Deep Sea Mining & The EV Revolution

Deep-sea mining was first considered in the mid-1960s as an alternative to terrestrial mining. It is only over the last decade or so that the interest in commercial deep-sea mining has reignited.

The International Seabed Authority (ISA) greenlighted seabed mineral nodule collection trials by The Metals Company (Nasdaq: TMC) in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean, in September 2022. TMC’s subsidiary, Nauru Ocean Resources Inc. (NORI), produced an Environmental Impact Statement (EIS) and Environmental Monitoring and Management Plan (EMMP) for approval.

- The trials were conducted by independent scientists from leading research institutions and analyzed the environmental impacts of seabed mineral nodules through deep-sea mining. Deep-sea mining is the extraction of valuable minerals from the seabed and subsoil in the deep-sea at depths exceeding 500 meters.

- Seabed mineral nodules, also called polymetallic nodules, are mineral concentrations found on the seabed. They typically contain a variety of metals such as cobalt, copper, nickel, lithium and other minerals that are vital for the production of, for example, batteries needed to power electric vehicles.

-

~14 tonnes of mineral nodules were collected using TMC’s pilot collector vehicle. The pilot showed that the Allseas (NORI’s strategic offshore partner) nodule collection system was able to withstand the deep-sea pressures and temperatures within the NORI-D exploration contract area in CCZ.

Deep-sea mining – a source for EV battery metals

The global sustainability agenda to be net-zero by 2050E, has led to an exponential growth in the demand for electric vehicles (EVs). The transition to EVs is likely to be metal intensive.

An electric vehicle with a 75 kWh battery pack with NMC (ternary cathode materials) chemistry requires 56 kg of nickel, 7 kg of manganese, and 7 kg of cobalt, plus 85 kg of copper for electric wiring (The Metals Company).

According to BloombergNEF, there will be ~1 billion EVs globally by 2050E, which in turn will need 56m tons of nickel, 7m tons of manganese, 7m tons of cobalt and 85m tons of copper.

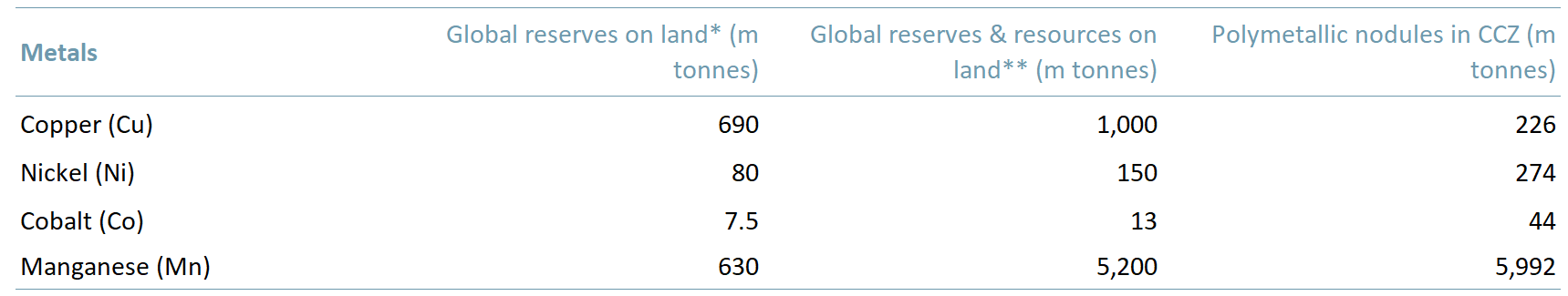

As illustrated in Exhibit 1 below, land-based mining resources are limited and may not be sufficient to meet the green-transition minerals demand. In order to meet the 2050E EV demand, almost all of the economic cobalt reserves would have to be used up. However, deep-sea mining has the potential to supply additional resources of cobalt and other metals needed for green technologies.

Exhibit 1: Land-based versus deep-sea mining reserves 2020/21 (excluding Mn & CCZ – 2014 data)

Sources: ACF Equity Research; World Ocean View; United States Geological Survey (USGS).

Sources: ACF Equity Research; World Ocean View; United States Geological Survey (USGS).

Notes: *economically minable deposits, **economically minable and sub-economic deposits. Numbers based on 2020/2021 USGS estimates except Mn and CCZ figures which are based on 2014 estimates

The Metals Company NORI-D project is currently the most advanced deep-sea mining project globally. NORI-D claims to have identified 866m tonnes of polymetallic nodules, in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean, which could supply battery metals for ~140 million EVs. (Globally, EVs on the road are expected to exceed 25m by YE22, BloombergNEF.)

