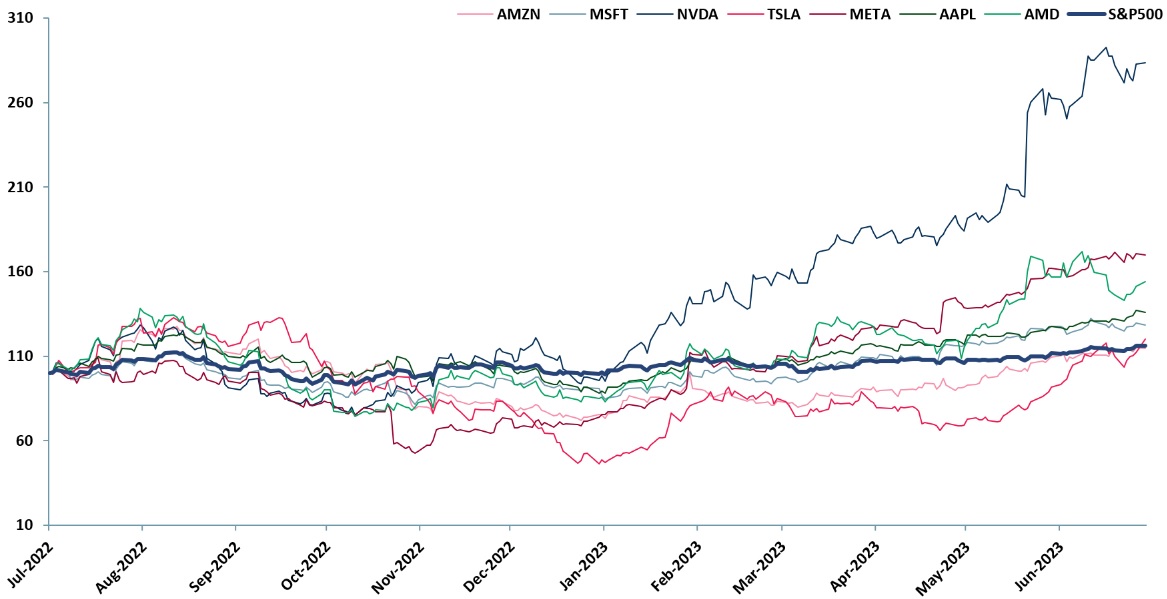

Exhibit 2 – Peer group of seven of the top 20 ranked US market rally stocks

Sources: ACF Equity Research; Refinitiv.

Innovation is the key to market outperformance this year and it is also at the forefront of investor psychology. Very broadly, if investors are not focussed on innovation, then they are focussing on value/defensives – there appears to be little or no middle ground for the majority of investors.

More worryingly investment risk is highly concentrated. Out-performance (or alpha) is available as ever but beware the concentration and ‘breadth’ of returns if your investment philosophy is US large or mega-cap stocks only in 2023.

Author: Christopher Nicholson, ACF Equity Research’s Managing Director / Head of Research, was a speaker for the future of US tech for the Financial Times Investors’ Chronicle Future of Private Investing on the 15th of June 2023.