The persistence of declining mental health

Mental health in the UK continues to create cause for concern in 2021 as Covid-19 lingers. The third lockdown will only increase mental health challenges.

- Blue Monday, the 3rd Monday of January, is apparently most depressing day of the year. Temperatures have dropped, you’ve spent all your money during the holidays and New Year’s resolutions have already gone out the window.

- However, behavioural scientists don’t believe Blue Monday/Blue January is an actual fact.

- A 2018 survey by Hitachi Capital UK Plc (Non-work related activities research report) carried out on 2,100 UK working adults found that January is indeed the worst month for productivity. However, this was not due to mental health but rather employees admitted to spending more time gossiping over cups of tea.

- A major concern is the continued lockdown measures. Researchers from the University of Glasgow found that suicidal thoughts after the first lockdown in the spring of 2020 increased over the first six weeks.

- Studies also found that 25% of respondents reported experiencing mental health issues during the first lockdown.

- If the first lockdown was tough, the third will be even worse as it is taking place during the coldest, darkest months of the year. Psychologist Cliff Arnall says “Stress is cumulative.” We are able to deal with episodic stress, but sustained stress is more difficult.

- If lockdown continues into April, it will further exacerbate the UK’s stress and anxiety levels because statistically Spring, and April in particular, present with the highest suicide rates annually.

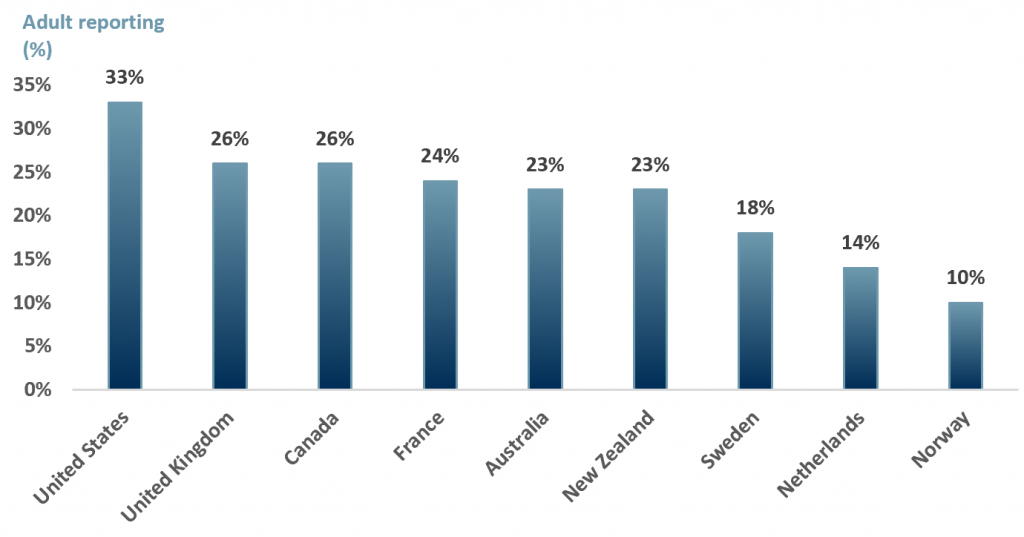

Exhibit 1 below shows the percentage of adults (18+) in select countries who reported stress, anxiety and sadness since the start of Covid-19. Given the UK ranks second is all the more reason that mental health issues during a third lockdown need to be watched very closely. Although of course this failure to get excited is part of the national character for Brits, which may act as an econometric bias.

Exhibit 1 – % of adults who reported stress, anxiety and sadness since Covid -19 in select countries

Sources: ACF Equity Research Graphics; Commonwealth Fund

Sources: ACF Equity Research Graphics; Commonwealth Fund

While many companies have made efforts to keep employees motivated and relaxed, e.g. Zoom yoga, pizza parties, team-building exercises, etc., it is not necessarily enough during a third lockdown. Humans generally crave physical contact – we are after all, herd animals.

WIRED suggests that employers give employees more freedom. Such as taking a longer lunch break in order to take advantage of the minimal daylight hours in order to get some Vitamin D and fresh air. We certainly encourage this at ACF, and give team members daily reminders and encouragement to take extra exercise during lockdown work days.

