Brexit – what now for EU markets?

UK markets have long been preparing for Brexit. Contingency plans are in place for a smooth transition.

The London Stock Exchange Group (LSE) has been preparing behind the scenes on how to handle the post Brexit trade deal plans. Risks of a no deal means reorganising how UK investors can buy and sell European mainland listed stocks.

-

- LSE announced in October 2020 will open its Turquoise platform in Amsterdam at the end of November 2020. Turquoise is majority-owned by the LSE and it is a European multilateral trading facility (MTF). It provides dealing services with discounts – following a hybrid system allowing on and off trading on traditional exchanges.

- Aquis Exchange, a potential competitor to the London Stock Exchange’s AiM, decided to improve its exposure to France on the 11th of November 2020.

- Aquis on the move – in March 2020 Aquis acquired London based NEX Exchange, the many-times renamed smaller companies challenger to the LSE’s AiM.

- Global banks and exchanges are pushing for an accord to be reached between London and Brussels. The exchanges and banks want the accord to allow UK exchanges to be run based on equivalent EU rules. The accord would also leave EU cross border trading untouched.

- Optimism for a trade deal is fading. Aquis CEO Alasdair Haynes declared that: “There will be no equivalence and people are getting prepared to move business over”.

- London is the largest trading centre in Europe, holding 30% of the €40bn daily market. The risk is that these trades will move to Amsterdam and Paris as EU based institutions will be banned from trading in London.

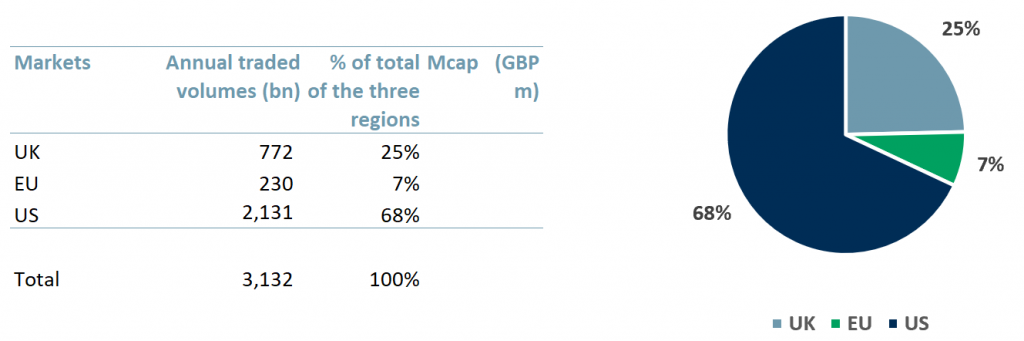

- Exhibit 1 – Annual traded volumes of selected UK exchanges, 21/10/19 – 19/10/20

Sources: ACF Equity Research; Yahoo Finance

Sources: ACF Equity Research; Yahoo Finance

-

-

- The concern arises from EU market rules – the “share trading obligation”. This rule defines on which platforms or markets investors are allowed to trade liquid stocks.

- This rule will be copied in the UK with the guarantee that all EU financial market standards will be adopted by the UK.

- If there is no accord, the risk is that a cold, hard Brexit will split European financial markets and create two insubstantial and saturated markets, weakening the entire continent’s access to capital.

-

The lack of clarity around Brexit makes it difficult for the financial sector to prepare accordingly. The overall sentiment is that markets’ interest will be overshadowed by political gains. There is historical precedence for political gains to win out over commercial gains threading through the history of the European Union project.

Adopting another set of regulations while the markets are still digesting Mifid II, may prove difficult to navigate and certainly is unwelcome.

Our view is that regulators will have to work together to avoid the worst in the short-term. It is timely to adopt the best possible attitude, which is to be prepared for the worst case scenario.

As with Mifid II, it will take time for markets to adjust. We are confident UK exchanges will find new ways to survive and thrive and, in the end, when it comes to access to capital the EU-Ex UK looks like a capital markets back water – the trading volumes in our exhibit above, speak for themselves.

- Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile