Saving the Care Home healthcare segment – Technology, M&A and the State

David Grabowski, a Harvard Medical School professor who specialises in healthcare policy, in an interview with Yahoo Finance in July 2020 spoke to the crisis of the US care home industry pre-Covid. Prior to the pandemic care home facilities were severely understaffed and underfunded. Things are not getting better, so they have to change.

As a result of Covid-19, care homes in the US and the UK have experienced a large number of deaths related to the virus, the tragedy of possibly avoidable deaths has a more prosaic facet – it has exposed concerning weaknesses in the business operations of the care home sector in the US and the UK. The pandemic has created alarm that the sector requires increased government intervention.

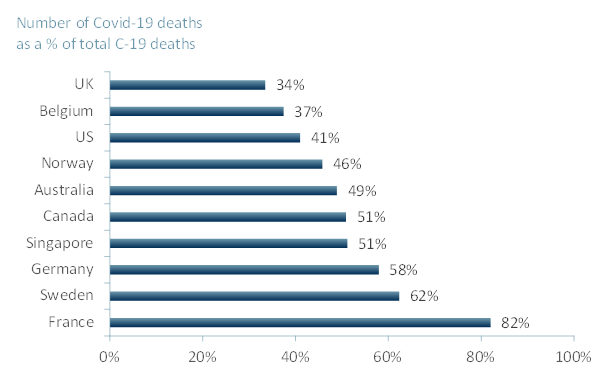

Exhibit 1 – Number of Covid-19 deaths linked to care homes, 2020

Source: ACF Equity Research; International Long-term Care Policy Network. Note: Figures based on partial data as of 20 May 2020.

- The New York Times reported that by the 26th June approximately 43% of the 125,000+ deaths in the US related to Covid-19 were related to patients in 15,600 nursing homes. The numbers are higher now.

- Over 1.3m residents are provided for in these 15,600 nursing and they provide employment to over 1.6m people.

- Pre-Covid there were several closures of nursing homes across the US due to understaffing and the persistent poor quality of care.

- Covid-19 has only worsened the situation with nurse aides having to look after 25 to 30 residents per shift on their own.

- According to a recent NCAL (National Centre for Assisted Living) survey, over 50% of nursing homes and assisted living communities in US have reported a shortage of PPE.

- 87% of nursing homes in the US have expressed issues with lab processing times for coronavirus tests which can take up to two days or more.

- In England, 29% of the 15,000+ care homes had been affected by the Covid-19 outbreak causing 4,343 deaths between 10 April and 26th June 2020.

- Prior to Covid the social care industry in the UK, including domiciliary care, was a safe haven for hedge funds and private equity firms who monopolised the industry by building, buying or leasing out care homes.

- The business model is also lacking in the sense that care home operators are paid a minimum fee by councils to carry out activities so in turn the operators charge individuals who are self-funded three times as much.

- Furthermore, rising PPE costs and a decline in the number of residents is pushing this industry even further into financial decline.

- At the current rate and with the significant lack of funding, 30% of the UK’s social care businesses are at risk of insolvency within the next three years.

- The UK government initiated a £3.2bn aid package for the industry, however it will only cover 1% of the Covid-19 crisis government-backed loans and these businesses seem unlikely to be able to repay their borrowings.

ACF View:

Nursing homes across the US and UK are at risk of shutting down due to weak foundations, lack of funding, lack of staff and supplies and an overall business/economic model that appears under threat. Covid-19 has added additional pressure on care homes business model with greater than 30% of all Covid deaths occurring in these facilities globally (Exhibit 1).

Many small businesses and niche markets have unavoidably felt the effects of Covid far greater than their larger and higher funded counterparts. Even though governments have stepped in with QE and fiscal stimuli, it is not at a level where these care homes can survive.

There is a next normal coming our way and all industries have to adjust their business models accordingly. Technology in healthcare is going to be one of the key driving factors this industry afloat, especially for the small and mid-cap companies. In their favour, there is strong and growing demand for their services because of developed economy demographics.

Eventually this may lead to an increase in M&A in the sector as there will be a need for increased collaboration among sub-sectors in order to rationalise costs and prioritise patient care.

Care homes already work in tandem with hospitals taking in patients in order to free up beds. An incentive for further collaboration with care home facilities is the rise in the use of telemedicine. Hospitals can still keep track of patients that reside in care homes via telemedicine and remote monitoring to ensure that the course of treatment is being carried out correctly.

Rather than divide and conquer, the healthcare industry and local governments will need to become, and remain, united now more than ever.