Beyond Meat (BYND) – a thought to chew on

Big Meat has so far been slow to adapt to the changing protein market and climate concerns. However, it is not too late to invest in alternative meats.

Key Points:

- A 2018 report by the Food and Agriculture Organisation (FAO) estimated that total emissions from livestock are 7.1 gigatonnes of CO2 equivalent per year. This is equivalent to 14.5% of all greenhouse gas emissions or more than all cars, planes, trains and all other methods of transportation put together.

- There is increased pressure on the meat industry to reduce emissions as countries aim for net zero emissions by 2050.

- ~75% of the 60 largest listed meat and fish companies have not made pledges to reduce emissions based on real numbers or “science-based” targets.

- The rising popularity of plant-based meat could threaten the traditional protein industry if it does not adapt.

- Lab grown meat was first created in 2013 and is expected to reach the global meat market over the next couple of years. Singaporean authorities were the first to grant approval for lab grown meat in December 2020.

With climate change at the forefront of the global agenda, many countries and industries have had to assess their contribution to the gigatonnes of CO2 emissions.

The US$ 1.4trn meat industry is amongst the worst emitting industries with the FAO estimating that both direct and indirect emissions amount to 7.1 gigatonnes of CO2 equivalent per year. Cattle rearing for beef, milk and inedible outputs (e.g. manure) make up ~65% of the sector’s emissions. (FAO, 2020).

But it is not the cattle themselves that are the problem as their methane emissions stay in the atmosphere around 10 years whereas CO2 emissions take 300-1000 years to leave the atmosphere.

Feed production – includes land use changes (land that has been converted for human use), is the most polluting part of the sector. This makes up ~45% of the total emissions for the industry.

According to the Fairr Initiative, a UK-based research company focused on sustainable protein production, 86% of major meat and dairy suppliers are yet to make science-based commitments to reducing their emissions.

However, there are signs of improvement with seven such companies creating tougher targets for emission reductions in 2020, up from two in 2019.

Deforestation – In terms of ESG, the meat industry is currently subpar because meat is a source of environmental damage and deforestation for cattle rearing and feedstock growth. Deforestation for cattle rearing alone is responsible for the release of 340m tons of carbon (~3.5% of global CO2 emissions) into the atmosphere each year. (WWF, 2020).

The alternative meat industry

Cargill, Inc. (one of the largest US corporations in the agricultural, livestock, and processed foods markets space) is a good example of a company looking to improve its business sustainability.

The company is looking at alternative ways in which it can provide protein to its customers, investing in the lab grown protein sector and investigating AI’s potential to make its standard operating procedures more efficient, and presumably less emitting.

There are several alternatives to the traditional sources of meat (slaughtering animals) protein. These include:

- Plant-based protein

- Insect-based protein

- Lab grown protein

Plant-based meat

Plant-based meat substitute protein is made from a variety of different sources with the most of which are soybean and pea protein. There are many products currently on the market. An example is Beyond Meat (NasdaqGS: BYND), a company with growing popularity selling a variety of products such as pea protein-based meatballs and burgers.

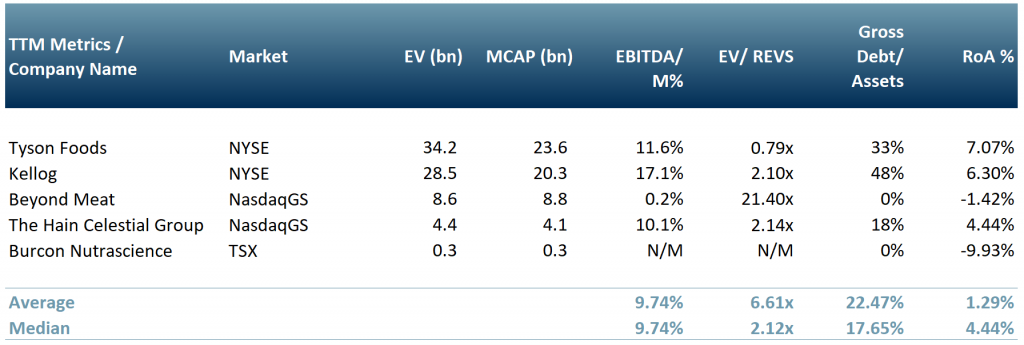

Exhibit 1 below shows five companies operating in the plant-based meat market. Tyson Foods Inc (NYSE:TSN), Kellogg Company (NYSE:K) Beyond Meat Inc (NasdaqGS:BYDN), The Hain Celestial Group (NasdaqGS:HAIN) and Burcon Nutrascience Corporation (TSX:BU).

Exhibit 1 – Peer group table for the plant-based meat market

Source: ACF Equity research Graphics

Source: ACF Equity research Graphics

The plant-based protein sector is a subject of increasing interest to investors. Sales growth in the US increased to US$ 5bn p.a. in 2019, up 11.4% yoy.

