AI in Cybersecurity

Cybersecurity is an ever rising challenge for business. We explore the role AI can play in safeguarding digital assets in an increasingly connected world. Digital technology is at the heart of every business and is central to delivering productivity gains, competitive return on investment and improving work satisfaction. However it comes at a cost…security risk.

An overview of the operational challenge

Cybersecurity threats are becoming more frequent and more damaging. In 2023, so far there have been approximately 5bn security incidents globally that have resulted in data breaches (IT Governance, IBM, 2023).

This surge in cyber incidents underscores the increasing sophistication of cyber-attacks but also highlights the urgency for companies to implement robust cybersecurity measures.

- Some market estimates suggest the cost of cybercrime could increase to US$ 8trn by end of 2023E up from $3trn in 2015A. According to Asta cybersecurity statistics, a cyber-attack happens every 39 seconds on average suggesting a daily average of ~2,200 cyber-attacks (Astra, 2023).

- The global average estimated cost of a data breaches p.a. increased to ~ US$ 4.45m in 2023A, up 15% from ~ US$ 3.86m in 2020A (IBM, Capita, 2023, 2020). In the US, the estimated average cost data breaches p.a. is higher at US$ 9.44m (Astra, 2023).

- According to Next Move Strategy Consulting there are ~300k new malware (software created specifically to steal data and damage/destroy computers) created daily. The majority (95%) of malware attacks are disseminated via email. The average time to detect a threat is estimated by Next Move Strategy Consulting at 49 days.

- Other market estimates suggest the global Security as a Service (SECaaS) market will grow in value to ~$22bn by 2026E, more than doubling in 4 years compared with $10bn in 2022A. (The SECaaS product market delivers cybersecurity services remotely over the internet rather on on-premises.)

The internal effect of the rising cost of data breaches

The increased cost (driven only in part by increased frequency) of breaches is prompting organisation to reevaluate their cybersecurity strategies – their go to response inevitably revolves around Artificial Intelligence (AI) tools. T

With an ever increasing sophistication, number, type and speed of cyber threats, AI based technologies appear to have the right characteristics to fight cybercrime. AI’s ability to process large amounts of data, its pattern recognition strengths and ability to adapt are a threat to human designed cyber-attacks.

AI’s automation capabilities and machine learning are able to reduce human error, enhance incident response and investigation and better predict and mitigate future against future attacks, making it an indispensable tool. AI appears to be much faster, more accurate than a human for these types of tasks – but it may not prove to be less costly.

Inevitably the attackers will also adopt AI to design attacks – it may all come down to who has the biggest engine and the most money.

Possible strategies to gain exposure to this attractive investible segment

If we are right that the outcomes of the battle between defenders and attackers will be determined by scale and money then there are two plays for investors to potentially consider – exposure to established cash flows with attractive growth (cybersecurity is looking much like a utility – without it most businesses cannot function) and M&A. In this scenario investment strategies should target a basket of stocks that include the largest players and a selection of smaller players offering leading niche products in the total cybersecurity suite.

