Wind turbines drive REE pricing not EVs

Wind turbines and wind farm development applications may drive REE prices more than electric vehicle (EV) demand. Wind turbines are an important part of renewable energy infrastructure and stand to play a critical and growing role in the transition to a more sustainable and efficient energy production world.

Long duration energy storage (LDES) systems remove the wind unreliability problem and so can tie wind power to electricity grid base load provision.

In terms of the REE demand schedule, wind turbine electricity production is currently reliant on the availability of rare earth elements (REEs), some argue this dependence is temporary, we do not agree.

Wind turbines are in many ways an extremely attractive part of the energy mix, they appear to provide a clean and renewable source of energy that does not produce greenhouse gas (GHG) emissions or contribute to climate change (though they may have other negative environmental impacts – bats, birds and SF6 in the switchgear).

Rare earth elements (REEs) currently play a significant role in wind turbines because of the use of, or need for, permanent magnets (made with REEs) in turbine design. REEs are increasingly crucial in green energy

REE use (by mass) is likely to be concentrated in electric vehicles with a comparatively small but still significant amount of REE used in wind turbines. The IEA’s March 2022 updated report – The Role of Critical Minerals in Clean Energy Transition – estimates REE EV demand of 35 Kt and 5.1 Kt wind turbine demand in 2040.

As such, wind turbines and wind farm planning applications could be the significant driver for marginal REE demand (and so perhaps the real driver for REE pricing). Demand for REEs from wind turbine manufacturers is always likely to be more variable than EV production line demand. It is this more variable demand from turbines that we propose does or will really drive REE market pricing.

- The Growth of Wind Power:

