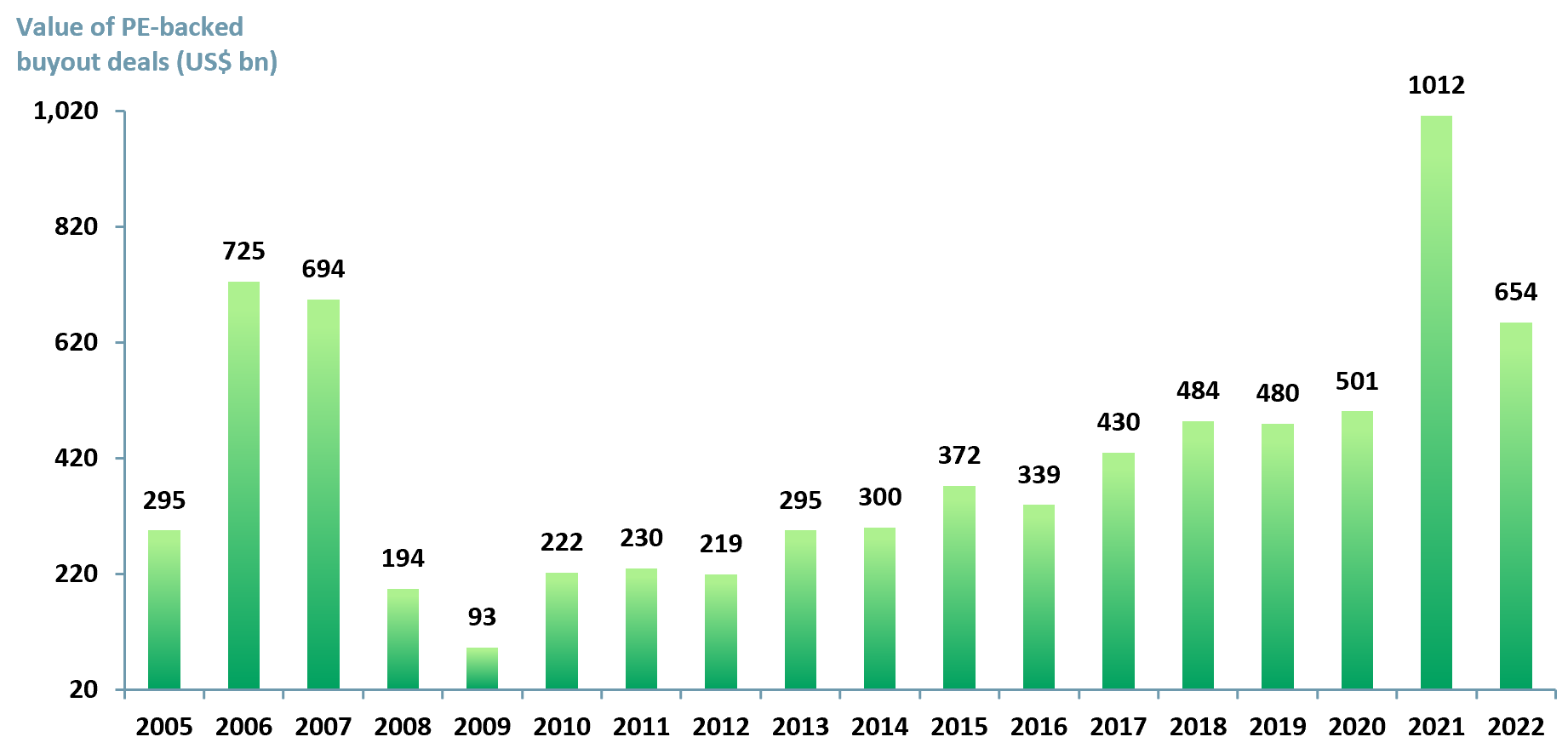

Is the Private Equity Boom Over?

