The hydrogen solution – an investor signal

Hydrogen is undergoing a UK trial this year for residential heating. This is one of many areas for which hydrogen is a hydrocarbon replacement fuel.

Key points:

- ~650 homes in a village called Winlaton, near Newcastle, will become the first in the UK partially heated by hydrogen. Around 20% of the gas sent to the village through the gas network is hydrogen.

- This is an important test as gas companies across the UK look to lower their CO2 emissions before the 2050 net zero emissions target date.

- Tim Harwood from Northern Gas Networks describes this blending test as “a stepping stone towards a 100% [hydrogen] world”.

- BloombergNEF estimates that hydrogen could meet up to 24% of the global energy demand by 2050E.

- Hydrogen producing companies flourished in 2020 with the third quarter showing the best performance due to the incoming Biden administration.

Hydrogen (H2) is a clean burning molecule that only produces water when combusted. Although hydrogen is colourless, it is labelled with four main colours (brown/black, grey, blue and green) according to how it is produced:

- Brown/black hydrogen is made through the gasification of coal. Coal is converted into Carbon Monoxide (CO), Hydrogen and Carbon Dioxide (CO2) under controlled conditions in order to produce fuel gas.

- Grey hydrogen is made through steam methane reformation, a process in which steam reacts with methane (CH4), also known as natural gas, to produce hydrogen. This process does however release Carbon Dioxide, as a by-product, into the atmosphere. Unlike methane (CH4), which stays in the atmosphere around 10 years, CO2, according to Nasa, takes 300-1000 years to leave the atmosphere.

- Blue hydrogen is made through steam methane reformation and instead of releasing emissions into the atmosphere, they are captured and stored underground through industrial carbon capture and storage (CSS). This can reduce emissions by up to 50%.

- Green hydrogen is produced using renewable electricity to power electrolysis of water (H2O) splitting it into its constituent elements – two hydrogen atoms and one oxygen atom. The power for electrolysis can come from solar or other renewables. Flow batteries can store renewable power at utility scale.

Hydrogen is one of the top candidates to help the UK economy to lower emissions and reach the climate goals set out in the Paris Agreement to limit global warming to well below 2 degrees Celsius, and preferably limit warming to 1.5 degrees Celsius, compared to pre-industrial levels.

In the UK it is estimated that ~85% of homes and 63% of commercial properties are heated by natural gas – a carbon emitting fossil fuel. As a result, buildings are the third largest emitters of greenhouse gas emissions in the UK, behind industry and transport. (The Financial Times, 2020).

Replacing natural gas with hydrogen is a potentially clean and cost-effective way to heat the UK’s homes. The conversion of gas domestic heating boilers to hydrogen is considered to require exchange of only a handful of components (CIBSE Journal, Jan 2020).

Using hydrogen for domestic and commercial heating adds to a list of ways in which hydrogen could replace fossil fuels, including in air travel. Hydrogen also has applications in producing electricity and is emerging as a potential alternative to fossil fuels in vehicles.

BloombergNEF estimated in its yearly Hydrogen Economy Outlook that if manufacturing is scaled up and costs of production continue to fall, the price of green hydrogen would fall to between US$ 0.7 to US$ 1.6/kg before 2050E. This price level would make hydrogen price competitive with natural gas priced at between US$ 6 to US$ 12/MMBTU. Note however that natural gas traded below US$ 6-12 at US$ 1.495/MMBTU to US$ 3.482/MMBTU in 2020. (BloombergNEF, 2020).

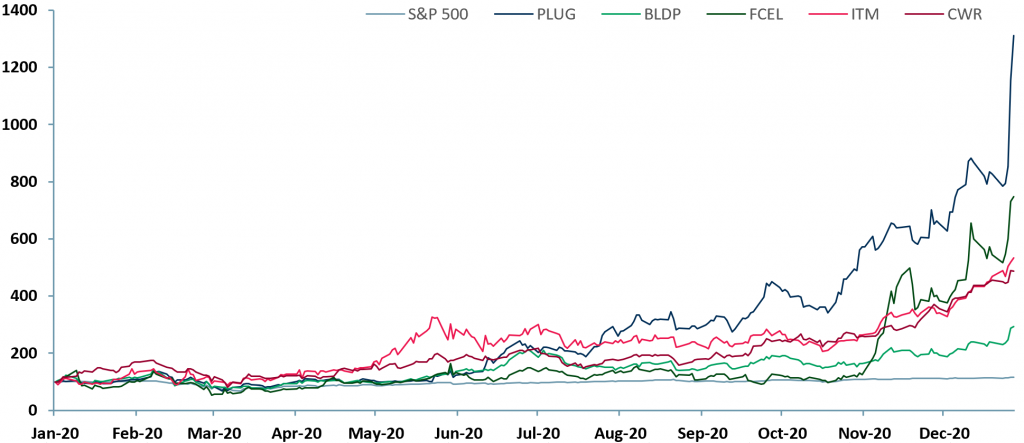

The past three months have delivered a boom in the share prices of green hydrogen companies. This is due to Biden’s US presidency win expectations (now delivered) and the expectation of a change to a Democratic majority senate (now delivered), which investors expect will drive large amounts of capital into renewable energy, and specifically – hydrogen infrastructure.