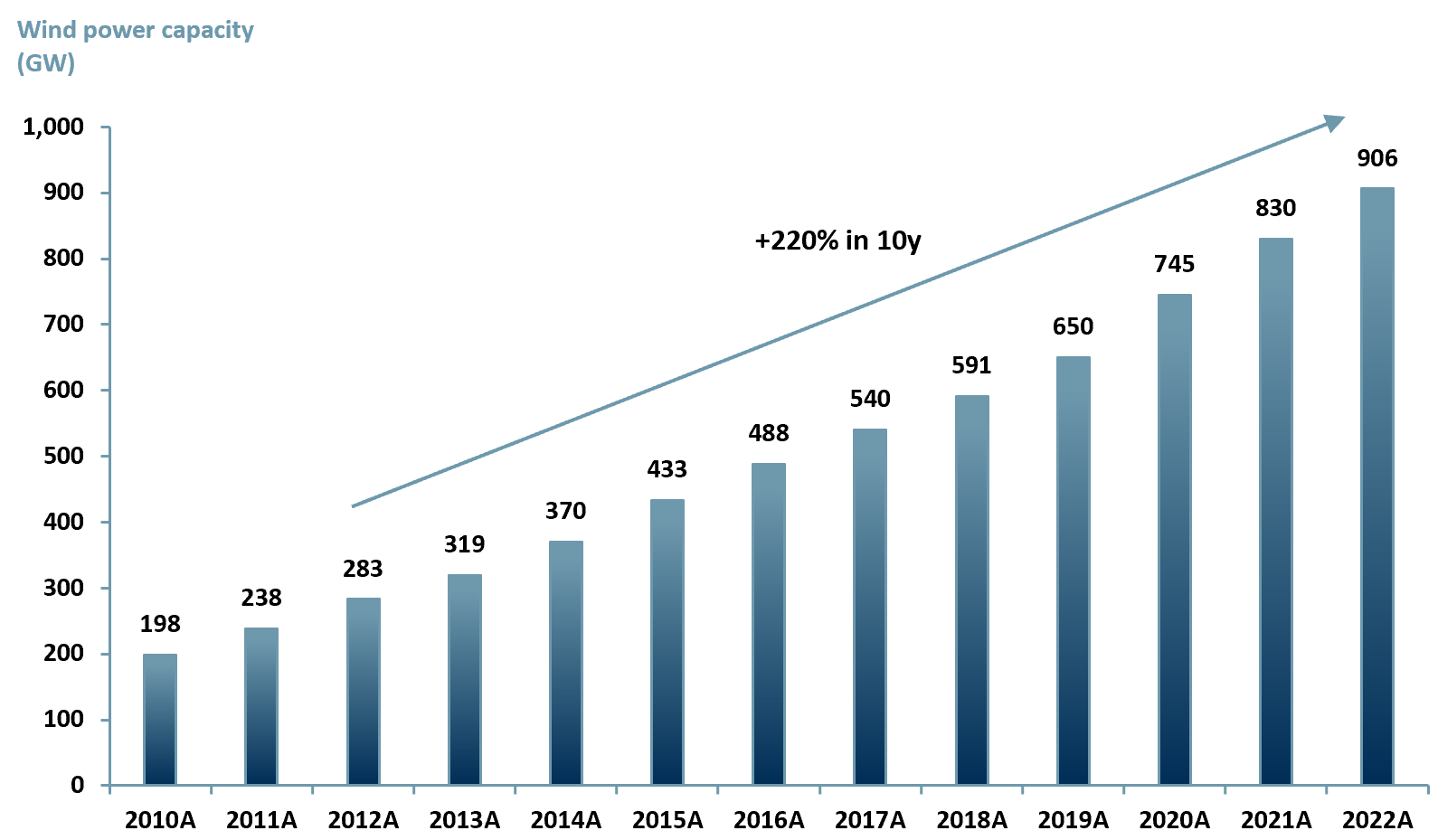

Global wind capacity increased by 220% in 10 years from 2021-2022 (GWEC), highlighting the rapid growth of wind power as a cost-competitive and clean energy source (exhibit 1). Wind power has become one of the most affordable electricity sources in many countries, challenging traditional fossil fuel alternatives. Wind turbines offer emissions-free electricity generation (more or less…note the use of SF6 in the switchgear), reducing reliance on fossil fuels and mitigating climate change impacts.

- Scalability and accessibility of wind turbines:

Wind turbines can be rapidly deployed and scaled (which also means the demand schedule is more variable than it is for EVs), making them ideal for meeting energy demands in remote or off-grid locations. Wind farms provide stable income for landowners and farmers through land lease agreements, stimulating economic growth. As a result, wind power contributes to job growth, supporting many jobs globally (refer below) and fostering economic development in wind-rich regions.

- Rare Earth Elements:

Wind turbines currently rely on powerful permanent magnets made from rare earth elements in the light rare earth oxides (LREO) group, such as neodymium, praseodymium, and dysprosium. REEs in turbine use are characterised by their high-strength, lightweight, and efficient performance.According to the IEA, global wind power capacity expected to double by 2025. As such, we infer that the demand for REEs in wind turbines will continue to rise, reinforcing their significance. The concentration of REE production in a few countries, mainly China, raises concerns about supply chain risks, emphasizing the need for diversification and alternative solutions (e.g. Ionic Rare Earths (IXR.AX) strategy and ACF Equity Research’s vision of a future in which economically rare/high value metals are only ever leased).

Exhibit 1 – Global installed wind power capacity 2010A-2022A

Sources: ACF Equity Research; GWEC.

Sources: ACF Equity Research; GWEC.

