Have diagnostic sector producers hit the ‘jackpot’ with the Covid-19 tests

● Abbott Laboratories (ABT.IXIC) had sold over 40m Covid-19 diagnostic-tests by mid-July 2020. As the virus infected cases rise globally demand for tests is soaring. But are the tests efficacious and is this a new dawn for diagnostics companies looking for investment? If it is a new dawn, we predict that smaller healthcare companies with a verifiable ESG policy are most likely to succeed.

● Although Abbott revenues are dominated by approved drugs, medical devices and diagnostics for people with diabetes, the company’s Covid-19 diagnostic-testing related sales accounted for $615m of £7.3bn total revenues or 8.4%, according to the recent 2Q earnings report.

● Abbott’s molecular diagnostic Covid-19 tests are as follows:

‘m2000’ and ‘Alinity’ used in hospitals’ laboratories for testing healthcare workers and symptomatic patients;

‘Id-Now-Covid-19’ test used largely in rapid point-of-care settings from ‘drive-thru’ clinics (temporary screening locations) to nursing homes and urgent care centres. These rapid diagnostics tests can deliver results in as little as 5 minutes and negative results in 13 minutes.

● According to the Abbot’s CEO, Robert Ford, Abbott’s Covid-19 molecular diagnostic tests have sold across all of their platforms in countries around the globe. He also pointed out that even after a vaccine is approved and widely used, Covid-19 testing won’t stop.

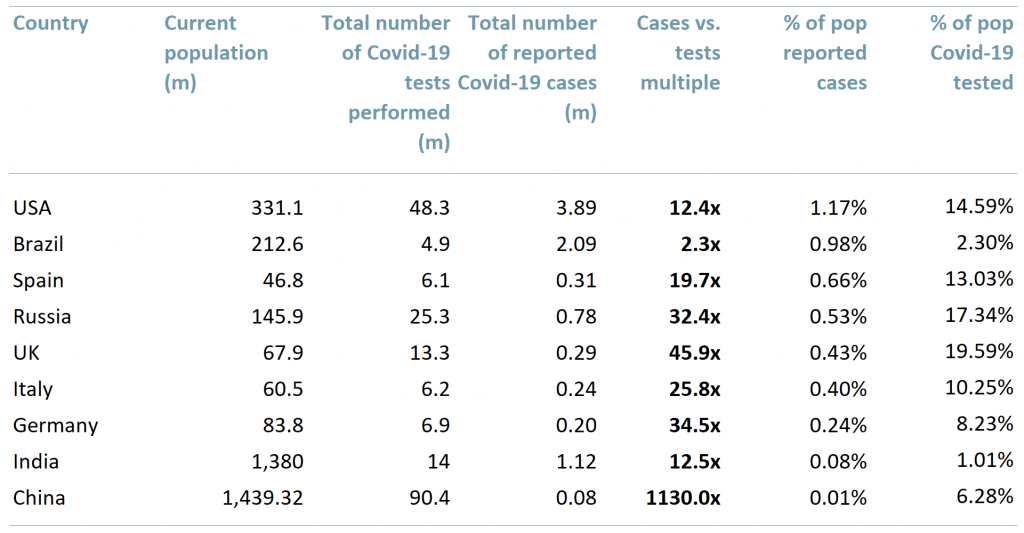

ACF insight: It seems that developing Covid-19 tests is a new ‘jackpot’ for companies in the diagnostic sector, if Abbot’s results are any kind of guide. For investors, any ‘jackpot’ in diagnostics has been a long time coming. Besides giants such as Abbott Laboratories, Becton Dickinson and Roche Holdings, the opportunity may arise for small and mid-cap companies to develop and supply Covid-19 tests on the global market as well.

The reason behind this assumption is our assessment that governments in the world’s major healthcare markets are pushing for more competition in healthcare. The world needs effective healthcare solutions for pandemics. At the same time, such life-saving products must also be cost-effective and equally available for everyone. Just as affordable as a pregnancy test or a flu-jab, governments are waking up to this.

So an opportunity exists in which governments could create a space for smaller companies in diagnostics to grow. However, in order for smaller producers to have a chance at competing on the global market, they must still attract investors’ money. In order to do so, these firms must increase their visibility and attractiveness – they can start this process by implementing an ESG policy (with metrics).

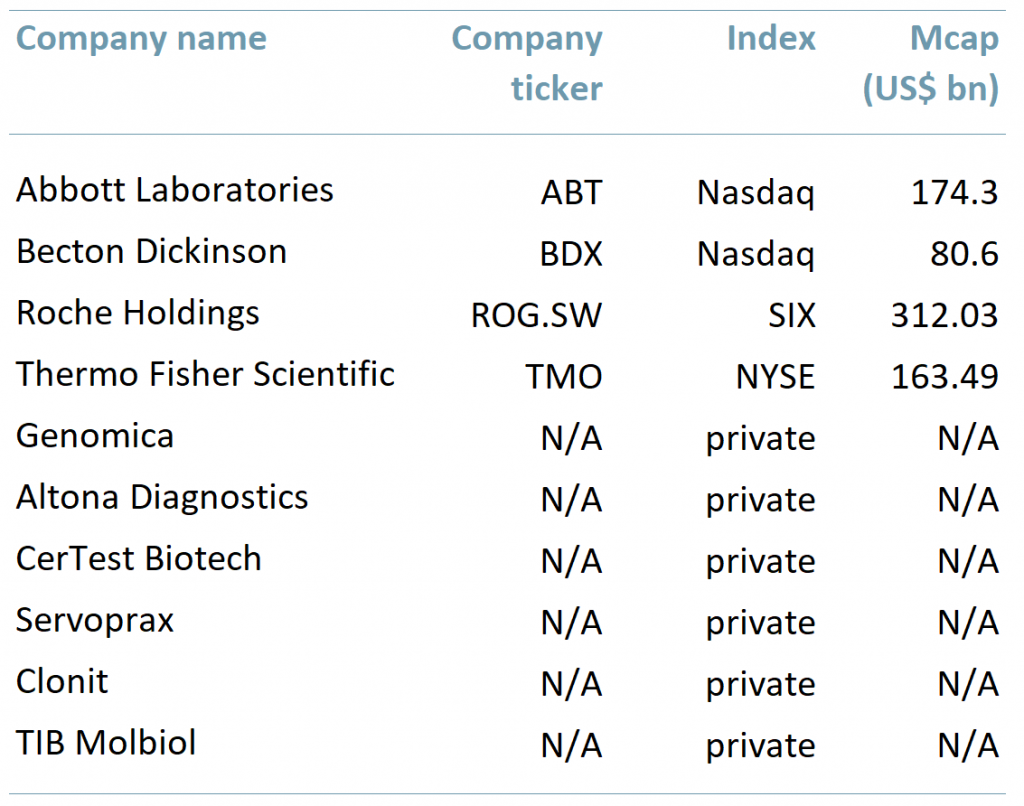

Exhibit 1 Statistics of reported Covid-19 cases vs. diagnostic testing by 20th July 2020

Exhibit 2 Selection of companies producing Covid-19 tests