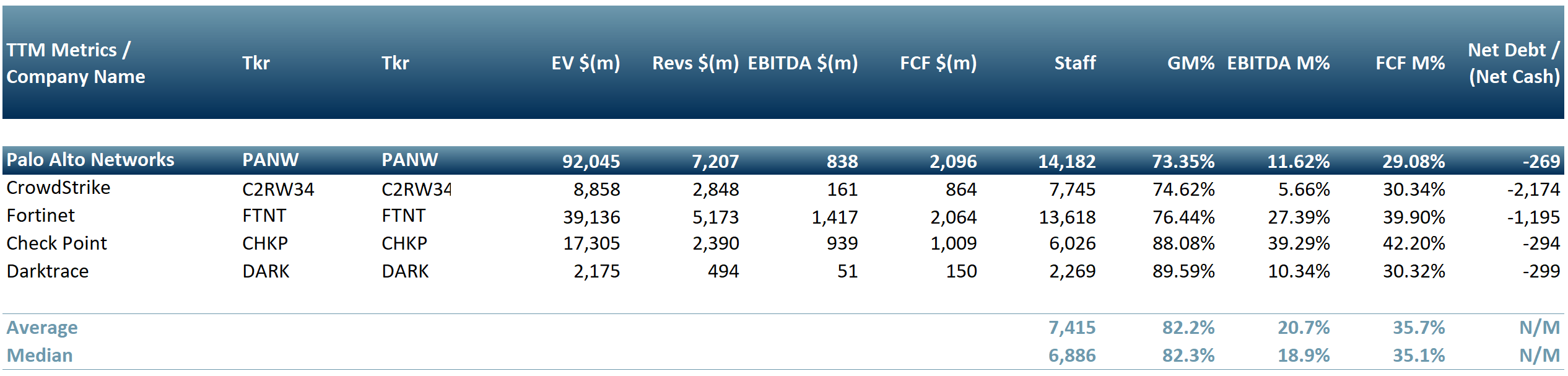

Below we highlight solutions produced by a select number of cyber security companies and provide a peer group table:

- Palo Alto Networks, Inc. (Nasdaq: PANW): Cybersecurity products that integrate AI for threat detection, e.g. WildFire, a cloud based AI-analytics service that identifies malware and threats.

- CrowdStrike Holdings, Inc. (Nasdaq: CRWD): Cloud-delivered endpoint protection, e.g. CrowdStrike Falcon Platform, a cloud-delivered service that provides antivirus protection, and endpoint and detection response (EDR).

- Fortinet, Inc. (Nasdaq: FTNT): Provides cybersecurity solutions, with a focus on network security, e.g. FortiGate Next-Generation Firewalls (NGFWs) that provides intrusions prevention systems (IPS) and web filtering.

- Check Point Software Technologies Ltd. (Nasdaq: CHKP): Software and hardware products for IT security, including AI-driven solutions, e.g. Check Point Infinity Architecture, which provides a consolidated approach for protection against threats across networks, cloud, endpoints and IoT.

- Darktrace plc (LSE: DARK): A smaller cap AI-driven cybersecurity solutions business, utilizing machine learning for threat detection, e.g. Autonomous Response Technology that can autonomously respond to cyber threats, taking precise actions without disrupting day to day operations.

Exhibit 1 – Peer group of companies that provide AI based cyber securities solutions – Key financials metrics

