Cannabis – Where is the light coming from?

UK company, Celadon Pharmaceuticals (LSE: CEL) has tripled in value since it got its Medicines and Healthcare Regulatory Agency (MHRA) approval for manufacturing its medical cannabis product in Jan 2023. This was followed up on the 14th March 23 with a confirmation that its Home Office licence had been updated to allow the sale of its high Delta9-tetrahydrocannabinol (THC) product.

CEL’s share price and volumes picked up on 10th Mar, doubled by the 14th, and are now up ~3x since the two announcements. The MHRA announcement confirmed CEL’s manufacturing process was ‘fit and proper’, which primed the pumps. However, the ability to actually sell the product is what drove the price for CEL in a sector characterised by moments of high hope followed by extended periods of beleaguered disappointment over regulatory and complexity impasses.

- The UK’s medical cannabis market depends mostly on imported cannabis. Without the approval of more UK-based facilities the market’s development will continue to face lengthy delays and relatively high costs. Those are the top line implications.

- Less obviously, the UK general public is overwhelming in support of the use of medical cannabis and increasingly at ease with recreational milder strains (as per pre-pandemic research and anecdotal evidence). So far, the UK government, the UK courts and the UK medical profession have paid lip-service to the societal change in attitudes. Practical change, to date, has been minimal, in our view.

- UK permissions have been granted for use and sale as a medical drug but the practical caveats have been so demanding, restrictive and risky that barely anyone has been prescribed cannabis-based medicines in the UK.

- Could the CEL decision finally signal a change in attitude by the UK authorities or will it end up as a permission to sell in the UK that is in practice nearly impossible to execute?

- If we are experiencing a sea change in practical policy then the UK government also needs to get the UK cannabis industry prepared – everyone else is sitting on the doorstep ready and waiting to go at scale.

- Currently, in the UK there are ~800ha of cultivated cannabis. The UK could make hemp a leading crop by increasing the cultivation to 80k ha with for example, the assistance of programs such as the ones from the University of York and the Bio-renewables Development Centre.

- According to industry analysts, Prohibition Partners, the number of patients using medical cannabis in Europe is expected to surpass 500k in 2023E, from ~342k in 2022E. In 2022 alone ~100k new patients accessed medical cannabis in Europe. The UK’s contribution to those numbers, in our view, is perishingly small.

ACF insight:

The therapeutic use of cannabis has been authorized in over 50% of European countries since 2003. Luxemburg was the first country to legalize the use of both medicinal (2003) and recreational cannabis (2019) in Europe. (NCBI, 2022; EU Observer, 2019).

The trend for recreational cannabis legalisation could accelerate in 2024. In 2021, Malta became the first EU nation to legalize cannabis cultivation and personal use. Other EU countries such as Germany and Czech Republic are looking into comparable legislation. (Health Europa, 2019; Cannabis Health News, 2022)

According to a report published by Statista in 2022 on the cannabis market, revenue for the European Medical Cannabis segment is expected to reach US$ 1.046bn by 2027E, up from US$ 629.80m in 2023E. The market development described by these forecasts is weighed down by regulatory and enforcement opacity.

Our research published at the end of 2020 suggests the global legal cannabis market will reach US$ 75bn 2027E, up from a market consensus value of ~US$ 18bn in 2019.

It feels like we may now, finally, be on the brink of the pragmatic (rather than theoretical) creation of a European cannabis market both for medical and recreational applications. We are not yet sure the same confluence of changes is occurring in the UK, but it can be hoped for.

What CEL’s announcements and subsequent rise in trading volumes and share price shows, is that investors are primed for the cannabis market, they just need to see practical legislation and actual meaningful sales from the players.