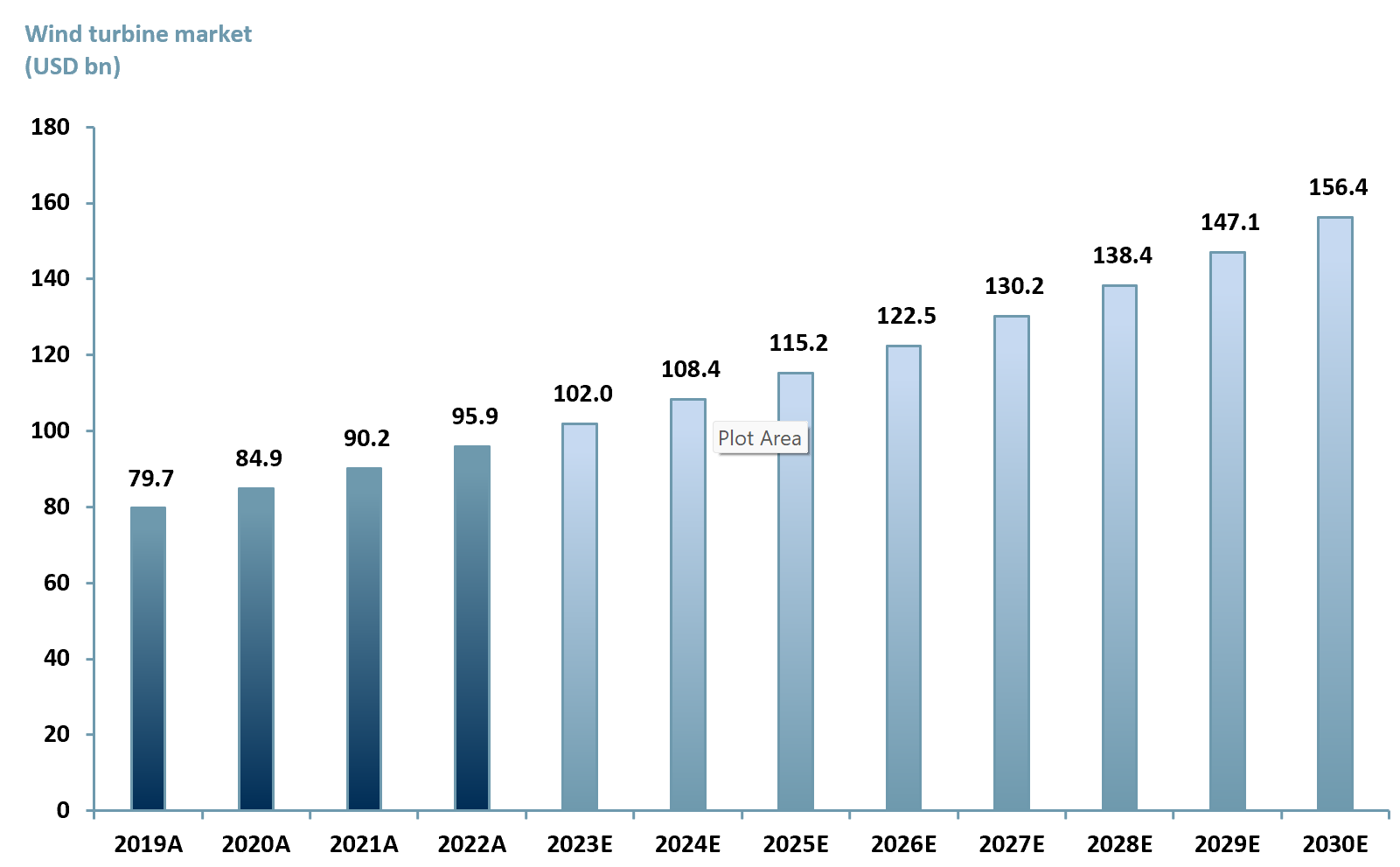

ACF Equity Research forecasts that the global wind turbine market will reach US$ 156.4bn by 2030E, up from $79.37bn in 2019A at a CAGRR of 6.32% (exhibit 2). Our wind turbine market growth expectations are influenced by the increasing need to substitute traditional energy sources for renewable energy sources combined with significant developments in long duration energy storage (LDES) systems providing for utility scale battery storage via for example vanadium (VRFB) and antimony cathode liquid metal batteries.

Exhibit 2 – Global wind turbine market forecast 2019A-2030E

Sources: ACF Equity Research Forecast; Research and Markets; GlobeNewswire; Allied Markets.

Sources: ACF Equity Research Forecast; Research and Markets; GlobeNewswire; Allied Markets.

Benefits of wind turbines

Wind power is considered one of the cheapest sources of electricity (energy.gov), and it is becoming increasingly competitive with traditional fossil fuel sources. Data on the levelized cost of energy (LCOE), though project dependent, suggests wind needs to achieve an LCOE of 5 cents per KWh to compete with fossil fuel generation. There is some evidence wind projects are achieving this competitive LCOE and suggestions that some wind projects are coming in at 4 cents per KWh.

Wind turbines can be deployed quickly and at scale, making them ideal for meeting energy demand in remote or off-grid locations, whilst also providing a stable source of income for farmers and landowners who lease their land for wind farm development.

In addition, wind power has the potential to create jobs and stimulate economic development, particularly in regions with strong wind resources such as N. Europe, N. and S. America, N. Africa and the Middle East and Asia-Pacific (i.e. China). Globally in 2021, the wind energy industry created 1.37m jobs, up 9% y/y (IRENA).

Wind turbines rely on powerful permanent magnets to generate electricity from wind power. These magnets are typically made from neodymium (Nd), praseodymium (Pr), and dysprosium (Dy), which are three rare earth elements that are critical to the production of high-strength, lightweight, and efficient magnets.

The use of rare earth elements (REEs) in wind turbines has become increasingly important – wind energy production has grown rapidly in recent years. According to the IEA, global wind power capacity is expected to more than double by 2025, and by 2040 it could provide up to 20% of the world’s electricity (IEA).

While REES are essential to the operation of wind turbines via permanent magnets, the supply chain is oligopolistic – REE production is concentrated in a small number countries, dominated by China, which accounts for ~90% of global permanent magnet production. This concentration of supply creates potential risks for the wind energy sector, as any disruptions in the supply of REEs could have significant impacts on the cost to rollout and availability of wind turbines around the world.

Wind turbine reliance on permanent magnets

The neodymium magnets used in wind turbines are made by combining neodymium, iron, and boron powders and subjecting the mixture to a process of sintering, which involves heating the powder to a high temperature (~1000-1300°C / 1273-1573 K)

to create a solid block of material. The block is then cut into the desired shape and magnetized.

