Deliveroo’s IPO downhill delivery – it’s not alone

Is the Deliveroo (ROO.L) IPO really a blow to London’s hope of attracting tech companies? UBER Technologies (NYSE:UBER), a ride hailing and delivery company, also fell sharply after its 2019 $45 p/s US IPO – it had a founder problem. ROO’s problem is no ESG.

The problems for ROO and UBER are related – they are about mistrust and particularly about the ‘social’ part of ESG / sustainability. The ~40% fall in Deliveroo’s share price since IPO is down to its lack of an ESG policy with metrics, which can otherwise be expressed as poor pricing.

Key Points:

- Deliveroo’s (ROO.L) shares dropped ~30% on its IPO debut on the London Stock Exchange taking ~£2bn off the initial valuation of the company. ROO is currently (as of 21/04/2021) down ~40% vs. its IPO price of GBp 390.

- Many institutional investors openly avoided investing in ROO at IPO, over concerns about gig-economy working conditions and the company’s corporate governance (i.e. ROO overlooking the ‘S’ -Social, in ESG).

Who is Deliveroo?

A cyclist wearing the silver and blue Deliveroo jacket is a common sight in at least 50 UK cities (ROO intends to expand its reach to ~100 UK cities during 2021).

Delivery services have become ever more popular during Covid lockdowns. Delivery services such as Deliveroo, JustEat (TKWY:AEX) and Uber etc. have become ‘trusted’ sources for the provision of basic needs as well as indulgences, but not all of them have this trusted status for investor returns.

The disastrous IPO

There are continuing concerns about how ROO treats its employees or better said ‘gig-economy workers’. In formal terms the issue is over ROO’s Human Capital Management, or lack of it. Human Capital Management issues are squarely on the radar of international standards boards’ such as SASB and regulators, the SEC in the US and, as demonstrated by ROO’s IPO, institutional investors.

ROO employs so-called ‘gig’ workers to carry out its physical delivery service. Gig-economy workers are independent contractors hired on a temporary basis. Typically, such workers are offered irregular hours at short notice.

The word ‘gig’ is slang for a job that only lasts a short amount of time; for example a music gig. In the UK, these types of workers are more formally referred to as zero-hour contract employees.

While this type of employment offers a certain degree of flexibility, which some welcome, in the case of companies like Deliveroo, the rights and working conditions of these ‘employees’ are under scrutiny. Uber Technologies (UBER : NYSE) lost a landmark high court ruling in Feb 21 on, substantively, the same issues in our view.

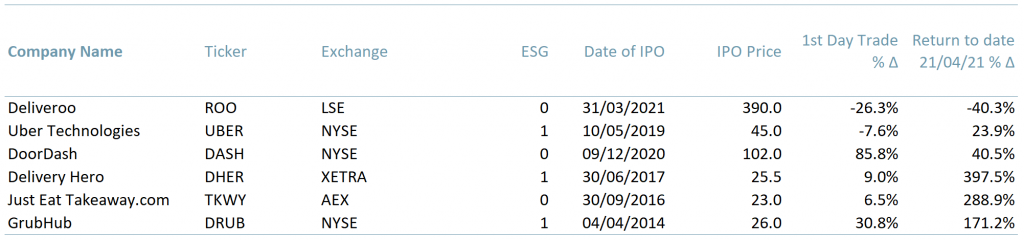

Exhibit 1 – IPO Returns for ROO and its peers 1 day of trading and to date since IPO

Source: ACF Equity Research; Company Reports; Refinitiv

Source: ACF Equity Research; Company Reports; Refinitiv

Exhibit 1 above suggests that ESG has not mattered with respect to IPO returns prior to 2021 and it suggests that most of the delivery company IPOs have been a success, at least at first glance. Two factors belie the % returns data – timing and relative performance (see exhibit 3 below).

Examining the date of the IPOs makes for a more sobering interpretation and whereas ESG does not seem to have made any difference to returns prior to 2021, in our view, that has changed radically as at the start of this year.

