Competition for investment in energy stocks is strong. What should be considered?

Being a successful long-term investor in energy stocks has become exceedingly difficult the past several years and increasingly there is competition in the form of renewable energy investment.

Below I give an account of the development of the oil industry over the last 4 decades and draw a handful of challenging conclusions about now and the future of oil investing. There are opportunities, but they are difficult to find, renewable energy investment is competing for my dollars and ESG or social policy is becoming a key investment decision filter.

From the early 1980’s to the mid to late 1990’s things weren’t that bad. The large, integrated energy companies, such as what we now know as Exxon, Shell, Chevron, Total, BP etc., produced steady financial results, whilst oil prices were trading within a band of $10 to $35. Earnings didn’t grow very much, but the businesses produced solid dividends and generated a dividend yield in the mid to high single digits, which was attractive.

The mid to late 1990’s were characterized by M&A – the sector went through a wave of mergers, which consolidated and rationalized the industry and generated strong stock gains for energy investors.

From late 1999 to mid-2014 we entered what portfolio managers now refer to as the golden years of energy investing. Back then the Chinese led demand and OPEC controlled supply. This dynamic drove the crude oil price per barrel from around $10 to over $140.

With oil over $90 per barrel this led to a situation where oil companies just needed to produce as many barrels as humanly possible as quickly as possible to maximise revenues and income (profits) – that was the only goal – get it out of the ground and onto the market no matter what.

This behavior happens when prices appear to be going up exponentially because revenue is a function of price times volume. As long as the money spent producing that incremental barrel is less than the incremental increase in price, value is created.

The rapid increase in the crude oil price was driven by an insatiable expansion in demand from developing economies (dominated by China’s incredible economic growth) led to an equally insatiable demand from investors that oil companies get more oil out of the ground.

Oil companies responded by sanctioning their exploration teams to embark on more and more expensive and more and more complicated projects. This behavior by the oil companies, in turn, was a godsend to the services companies that helped create these projects. As a result, almost every energy company involved in the production and servicing of the oil business, benefited.

Then came the great technological innovation that transformed the entire oil map – US shale production growth in North America, which turned the Permian basin from a nearly dead field to one of the great oil producing basins in the world and opened up the Bakken shale oil formation amongst others.

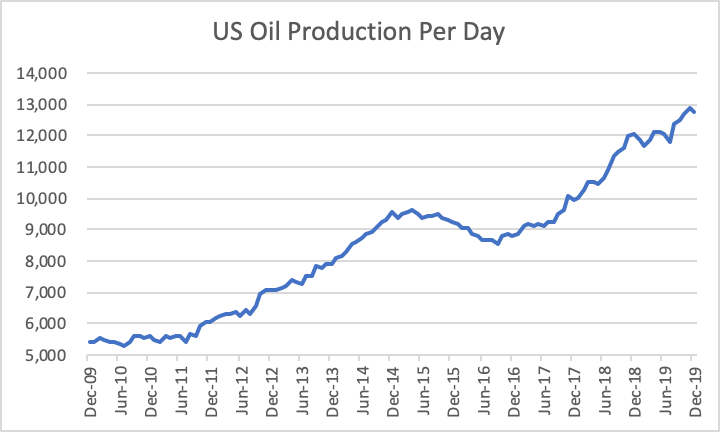

The Permian transformation and the Bakken field have been the main drivers in US crude oil production rising to just under 13 million barrels per day today, up from 5.5 million barrels per day in 2011. The effect of the US becoming a net exporter of oil caused the following effect – the price of Brent crude oil declined to under $30 per barrel in early 2016, down from almost $115 in June of 2014. Brent crude prices have been prevented from climbing above $85 a barrel ever since.

This upper price limit and lower average price per barrel is a problem for energy companies because they produce a commodity that they sell into a spot market, and thus have no pricing power. In addition, they have an asset which depletes annually and they must divert cash flow every year to maintain and grow this asset (or better said re-grow it) and so their production capacity, instead of paying it out (theoretically and in practice) to investors.

The large integrated majors also invested in their so-called ‘downstream’ chemicals units (using their own oil production as their feed-stock) again anticipating vast economic expansion across the globe (viz India and China), but China also invested heavily in chemicals production (something it did not do for oil production). The effect is that demand for product of the integrated majors has not hit the forecast highs justifying the expansion of production of the chemicals businesses – the world has effectively over invested in chemicals production.

The strategy for large integrated oil companies used to be that if one unit of the business was not profitable at any point in the business cycle, the other two (midstream and downstream) would compensate, or put another way, at least two cylinders of three would be firing at any one time. Now we have a situation where no integrated oil business units are profitable (i.e. no cylinders are firing), that is new.

From an investor perspective, oil investing now has to be about finding oil companies with low-cost to extract high-grade oil, essentially this means search for companies in E&P (Exploration and Production – so the upstream businesses) or alternatively roll up strategies where the original capital investment by former owners is now a sunk cost.

The figure below shows the development of oil production per day over the last decade, the price per barrel chart goes broadly in the opposite direction.

More technically, in an environment in which producers don’t have pricing power one of the few ways to create a competitive advantage is to have a low cost high quality oil production asset or a structural low-cost position of some other type that is difficult to replicate, such as low labour costs, few regulatory barriers and low transportation costs to market (which is either a distance or geography factor).

These developments in oil production and price have lead to a series of changes of behavior and view on my part.

Firstly time – as a professional portfolio manager, I currently find it hard to find the time, or to justify the time, needed to look for these opportunities in public companies. As a result for now, and for more than a year and a half, I have had no fossil energy investments in my funds.

Secondly competition for my investment dollars – the rise of renewable energy investment is inescapable from a portfolio management perspective. A lot of capital has gone into the renewable space over the past several years. The renewables sector is now reaching a point of self-sustainability, even as government subsidies and tax credits are getting phased out.

Renewable energy is now a legitimate alternative to fossil fuels from an investment perspective in terms of scale of returns and liquidity, both essential factors. Investors are contemplating a significant decline in fossil fuel production in their lifetimes and with current price volatility (WTI oil price futures go negative), shale production decline too. This has a negative impact on the fossil fuel sector in terms of available capital from professional investors and so future cash flows and therefore on the valuation of fossil fuel energy stocks.

Thirdly, social awareness – ESG investing and social awareness are a weight on fossil fuel energy stock valuations in particular (and also on renewables), that do not appear to be going away. It has to be the case that a verifiable active ESG policy is crucial in order to attract investment in fossil fuels as well in the renewable energy sector. Money flows tell you a lot and trillions of dollars are flowing into investment funds with an ESG stock selection filter.

The message is plain. I need stocks in fossil fuels with real sustainable advantage, they need to be brought to me rather than me have to find them, they are competing for my investment dollars with renewables and they increasingly need to have, or be developing, ESG policies they can actually execute.

The author is a highly experienced, leading international Portfolio Manager based in the US, who looks for investments globally for the funds he manages.