Will smaller biotech companies challenge or replace the current cohort of Big Pharma?

The Financial Times released an article on 14 August 2020 highlighting the significant increase in healthcare IPOs of companies that are working towards a Covid-19 vaccine.

According to Martin Steinbach, Head of EY’s IPO and listing services EMEIA, “2020’s initial public offerings of businesses related to the Covid-19 vaccine development drive has been the most active form of raising capital in the last 20 years”.

EY expects that six companies (not all named in the article) will raise a total of $1.8bn by the end of August.

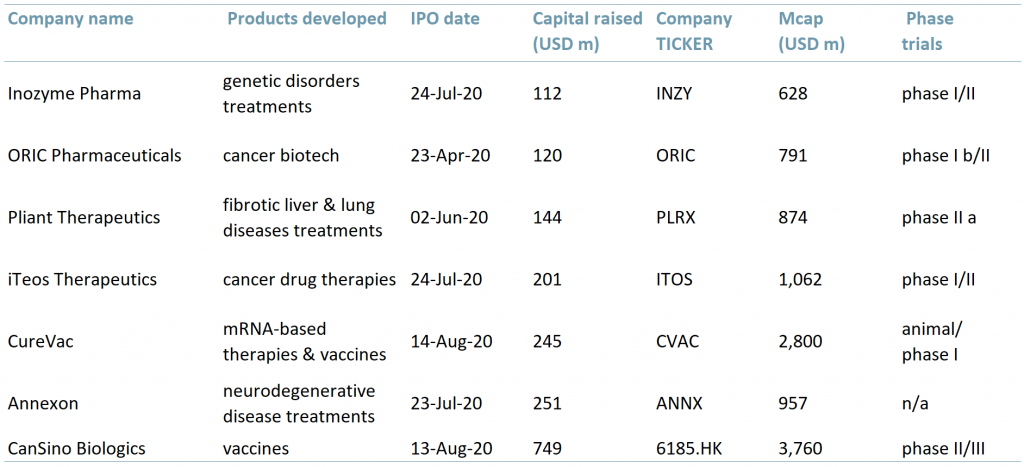

Exhibit 1 below highlights notable IPOs of biotech companies since the start of the pandemic, how much capital they have raised and what other products they are developing. Companies are presented in ascending order by the amount of capital raised.

Exhibit 1 – Notable biotech IPOs 2020

Sources: ACF Equity Research; FierceBiotech; IG

Among the six, CureVac (CVAC), a German company, raised $245m in an IPO on Friday 14th August, for their listing on the US tech market Nasdaq in order to accelerate the development of a Covid-19 vaccine.

CureVac’s shares were priced at $16 per share bringing the company’s valuation to $8bn+.

CanSino Biologics (6185.HK / 6881.85.SS), a Chinese company, raised $749m on Thursday 13th August on its secondary listing on the Shanghai Star Market (primary listing is on the Hong Kong Exchange – HKG). Shares were up 85% on its first day of trading.

CanSino shares, listed on the Hong Kong Exchange stock market (otherwise referred to as the Hang Seng Index or HSI) were up more than 3x as a result of the announcement and optimism around a Covid-19 vaccine.

CanSino’s vaccine is being developed alongside a team of immunologists from China’s People’s Liberation Army (PLA). The vaccine intends to stimulate an immune response to SARS-CoV-2 using a weakened strain of the common cold. The vaccine has already been approved to be tested on PLA troops.

CanSino’s vaccine has entered its final stages of clinical trials in Saudi Arabia, it will be months until it will be available globally.

CanSino has not been profitable in years. Brock Silvers, CIO of Adamas Asset Management in Hong Kong, remains sceptical as to CanSino’s success – “CanSino looks deeply speculative— no profit, deep tech hype, abundant risk, but at premium valuations.”

Investors (retail and institutional), governments and big pharma groups are all competing for biotech company shares as the general opinion is that this is not a ‘winner takes all’ market.

-

- In July, GlaxoSmithKline and the German government acquired 10% and 23% respectively of CureVac shares.

- Dietmar Hopp, billionaire and founder of German software company SAP, is expected to purchase €100m CureVac shares.

- US president Trump has pledged to purchase 100m doses of Moderna’s vaccine and 100m from BioNTech and Pfizer.

The year 2020 is beyond doubt a year that will be remembered in history for the pandemic and the race against time to develop a vaccine and/or treatment for Covid-19.

In this race there are two main groups – one consists of the biotech companies and researchers that are developing the vaccine, the other is comprised of the different types of investors (retail, institutional, governments and big-pharma organisations).

As investors realise that the vaccine market is not going to be a ‘winner takes all market’, they are shifting their focus and adopting portfolio management decision making processes when it comes to purchasing shares. Investors are taking note that biotech companies can actually provide higher returns still, despite already high biotech company valuations.

Giant companies such as AstraZeneca, Moderna, BioNTech-Pfizer, Sinovac Biotech and Sinopharm Group have already begun or are approved to start their third stage human trials.

Smaller companies, on the other hand, such as CureVac, Inozyme, ORIC, Pliant, iTeos, Annexon and CanSino are both testing and moving opportunistically within the capital markets’ waters by launching IPOs (increasing cash resources and gaining higher investor visibility).

These new biotech IPOs may give the companies above such a push that they will, in time, challenge or replace the current cohort of Big Pharma – certainly they have the potential to seed yet another healthcare M&A wave.

There is also an opportunity for other small and mid-cap healthcare companies to take advantage of renewed investor interest in healthcare (after years of rather jaded investor sentiment towards the sector).

The way forward is implementation of the right policies within their business operations. Having an ESG policy as part of their core business activities is an excellent place to start.