In a full valuation analysis, we would also consider the quality of the ESG and related metrics, which may well reveal that ESG was beginning to inform returns prior to 2021. Publicly available index data and EVA scoring data related to the ‘quality’ of an ESG clearly suggests this is a factor for outperformance going back at least 24 months.

We concluded at the start of 2020 that the investor community concern with ESG was rapidly extending both more broadly and deeper into capital pools.

In a year (and perhaps an era) when human rights and sustainability are on everyone’s radar, failing to address ESG concerns was, pretty much, an inexcusable error by Deliveroo. The fear, of course, is that Deliveroo’s business model does not actually work with a cost base centred on full-time employee rights.

In addition, many institutional investors believed that the initial IPO price of GBp 390 was too high for a company that is not generating any profits and that is operating in a particularly competitive sector. Deliveroo’s lack of profitability is not unusual for high growth companies, but it does raise the risk profile and so should reduce the valuation, ceteris paribus.

Many of the retail investors interested in Deliveroo were attracted to the IPO via adverts on the Deliveroo app. Deliveroo’s campaign quipped “Great food with a side of shares”.

What the Deliveroo IPO reinforces is that it is both right and proper that everyone has cost effective access to capital markets, but less experienced investors need legitimate protections – after all, no-one would put a learner driver in a top-end Ferrari.

Part of that legitimate protection is access to institutional (fund / portfolio manager) quality research. Such research should, additionally, capture or discount valuations based on the presence (or lack of it) of an ESG / sustainability policy with metrics.

Deliveroo is a clear example of what can happen now to investors if companies are not implementing an ESG policy. Last year this was not so clearly defined – but the markets have changed as investor momentum pushing ESG / sustainability with metrics has accelerated.

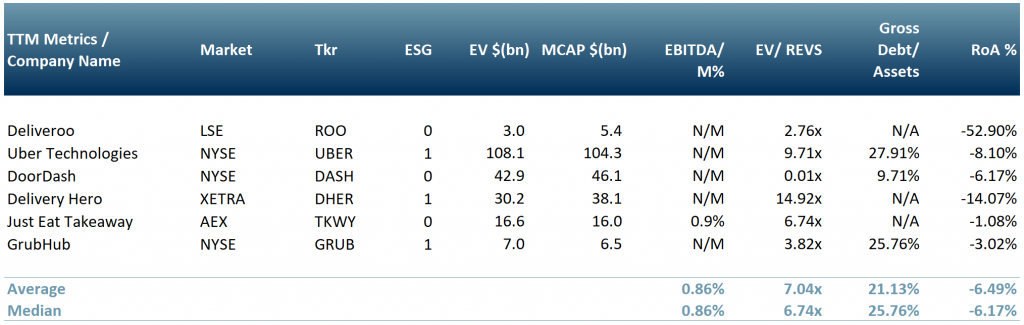

Exhibit 2 shows five of the top publicly traded food delivery companies, most of which, like Deliveroo, do not have positive earnings. These include Uber Technologies (NYSE:UBER), DoorDash (NYSE:DASH), Delivery Hero AG (DHER:XETRA), Just Eat Takeaway.com (TKWY:AEX) and GrubHub (NYSE:GRUB).