Plant-based protein has several hooks in the market:

- Health – perceived to have health benefits

- Vegan movement – prioritised by the rising vegan movement

- Flavour and texture – products have a texture and flavour that can closely mimic the pleasures of eating animal protein (Plant Based Food Association – PBFA, 2020)

- Improved efficiency – the plant-based protein sector has greater environmental efficiencies. Plant base protein production uses on average 73% less land and reduced climate impact and emits ~60% less greenhouse gases by comparison to the traditional meat industry. (The Good Food Institute, 2020)

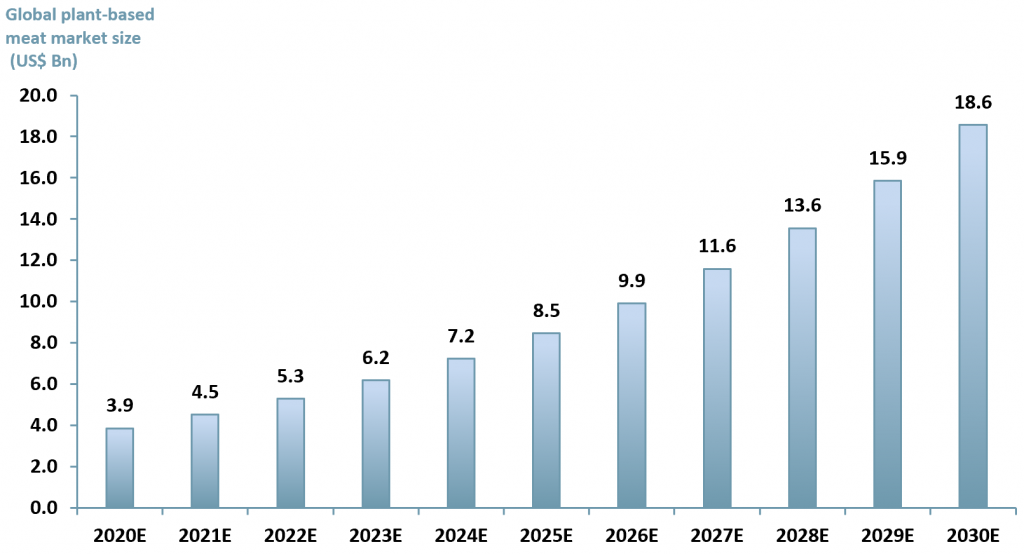

ACF estimates the plant-based protein market will be worth US$ 18.6bn in 2025 up from US$ 3.3bn in 2019 – a CAGR of 17%. We think our forecast is conservative, based on continued concerns over the environmental impact of the meat industry and the growing number of high quality brand and products providing a real alternative to meat. (exhibit 2).

Exhibit 2 – Forecasted value for the plant-based protein market 2020–2030

Source: ACF Equity Research Estimates; Grand View Research; Market and Markets; Research and Markets; Polaris Market Research

Source: ACF Equity Research Estimates; Grand View Research; Market and Markets; Research and Markets; Polaris Market Research

Insect-based protein

Insect-based protein benefits over traditional meat – crickets deliver 69% protein vs. beef 29% kilo for kilo. Crickets also produce 80x less methane vs. cows kilo for kilo.

Land use – 150 tons of insect protein is produced from only one hectare of land vs. UK beef 2.095 tons per hectare. (Interesting Engineering, 2020) (ResearchGate, 2020).

The market – the insect-based protein market is growing both for human consumption and as animal feed. It is estimated that ~2.5bn people already eat insects across Asia, Africa and Central America. For North America and Europe there is a stigma attached to insect-based protein that will probably limit its uptake. (FAO, 2020).

Lab grown protein

Lab grown protein, or cultured meat, was first created in 2013 and at the time cost US$ ~300,000 for one burger patty! It is yet to gain regulatory approval in most countries and is produced by the in vitro cell culture of animal cells – completely avoiding the rearing and slaughtering of animals. (Sifted, 2020).

In December 2020, Singapore become the first country to authorise the sale of lab grown meat from a private US company called Eat Just that specialises in plant-based products. Other countries have yet to follow suit but they are monitoring Singapore’s move to legalise sale to consumers closely.

The UN Population Division forecasts that the current global human population of ~8bn will reach ~10bn by 2050. The UN expects Africa to account for ~66% of the 2bn increase over the next 30 years.

The inference from population growth projections is that the demand for protein will increase.

In order to meet demand in a sustainable manner, the sources of protein will need to vary between plant/insect-based protein, lab grown protein and traditional meat protein (from the slaughter of animals).

We infer from the above that protein farming of the future will evolve to the extent that large traditional protein companies will have to change too, in order to remain dominant players in the protein markets. And of course changing the status quo always creates opportunities for new entrants.

Statistically it is likely that today’s dominant public companies will not make the transition to the new markets successfully. The wholesale change in culture often required is not easy to create and implement effectively in large companies. Notwithstanding the statistics, our peer group is worth watching for winners and losers.

Authors: Sam Butcher, Renas Sidahmed, Christopher Nicholson See their profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)