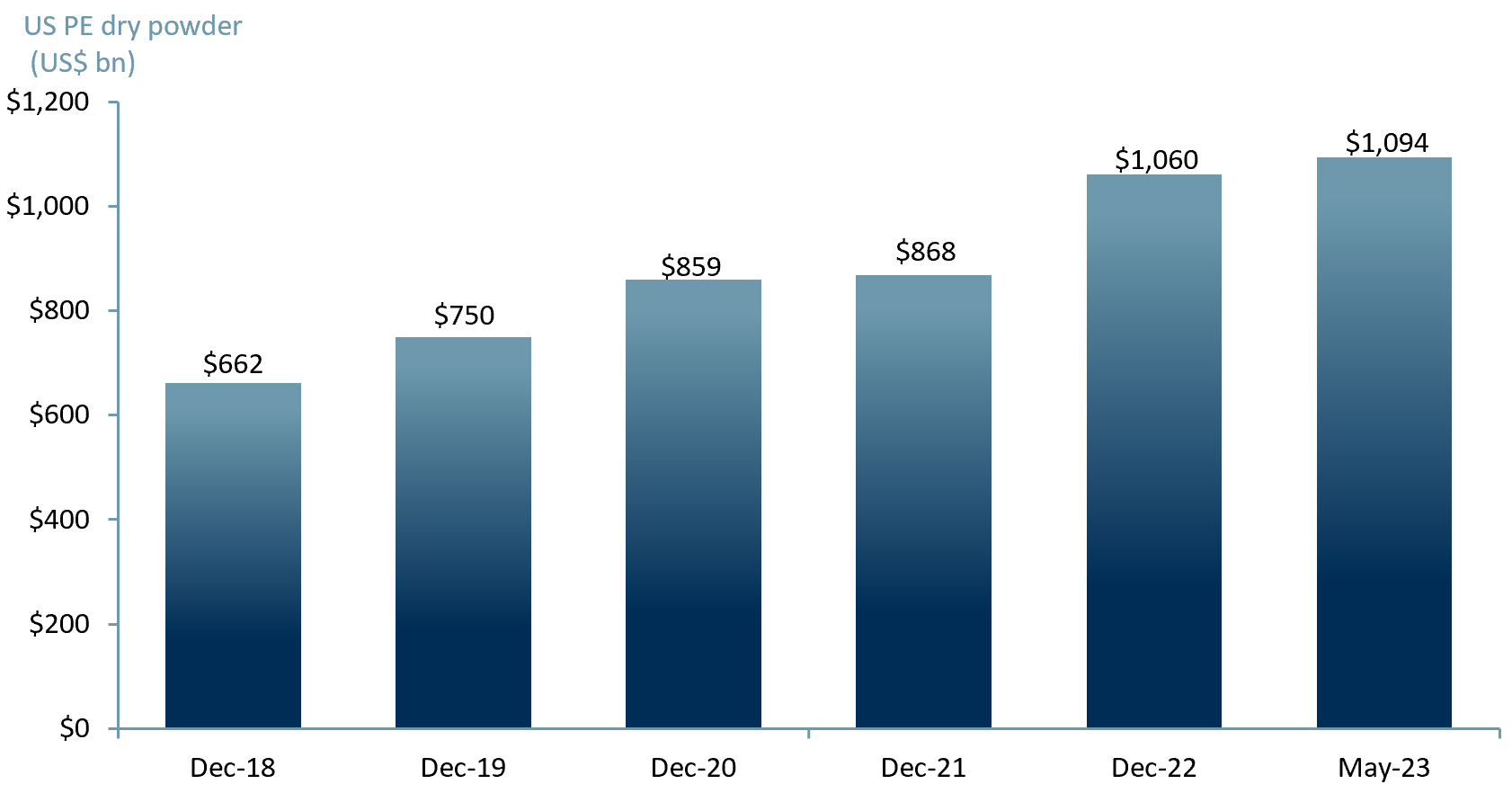

Is the private equity (PE) boom over? There were US$30bn of uncompleted deals in 1Q23 and no shortage of deployable capital (over $1trn dry powder as of May 2023). US private equity buyouts 2Q23 were approximately 16.5% of the 2Q22 value (according to Prequin). PE deal values are down ~85% year on year before the effect of inflation on the real value.