Exhibit 2 –Peer group of food delivery companies

Source: ACF Equity Research; Refinitiv

Source: ACF Equity Research; Refinitiv

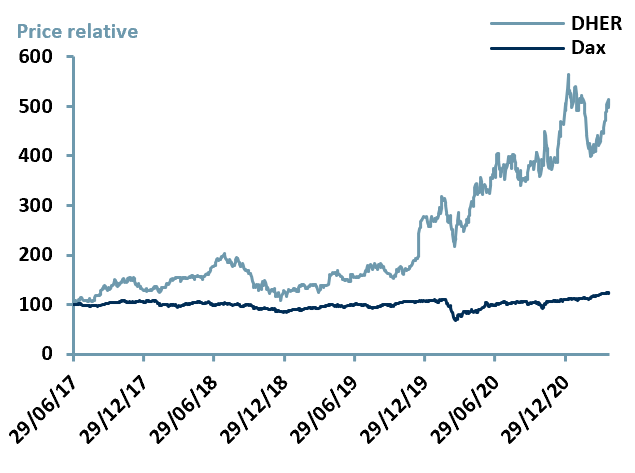

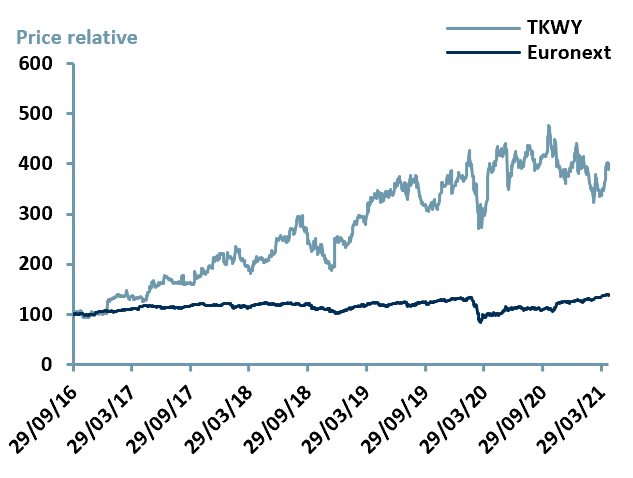

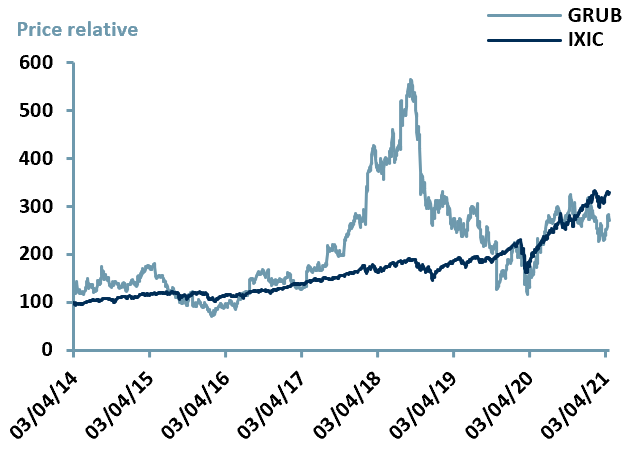

While these companies’ IPOs appear to have been mostly successful, or at least not disastrous, only two, DHER and TKWY have shown strong out-performance over time vs. their indexes. And only one of those, DHER, has an eye to ESG.