For example, since the US presidential election on 3rd November, Plug Power (NasdaqCM: PLUG), a company focused on providing hydrogen fuel cell solutions, has increased in price by ~217% to US$ 53.78 on 8th January 2021 up from US$ 16.95 on 3rd November.

Exhibit 1 below shows a 12-month price chart of five of the largest companies working in the hydrogen sector by market cap. This includes Plug Power Inc. (NasdaqCM:PLUG), Ballard Power Systems Inc. (NasdaqCM:BLDP), FuelCell Energy, Inc. (NasdaqCM:FCEL), ITM Power plc (ITM:LSE) and Ceres Power Holdings pls (CWR:LSE); with the S&P 500 index used as a comparator.

These companies showed an average valuation increase of ~580% vs. a 16% increase in the S&P 500 over the same period. ETF funds would struggle to deliver close to these returns. Which suggests that supernormal returns for most investors can only be delivered by active rather than passive fund management.

Plug Power Inc. showed the largest increase of 1,211% to US$ 53.78 on 8th January 2021A up from US$ 4.10 on 13th Jan 2020A.

Exhibit 1 – 12 month price chart of leading hydrogen producing companies

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

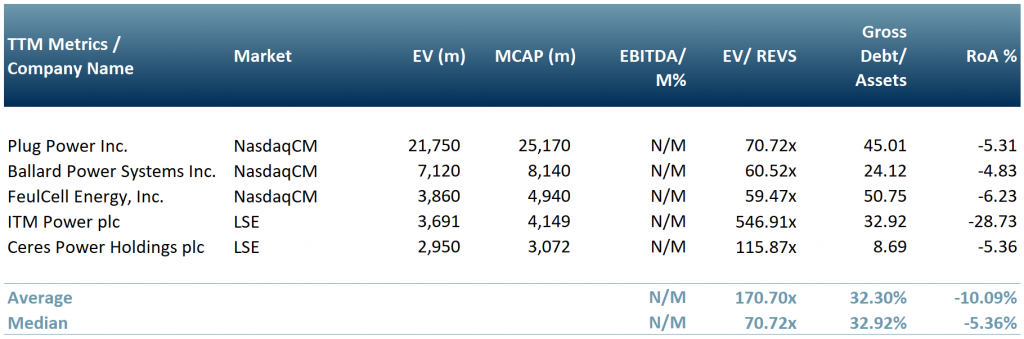

Exhibit 2 below is our peer group table for the five hydrogen companies shown in exhibit 1. Note that in spite of the rally in their share prices and valuation, none of the them are profitable at the EBITDA level and the prices to sales ratio is…demanding – i.e. there is long way to go and plenty of risk. Nevertheless, it is currently still a very promising outlook for these hydrogen companies.

Exhibit 2 – Peer group table for our five top hydrogen producing companies

Sources: ACF Equity Research Graphics, Yahoo Finance

Sources: ACF Equity Research Graphics, Yahoo Finance

Major oil and gas companies such as Royal Dutch Shell (NYSE:RDS) and BP (BP:LSE) have also announced interest in green hydrogen, although mainly to offset emissions from their standard operations, which feels unimaginative.

BP is partnering with Ørsted (ORSTED.CO:CPH) to develop a green hydrogen project with a capacity of 50 megawatts at one of its refineries in Germany. The project is expected to close in 2022E and come online by 2024E. (BP, 2020).

Royal Dutch Shell is involved in the largest hydrogen project in Europe, the NortH2 project. The project aims to produce 800,000 mt/year of green hydrogen by 2040E, powered by offshore wind. (S&P Global Platts, 2020).

This year’s increase in the share prices of hydrogen producing companies also reflects a trend in increased interest in ESG. BlackRock, the largest asset management company by AUM in 2020, announced that all of its ~US$ 7trn AUM would be governed by ESG considerations. (Forbes, 2020).

As ESG investment funds grow, they are looking for new investments, driving the price of companies working in the hydrogen sector to their current highs, in part because so many companies do not pass ESG filters.

In our view, the next ten years will show a dramatic change in the current energy market (hydrogen or no hydrogen) and stock market as a whole.

Companies with in-depth ESG policies, working to cut emissions and help the global economy become ‘green’, will thrive whilst those that do not adapt will be left behind…and their managers will be on the wrong side of history, which has an interesting corollary effect.

Faced with being on the ‘wrong side of history’ socially, the most talented managers will leave and the open positions will be filled by less talented managers than those that do not leave because they can’t.

This not only makes these companies less exciting from a growth perspective, it makes them a lot more risky with a higher probability of suffering internal black swan events.

MiFID II amendments are likely to make it mandatory for firms to integrate ESG considerations into business activities by 1H21. Implementing an ESG policy is effectively low-hanging fruit as many of the metrics can be captured from current financial reporting systems used for vanilla accounting.

With the Paris Agreement, the new democratic Biden Administration and the effects of the Covid-19 pandemic, alternative energies such as hydrogen, utility scale battery storage in commercial beta, ESG funds outperforming all but the technology heavy US Nasdaq – there are no more excuses not to focus on sustainability – it is, as some say, ‘a no brainer’.

Authors: Sam Butcher, Renas Sidahmed and Christopher Nicholson are part of ACF’s staff analyst team – See their profiles here