Exhibit 1 – Value of private equity-backed deals worldwide 2005 to 2022 (US$ bn)

Sources: ACF Equity Research graphic; Bain & Company.

Sources: ACF Equity Research graphic; Bain & Company.

The private markets continue to be extremely important. They are a key facet of the deepest pool of capital on the planet, the US. Because more or less everyone looking for capital knows this, the US is also the most competitive pool of capital in the world.

Exhibit 2 – US private equity dry powder (US$ bn)

Sources: ACF Equity Research Graphics; Preqin (PE ex Venture Capital US Based Fund Managers); PwC private equity deals outlook.

Sources: ACF Equity Research Graphics; Preqin (PE ex Venture Capital US Based Fund Managers); PwC private equity deals outlook.

All the same, in our view, private equity has at least temporarily boxed itself into a corner. For us, there are three items at play within the private equity industry:

-

- Private equity promises ‘super normal returns’, which it is finding increasingly hard to deliver. The deals that deliver super normal returns are no longer as abundant.

-

- Private equity had competitive advantage. Competitive advantage is eroded over time without constant cycles of innovation.

PE targets have enough experience and information available to be able to enter into more even-handed negotiations. Private equity backers are facing lower returns. Lower returns means better pricing for the seller (initially this is the corporate), and less good ones for the buyer (investor). The more private equity struggles to do deals, the more the balance of negotiating power moves in the direction of the targets.

- Private equity had competitive advantage. Competitive advantage is eroded over time without constant cycles of innovation.

-

- Debt capital is no longer cheap and inflation is still clouding the investment horizon. A favoured tactic for private equity investors was to pay for an acquisition using debt financing, which was then loaded back on the target’s balance sheet.

This debt funding strategy has various merits. One advantage of debt funding is that it forces high levels of efficiency onto targets that might have been a little on the sleepy side when it comes to cost savings.

This debt raise and debt transfer strategy is most effective when debt is cheap. Lending multiples tend to expand, whilst the reliability of the target servicing the repayments is much increased – something of a virtuous circle for investors.

Whilst debt is cheap the target can still produce attractive FCF margins, so that the other end of the process, the exit, also works. PE exits are often through trade sale (including selling on to another private equity fund) or IPO.