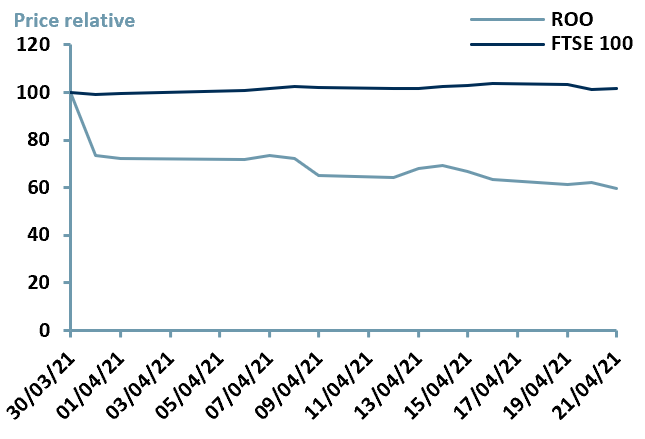

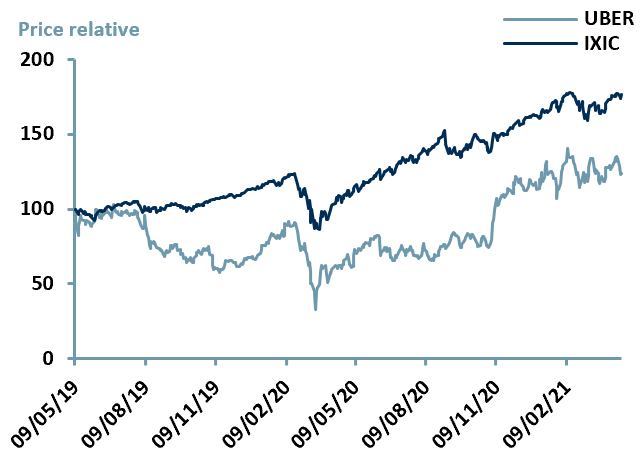

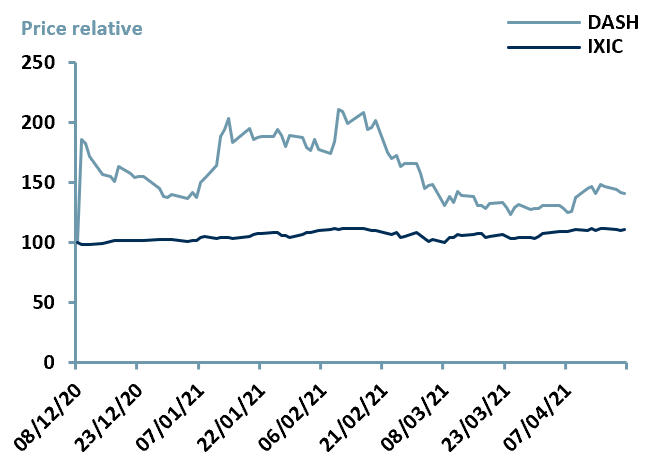

Exhibit 3 – Price Relative Performance vs. Index since IPO date of $ROO, $UBER, $DASH, $DHER, $TKWY and $GRUB.

|

|

|

|

|

|

Source: ACF Equity Research, Refinitiv.

The change in respect of the importance of ESG, in so far as it relates to investor returns, is its increasingly clear effect on relative EVA outperformance. The connection between ESG and EVA now looms large in the minds of portfolio managers and other investors.

To emphasise the significance of the ESG ‘movement’, it is important for all companies, from nano to mega-cap, to implement an ESG policy in order not to exclude themselves from what ACF forecasts as being USD 30.7trn in ESG filtered funds by YE21 – remembering that this formally filtered number is just the tip of the iceberg. The real challenge is informally filtered funds and other types of investor using informal filters.

An ESG policy must cover all three areas – Environmental, Social and Governance. Both Aviva (AVL.L) and Aberdeen Standard Investments (SLAL.L), asset managers with AUM of GBP 334bn (~US$ 458bn) and GBP 464bn (~US$ 637bn) respectively, declined to invest in the Deliveroo IPO over the ‘S’ in ESG – concerns on employee treatment.

For corporates the key message is that the ESG agenda is on the radar for all investor classes – retail and institutional. Retail investors currently make up ~15% of the UK stock market, up from 10% in 2009. In the US, retail investors make up an estimated 25-30% of the stock market capital pool.

Retail investors want to invest sustainably, indeed if they do not, they find themselves increasingly at odds with the institutional investment community – this increases the chances of an investment ending in disappointment.

Retail investors perceive the longer-term gains available in companies that are sustainable and are more supportive towards them – the ESG outperformance data is beginning to clearly support their instincts and analysis.

Companies are also sensitive that retail investors will not hesitate to expose companies (via social media commentary) that are not actively attempting to be sustainable / ESG ‘genuine’.

For investors, it is crucial to do proper research before investing in a company and the most time efficient way of doing that is by reading professional investment research.

Some of what we have raised in this analytical blog is of course open to debate and counter point. What is far less debatable is that companies that strive to meet their sustainability metrics achieve higher EVAs.

The higher EVA comes about because ESG with public metrics imposes an internal discipline that improves marginal capital management. That’s good for company owners and good for investors.

Authors: Christopher Nicholson, Renas Sidahmed, Sam Butcher.

Christopher is a founding executive, MD and Head of Research at ACF Equity Research. Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. Sam is a Junior Staff Analyst at ACF Equity Research. See their profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)