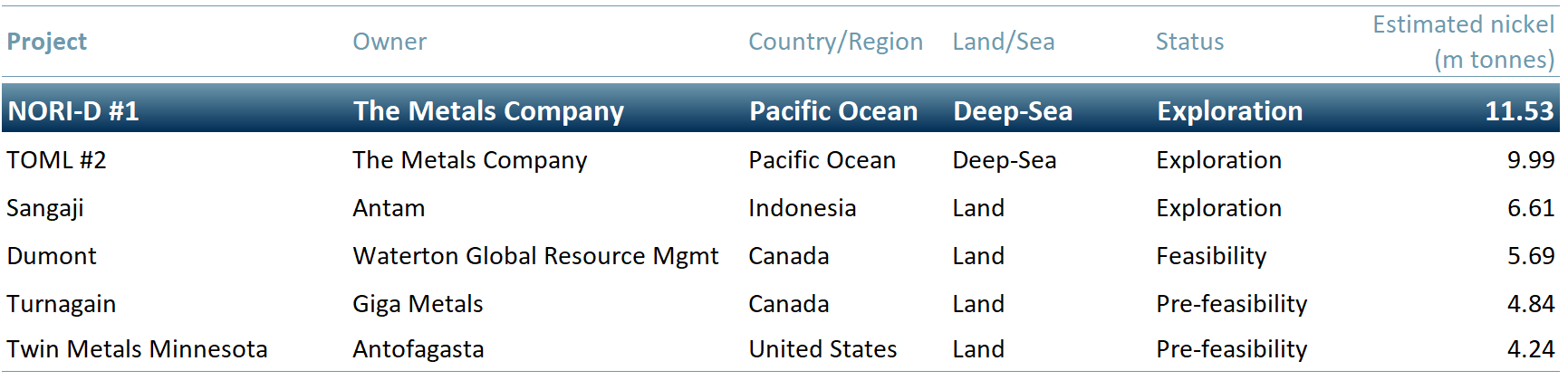

In exhibit 2 we showcase the top five largest undeveloped nickel projects globally by estimated nickel explored (in million tonnes). Projects #1 and #2 of TMC (NORI-D and TOML), put the company in first place with a total of ~21.52m tonnes nickel explored.

Exhibit 2: Global largest undeveloped nickel projects 2022

Sources: ACF Equity Research; MiningIntelligence.

Sources: ACF Equity Research; MiningIntelligence.

Deep-sea mining offers scalable opportunities, but at the same time it is important to note that deep-sea mining remains financially unproven and the commercial viability of mining nodules has yet to be established. Past attempts to develop deep-sea mining projects have not delivered as expected.

The standout failure among them was Solwara 1, the world’s first deep-sea mining project, developed by Nautilus Minerals (a Canadian company). Nautilus Minerals planned to mine mineral-rich hydrothermal vents (fissures on the seabed that discharge geothermally heated water) in the Bismarck Sea, Papa New Guinea. The project was approved but failed before the extraction phase due to community resistance, legal and financial challenges.

Currently, a global framework does not yet exist to regulate deep-sea mining as countries have failed to reach common ground on ways to assess deep-sea mining activity. However, since 2014 the ISA has been working on a ‘Mining Code’ that will “regulate prospecting, exploration and exploitation of marine minerals in the international seabed Area” (Area = ‘the seabed and ocean floor and subsoil thereof beyond the limits of national jurisdiction’).

Environmental risks remain the biggest detriment towards a comprehensive global framework for deep-sea mining. The potential impact of deep-sea mining on marine biodiversity and habitat is still unknown.

The supply of green-transition minerals from land-based reserves alone are unlikely to be sufficient to meet the net-zero goals. Deep-sea mining offers an interesting alternative. For example, tonnages of critical metals found in CCZ nodules have been verified to be greater than those found in land reserves (TMC).

A United States Geological Survey (USGS) equates the transition from land mining to deep-sea mining to the transition of onshore petroleum production to offshore. “if deep-ocean mining follows the evolution of offshore production of petroleum, we can expect that about 35-45% of the demand for critical metals will come from deep-ocean mines by 2065E.”

In our view, this timeline is reasonable based on our assumption that the complete transition of fossil fuels to green energy, will take ~30-40 years. Albeit a ‘slow’ transition, but a transition that is underway and on the right sustainability pathway.

The critical question remains – how to make deep-sea mining environmentally neutral or positive? If we cannot answer this question we are simply substituting one environmental problem for another.

The deep-sea mining subsector remains, in our view, an interesting if higher risk variant of extractives investing at this time. Early data on metals concentrations in deep-sea modules suggest to us that the reward / risk profile is worthy of further investigation.