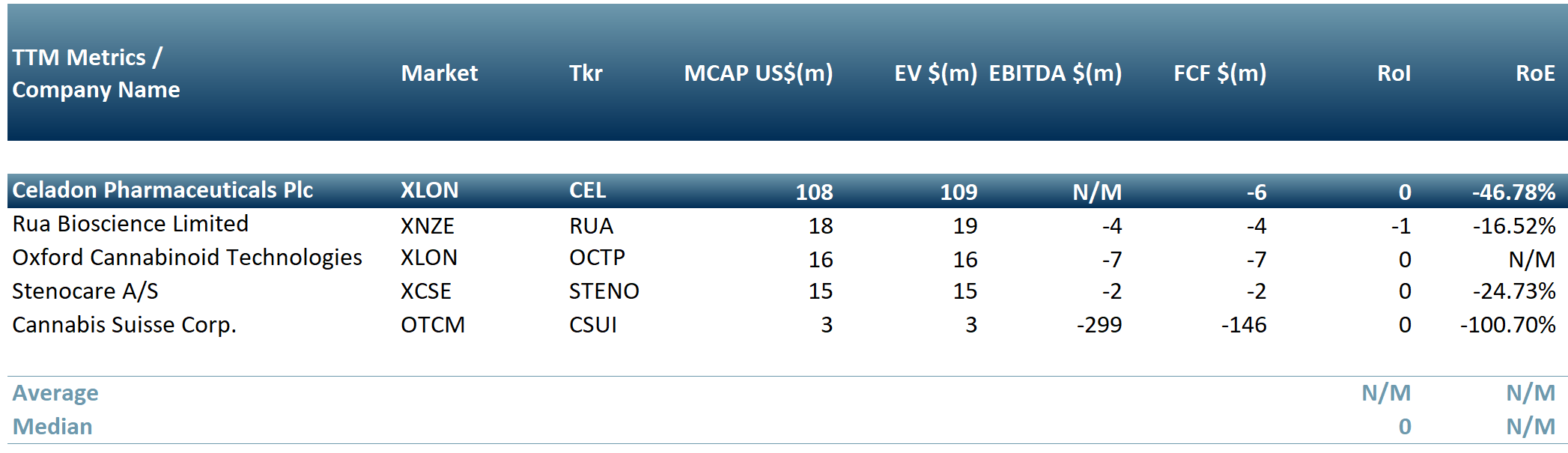

In exhibit 1 below we present some of the existing public European stocks: Celadon Pharmaceuticals PLC (XLON:CEL), Rua Bioscience Ltd (XNZE:RUA), Oxford Cannabinoid Technologies Holdings PLC (XLON:OCTP), Stenocare A/S (XCSE:STENO), Cannabis Suisse Corp. (OTCM:CSUI).

Exhibit 1 – Top European cannabis stocks as of 3 May 2023

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

Outside of the high profile medical and higher profile recreational (retail) markets, cannabis could have a third major growth market underpinned by the E in ESG.

Hemp is a fast growing plant, up to 4 meters high in 100 days. Cannabis absorbs and locks up more carbon than a forest – 1ha hemp absorbs ~22 tonnes CO2/year vs 1 ha woodland 14 tonnes CO2/year – according to the Forest Commission report, Cannabis Health News, 2023.

There are also claims that hemp, unlike bamboo, enriches and improves the quality of the soil it is grown in.

Moreover, according to a study available via Science Direct, CO2 captured by hemp is permanently fixed in the hemp fibres. “Hemp fibre is carbon negative – ~1.67 kg of embodied carbon per kg of hemp fibre.” Hemp fibre has a range of interesting and unexpected properties that have broad commercial/industrial applications.

Cannabis crops could therefore be used as an environmentally friendly CO2 negative substitute for other materials, in many commoditised (read high volume) products including textiles, medicines, insulation for buildings, concrete and perhaps even replace plastics in some car parts. (ScienceDirect, 2003)

The more countries introduce access to legalized cannabis and existing markets mature, the chances for an expansion of the cannabis market into different niches will increase.

In the end, recreational and medical cannabis use may turn out to be the minor markets for cannabis compared to the market applications for hemp fibres – another reason for the UK not to ignore this sector and for the government, medical profession and judiciary to consider catching up in practical terms and not just philosophical terms, with our European neighbours.

Authors: Anda Onu, Christopher Nicholson – Anda is part of ACF’s Sales & Strategy team, Christopher is ACF’s Head of Research. See their profiles here