Wind turbines may also use other REEs such as praseodymium and dysprosium to enhance the performance of the magnets. These REEs are used in small quantities, but they can have a significant impact on the efficiency and power output of the wind turbine.

The amount of REEs needed to build the permanent magnets used in wind turbines depends on the specific design and size of the wind turbine. However, neodymium-based magnets, which are the most commonly used type of permanent magnet in wind turbines, typically contain between 28% and 32% neodymium by weight, as well as other elements such as iron, boron, and small amounts of other rare earth elements such as dysprosium and praseodymium.

A 3 MW wind turbine may contain up to 600 kg of neodymium in its permanent magnets and ~50 kg of dysprosium can be present, which is added in small quantities to improve the high-temperature performance of the magnets. Other statistics suggest that 1 MW wind turbine power generation requires ~150 kg of rare earths. Estimates for total mass of REEs in an electric car vary very considerably but seem to be in the range 1-5 Kg per unit.

It is important to note that although individual turbine units appear to consume more REE than individual electric vehicle units, the mass of rare earth elements required to build wind turbines to satisfy sustainability goals, though not insignificant, is relatively small compared to the total rare earth demand in relation to EV production (see above).

The ferrite magnet alternative

There are questions over the permanency of the critical role of REEs in wind turbine production. The counter proposition is that ferrite magnets are a substitute good for neodymium magnets.

We would argue that ferrite magnets are currently not efficient enough to substitute permanent magnets. Efficiency is measured by a magnet’s energy product, which is a measure of its magnetic strength. As such, ferrite magnets, we propose, are not a true economic substitute. We infer that ferrite magnets are unlikely to replace rare earth elements in mass produced wind turbines, at least not for the foreseeable future.

Neodymium magnets have a much higher magnetic energy product compared to ferrite magnets, making them much more efficient at converting the rotational energy of the wind turbine into electrical energy. Neodymium magnets have a magnetic energy product that is ~10x higher than ferrite magnets, which means they can generate a much stronger magnetic field for a given amount of magnet material, making them (REE permanent magnets) much more effective at energy conversion.

The higher efficiency of neodymium magnets is particularly important in large wind turbines, where the power output is much higher and the demands on the magnets are greater. Ferrite magnets can be used in smaller or lower-power wind turbines where their lower cost and durability are more relevant.

Ferrite Magnets vs. Neodymium Magnets:

- Neodymium magnets have a significantly higher magnetic energy product compared to ferrite magnets, making them more efficient at converting wind turbine rotation into electrical energy. Ferrite magnets have a weaker magnetic field, are more brittle, and have lower temperature resistance, making them less suitable for large or high-performance wind turbines. While there is ongoing exploration of alternatives, the current efficiency and performance of neodymium magnets justifies their continued use in wind turbines.

- Ferrite magnets compared with neodymium magnets have a weaker magnetic field for a given amount of magnet material – which means lower electricity production efficiency.

- Ferrite magnets are more brittle than neodymium magnets and are more susceptible to cracking or breaking under stress. This can be a problem in the harsh operating conditions of wind turbines, where the magnets are exposed to high levels of vibration and mechanical stress.

- Ferrite magnets have a lower temperature resistance than neodymium magnets, which means they can lose their magnetization at high temperatures. This can be a problem in wind turbines, where the magnets can be exposed to high temperatures during operation.

Whilst ferrite magnets have a lower initial cost compared with neodymium magnets, they are not as efficient or durable, and may not be suitable for use in large or high-performance wind turbines. The transition to alternative materials will inevitably depend on advancements in magnet technology and the availability of economically viable and sustainable alternatives.

Research continues to improve the performance of ferrite magnets and even the development of magnets that do not require REEs at all. However, these alternatives have not yet reached the level of efficiency and performance offered by REE magnets – We infer demand for REE magnets and so REE from the wind turbine electricity generation sector is here to stay for at least a while.

How might investors in REEs and REE dependent segments proceed?

We suggest therefore that the strong growth demand schedules for both wind turbines and EVs, the likely difference in variability of these demand schedules and the relative masses of REEs used in each of these applications, makes a case for wind turbines and wind farm development applications as the real marginal price driver for REEs.

If investors want to understand REE future pricing, maybe market beating returns can be achieved from studying wind turbine actual and expected orders, which in turn is underpinned by applications to develop wind farms.

Exhibit 3 – Rare earth element producers peer group

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

Authors: Renas Sidahmed and Christopher Nicholson. Renas is ACF’s Head of ESG and a Staff Analyst, Christopher is Head of Research see their profiles here.