Will the UK government consider CBD an investment opportunity and bring legislation up to date?

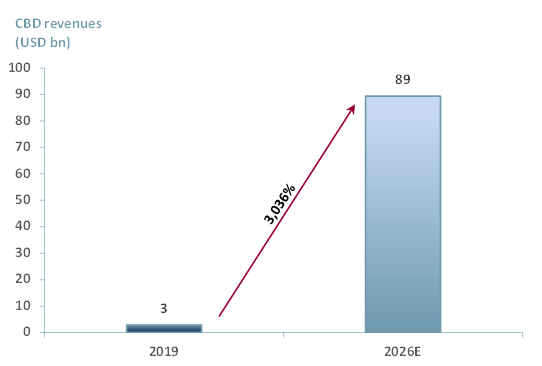

Global Market Insights published a report in February 2020 on the cannabidiol (CBD) market, forecasting a global market value (in terms of revenues) of USD 89bn by 2026 up from $3bn in 2019; a striking 3,036% increase, which is a CAGR of 52.7% (Exhibit 1).

Exhibit 1 – Global cannabidiol market by revenues, 2019 & 2026E

Sources: ACF Equity Research; Global Markets Insight

This punchy growth rate is attributed to the increasing sales of CBD products in retail stores, pharmacies, online and the efficacy of CBD products compared to opioids.

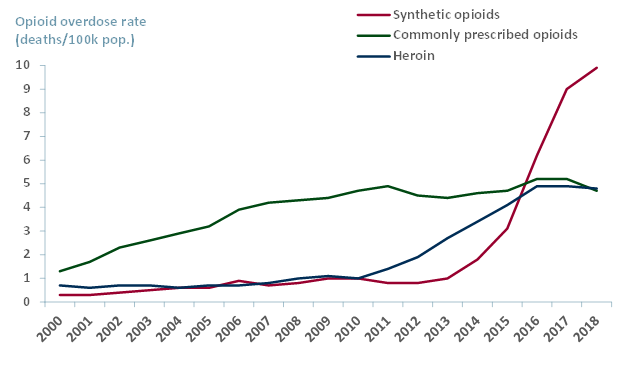

CBD compared to opioids: In 2017 the United States faced its very own opioid epidemic with over 70,000 deaths related to overdoses from not only heroin, fentanyl or synthetic opioids but also from prescription opioids.

The number of fatalities made opioids the leading cause of death in the US. According to the US’s Centre for Disease Control (CDC), opioids are responsible for over 750k+ deaths since 1999.

Exhibit 2 below shows the overdoes rate in the US by type of opioid – Heroin, synthetic opioids (e.g. fentanyl, tramadol) and commonly prescribed opioids (natural and semi-synthetic and methadone). What the data points to is how inefficient opioid drugs are for treating patients if the end result is so often death.

Exhibit 2 – Opioid overdose rate by type – deaths per 100,000 population, 1999-2018

Sources: ACF Equity Research; CDC

CBD as an alternative to opioids – Patients and physicians are increasingly turning to CBD as a more organic and less harmful alternative to opioids for treatment. CBD products have proven to be less addictive and as a result the demand for CBD in medicine is growing.

Cannabidiol (CBD) can be extracted from hemp – Cannabis sativa that contains less than 0.3% THC by dry weight. In order for hemp to be legal it must contain less than or equal to 0.3% of the psychoactive component tetrahydrocannabinol (THC).

CBD’s effects on people differs from THC (i.e. it does not have the same psychoactive effect). CBD and THC have the same number and combination of atoms – 21 carbon (C), 30 hydrogen (H), 2 oxygen (O), but they differ very slightly in the way the atoms of their molecular structures are arranged.

Increased knowledge of CBD, its medicinal value and the fact that it does not contain THC has allowed the market to grow and governments to ease regulations, including legislation allowing the sale and resale of cannabis in some US states.

In 2018 the US farm bill was passed which, for the first time, removed some cannabis products from the Controlled Substances Act list. As a result, we have seen a rapid increase in demand for CBD in developed countries such as the US, Canada, France and the Netherlands.

The growth and popularity of CBD has not been limited to developed countries. In Peru, cannabidiol and its derivatives were legalised on 23 February 2019 for medicinal and therapeutic use. The arable conditions required to farm hemp are excellent in Peru due to its mild and humid climate.

The Peruvian cannabidiol market is expected to grow at a CAGR of 59.5%. Training farmers and providing them with sufficient information on hemp farming will definitely boost supply. We are seeing this as other developing countries jump on the hemp farming train, such as Uruguay, Argentina, Chile, Colombia and Mexico.

According to the Global Markets Insights report, the execution of strategies such as partnerships and collaborations by major industry players will also boost global market growth.

We have listed some of the currently recognised significant CBD companies (see Exhibit 3 below). Significant players in the CBD market tend to be characterised by their apparently robust development and marketing strategies as well as the launch of advanced products for the cultivation of CBD.

Exhibit 3 – CBD market leaders by MCAP and revenues, 2020

Sources: ACF Equity Research

The UK opportunity – As the CBD market is expected to grow strongly globally, this is likely to open opportunities for the UK, which lags behind its developed counterparts in CBD production (and medical consumption).

As physicians, clinics, researchers and patients start to see the positive effects of CBD, in the short and long-term, especially when compared to opioid alternatives, and as farmers become more educated about farming hemp, a UK opportunity may be about to arise.

At this point education and knowledge are the main growth drivers as they are the precursors to creating demand growth.

It is timely for the UK to consider CBD as an alternative to opioid drugs but also as a tool to boost the economy. Let’s not repeat the US opioid epidemic in the UK.

The CBD market looks as if it is set for another surge in growth and investment and may finally be on the verge of becoming an attractive investment class as both consumer and medical demand begins to rise.

Cannabidiol (CBD) is largely distributed online. In 2019 the value of online CBD distribution was $1.3bn, which in turn means there is no particular barrier to entry with respect to distribution.

Global competition in the CBD market is accelerating rapidly, if the UK government considers that this is a market and industry in which the UK should be a significant player, then both the government and medical profession need to bring themselves and legislation up to date.