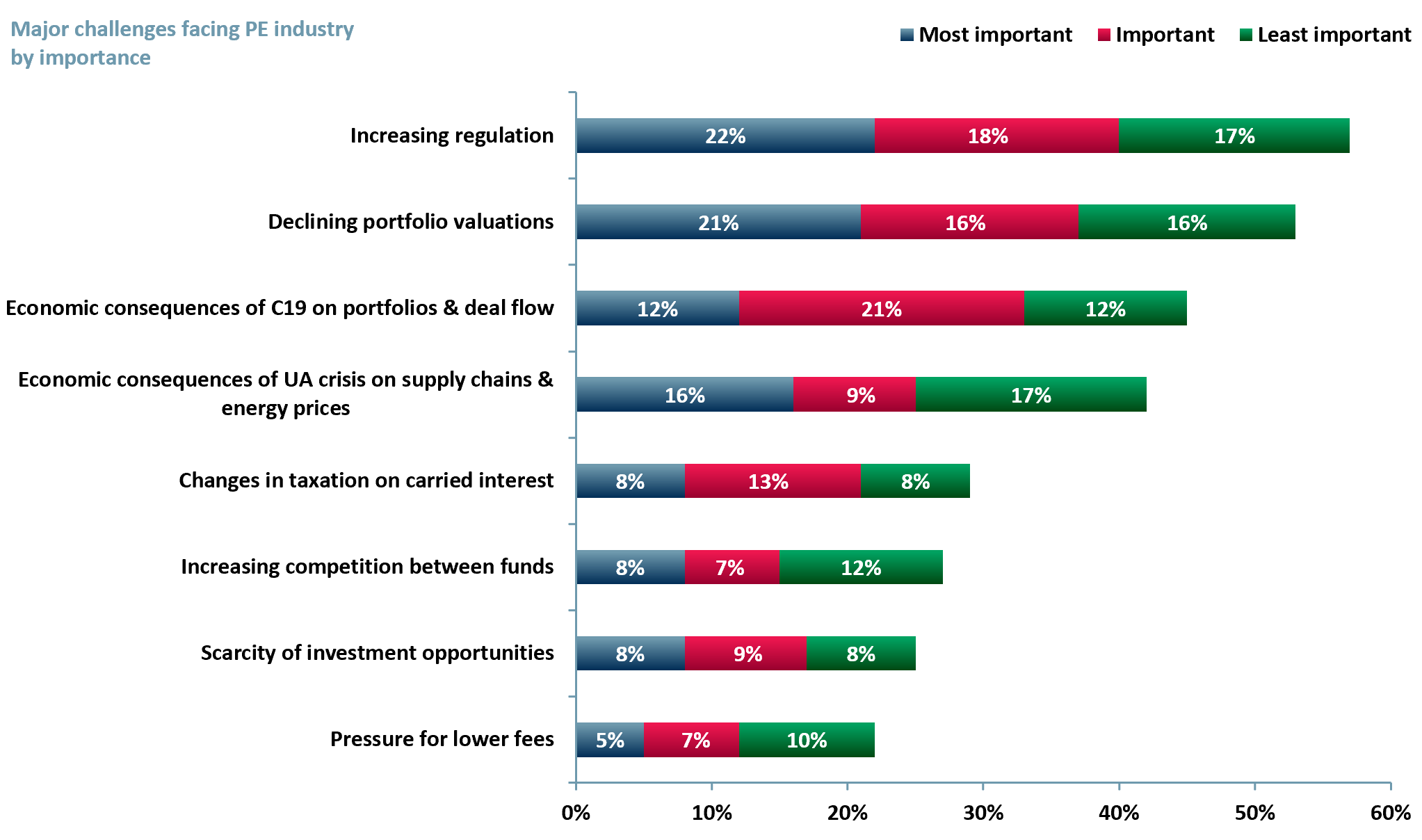

In addition to our observations, private equity has its own range of concerns. These concerns are still connected to deal quality, transaction volumes and in the end, delivering investor returns. Exhibit 3 below is based upon the results of a survey conducted by PwC and Acuris Global completed 1Q23 with a sample size of 250 respondents. Increasing regulation is the top concern.

Regulation has a tendency to increase costs and raise barriers to entry. In certain circumstances, regulation can also reduce returns. Though what regulation generally does is protect incumbents. The protection of incumbents makes it harder to promulgate innovation. Increased regulation, as a long-run hyper developed economy trend, could end up creating a major challenge for private equity growth and returns.

Exhibit 3 – Major expected challenges facing the private equity (PE) industry in Europe 2023-2028

Sources: ACF Equity Research Graphics; PwC; Acuris Global.

Sources: ACF Equity Research Graphics; PwC; Acuris Global.

We would say ‘private equity is not over’ and it is probably always going to be a significant force because of various other market factors. But, perhaps, we are entering a shakeout with those that are not really up to the job, finding themselves forced out of the sector.

Investors in PE funds beware, more so than usual, and at least for the rest of 2023. Finding the right moment to re-enter PE will depend, as with so much in markets, on what happens to inflation and interest rate policies

Author: Christopher Nicholson, ACF Equity Research’s Managing Director / Head of Research, was a speaker for the future of US tech for the Financial Times Investors’ Chronicle Future of Private Investing on the 15th of June 2023.