Ricardo Twumasi, lecturer of psychology at King’s, encourages time away from screens during the darker and drearier days. Twumasi encourages employers to give employees individual freedom to take care of their own health and ultimately their productivity.

While giving employees ownership of their health is a key step forward, it is also interesting to look at the cyclicality of mental health periods of decline throughout the year.

Studying cyclicality gives employers insight into employee behaviour and allows the firm to pre-emptively find ways to offset anxiety and stress issues during more difficult periods. This approach improves overall productivity.

A company focus on employee mental health is more important and relevant now with so many working from home. While Microsoft Teams and Zoom calls are all the rage, it is not the same as having those in-person meetings – yet another cause for mental health decline.

However, ‘monitoring’ employee productivity especially for those working from home, comes with its challenges. A balance is to be had so that employees do not conclude their privacy is being violated and lose trust in their employers. Firms must work to find the balance so that a policy or approach of trust building through concern and care does not inadvertently undermine the vary employee trust it aims to enhance.

Mental health and psychosocial support (MHPSS) has been included as part of the 2020 government response to C-19. 17% of countries globally had funding fully allocated for MHPSS and 47% had funding partially allocated.

Surviving the pandemic is a multifaceted effort. We see this in an increasing number of companies across a variety of sectors prioritising the mental health of their employees.

At ACF, because we have a core team of only 15 and some 25 others off balance sheet, we are still a small firm, it is relatively easy to offer genuine support – we are still very much a ‘family team’. In larger firms it is an altogether tougher challenge because of the scalar effect, making it much trickier to address successfully. But larger firms have greater resources and there is significant help available:

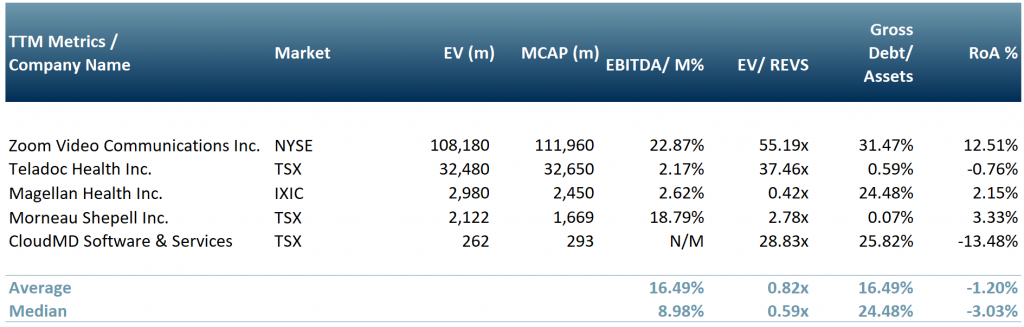

In Exhibit 3 we show a peer group of five companies that function in the telehealth space providing virtual healthcare and support to consumers – CloudMD Software & Services Inc. (TSXV:DOC), Teladoc Health Inc. (NYSE:TDOC), Morneau Shepell Inc. (TSX:MSI), Magellan Health Inc. (NASDAQ:MGLN) and Zoom Video Communications Inc. (NASDAQ:ZM).

Exhibit 2 – Peer group table of companies in the telehealth space

Sources: ACF Equity Research Graphics; Yahoo Finance

Sources: ACF Equity Research Graphics; Yahoo Finance

In a recent S&P Global podcast aired on 31/12/2020 (“the ESG trends that will drive 2021”), it was highlighted that the importance of the ‘S’ (Social) in ESG is at the forefront of asset managers, compliance agencies and investors’ minds and activities. More specifically issues around human capital management.

The concern is that current financial regulations still do not make some of these metrics a requirement for company reporting. So as a result, investors are taking a stronger stance against companies that are not ESG compliant.

Given the ongoing uncertainty in the markets, companies, in particular small and mid-caps, cannot afford to lose investor interest. They must take hold of the opportunity and act, even though regulatory agencies are lagging behind. The economic case for the S (social) in ESG is compelling in of itself, no point in waiting in our view.

Author: Renas Sidahmed – Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See Renas’s profile here