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

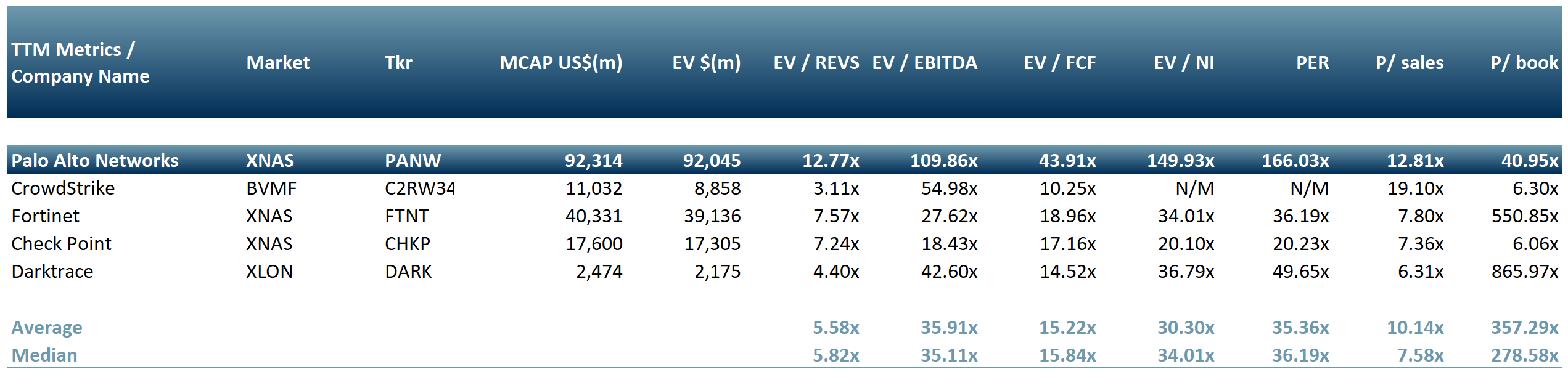

Exhibit 2 – Peer group of companies that provide AI based cyber securities solutions – Key multiples

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

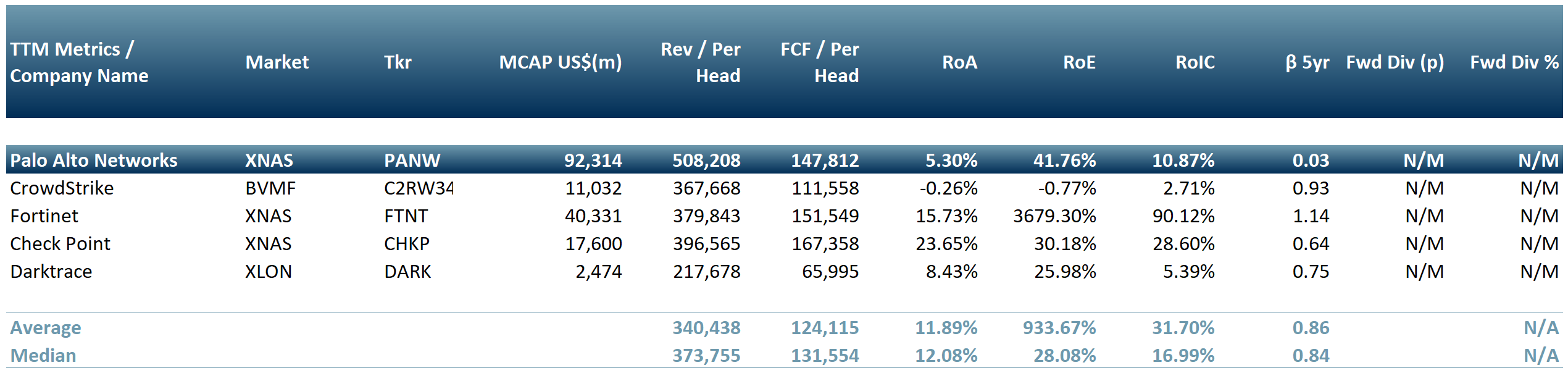

Exhibit 3 – Peer group of companies that provide AI based cyber securities solutions – Key returns metrics

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

Sources: ACF Equity Research Graphics; Refinitiv. Palo Alto is excluded from our average and median values in order to provide as useful as possible central tendency because it is an outlier compared to the rest of our peers.

AI-driven cybersecurity not only defends against cyber threats, it empowers developers across various industries to devise proactive solutions to prevent attacks. The technology contributes to ensuring uninterrupted business operations and safeguards critical data. The market extends from sole traders up to the largest companies on the planet and stretches equally across private and public markets.

According to a Morgan Stanley research report from September 2023, the global market for AI-based cybersecurity products is estimated to reach ~$135bn by 2030E, up from ~ $15bn in 2021A, which compares favourably to the estimated US$ 8trn cost of cybercrime by 2023 (referenced above). At the same time, the broader AI market is expected to grow to ~US$ 1.85trn by 2030E (Next Move Strategy Consulting, 2023).

This expanding investment in AI emphasizes its pivotal role in not just protecting data but also in fostering industry innovation, enhancing product quality, and elevating customer experiences, thereby driving overall business growth. Cybersecurity appears to be an interesting way to get exposure to both positive developments in the AI market and to growth in the security threat market – such an approach diversifies investment risk.