Competition lowers drug prices, FDA says

According to a report by the US Food and Drug Administration (FDA), increased generic drug entry will lead to price reductions in the market (see our table below) as well as huge savings opportunities for patients, or at least their insurers. The FDA suggests that generic drugs saved the US healthcare system US $293bn in 2019.

Typically, the cost to bring a generic drug to market is significantly less compared to their brand-name alternatives. The reduced cost to bring generics to market is driven by a reduced or even no requirement to carry out further animal and clinical research. (FDA, 2019)

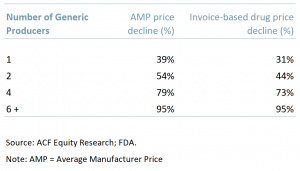

The FDA examined products that entered the marketplace between 2015 and 2017 and concluded that after a drug loses its patent protection (loss of exclusivity), the appearance of generic drug manufacturers will reduce average prices. This observation in of itself is not a surprise, the rates in the exhibit below however are more elucidating.

In contrast, prices of brand-named drugs are set to increase this fiscal year. In the US, an average 51% price rise is expected on 457 brand name drugs. The FDA is looking to depress these price increases by ‘flooding’ the market with competitor generics and biosimilars – over 1,170 generic drugs were approved in 2019 by the FDA.

In an FDA report ‘Generic Competition and Drug Prices: New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices’, the price differences for both average manufacturer prices (AMP) and invoice models were calculated and analysed based on the number of generic competitors in the market.

The FDA results confirmed what capital markets analysts have long forecast – generic introductions have a stark effect on branded drugs prices.

What the FDA concluded was that there is a distinct leverage effect – the more generics that are introduced the further prices fall but that there is a floor to AMP declines.

- One generic producer: The generic AMP was 39% lower than the brand AMP before competition compared to a 31% price reduction using invoice prices.

- Two generic producers: Generic prices were 54% lower than the brand-name prices before generic competition and 44% lower when calculated using invoice-based drug prices.

- Four competitors on the market: Generic AMP prices were 79% lower than the brand-drug prices before generic entry compared with 73% using invoice prices.

- Six or more competitors: Generic prices using both AMP and invoice prices represented reductions of more than 95% compared with brand prices but this was the lower limit or floor for generics price declines vs. brand prices.

As in any market, however, increased competition, i.e. in this case having multiple manufacturers producing the same drug, will inevitably bring down prices and eventually lower profit margins for all over time.The cost of producing generic drugs is lower than brand name drugs as manufacturers have minimal research and development expenses. As a result, profit margins tend to be higher initially than brand name drugs even though drug prices are lowered.

There is an ongoing concern around the price of drugs and government authorities are looking for ways to make them more affordable.

Increased competition in the generic markets could be a mixed blessing as on the one hand it will lower the price of drugs for the general population but on the other hand it may no longer seem like such a lucrative business for companies and investors involved in original drug development.

Lower profit margins will make it difficult for small and mid-cap companies to operate in the long run. It is smaller companies that are carrying out much of the most innovative drug development work.

Covid-19 and the increasing elderly population present a need for easily accessible and affordable medication for all.

Governments, regulatory authorities and pharmaceutical and biotech companies will need to work together to ensure capital markets deliver their part of the bargain, whilst keeping the needs of patients at the forefront. This is not an equation that is easy to resolve.