Mining tech investment opportunities

Mining tech investment has moved into vogue in 2021, particularly automation and electrification and was the subject of an ACF Equity Research executive briefing series in early 2019.

In that briefing, we argued, and continue to argue, that live data collection and its real-time processing at HQ and away from the mine site is at the heart of automation and electrification.

We argued that various flavours of AI and VR and the expansion of new LEO satellite constellations are the driving forces in this transition and that the data represents both a potential revenue stream as well as a series of cost and production efficiencies.

Pressure has been building over the last 24 months for mining companies to invest in automation, electrification and data collection to improve RoI and health and safety (ESG).

Explicitly, mining companies are responding to pressures to incorporate more sustainability by, for example, reaching net zero carbon emission targets and improving health and safety.

- EPIROC (EPI-A.ST), a public Sweden based company, provides cutting-edge technology (e.g. drill rigs, rock excavation and construction equipment) to the mining, infrastructure and natural resources industry.

- Helena Hedblom, CEO and director of Epiroc, is on record saying that mining companies are increasing investment in automation and technology upgrades as a result of the pandemic in order to reduce the numbers of staff on site.

- ACF forecasted that data collection and live feeds by satellite from exploration blocks direct to the centre (HQ) will become both cost effective and necessary to maximise RoI by 2021/22.

- Most miners have equipment from a range of manufacturers and Ms Hedblom says that a major change driver is “mixed-fleet automation” – where one central system could manage machinery from different manufacturers. Epiroc is currently taking part in two trials in Australia to verify the efficacy of such a system.

In our view, there are four key themes driving automation, live data collection and off-site processing in the mining industry:

- Capital/Valuation – Going Green (ESG) – Working towards the Paris Agreement in order to become net zero by 2050. In doing so companies can put themselves in the running to gain access to US$ trillions in green funds whilst improving their EVA.

- Profitability – the microeconomic analysis of big data is essential to reducing costs – satellite infrastructure and tech advances around data collection are forcing competitive change.

- Efficiency – Having an automated centralised system that can work with machinery from different manufacturers, will reduce equipment wear and damage, prolonging its life, reducing servicing costs and improving ROIC. It also plays a role in streamlining business operations and improving health and safety for miners and supporting staff.

- New revenue streams – resale of anonymised data collected on operational efficiency and more contentiously, anonymised exploration efficiency data.

Going Green – access to US$ trillions in funds

By going green mining companies can attract the longer term supportive investors and open themselves up to trillions of dollars in sustainability funding.

According to ACF’s forecasts, if a company implements an ESG policy, it will have access by 2021 to US$ 30.7trn in formally filtered ESG funds. Or put another way, they will not be excluded from well over US$ 30 trn of AUM (note that it stands to reason that the informally filtered ESG AUM is far larger than the formally filtered portion).

Implementing an ESG policy is low hanging fruit for smaller companies. Companies already collect these metrics in their management accounts. Metrics such as water management, waste & hazardous materials management and energy management for example, are a staple data points in the mining industry.

Furthermore, given the issues surrounding climate change, the BLM (Black Lives Movement) and the pressures employers are facing as a result of Covid, investors are increasingly focusing on human capital management issues (the ‘S’ in ESG). This involves health and safety and incentives as well as equal opportunity policies.

Eurasia Mining ($EUA.L) is a good example of a PGM miner that has embraced ESG in recent times.

Profitability – Automation tech companies are making a drive for mining business

There is a growing demand for the mining sector to transmute its business operations into safer and more sustainable versions of current activities. This transition to an ESG approach would also prove profitable to company management as a way of speeding up access and concentration of capital (the more capital, the faster the project can be completed, all other things being equal).

Companies like Epiroc are reacting to pressures from investors to reduce carbon emissions. As a result Epiroc is improving safety and productivity by adding autonomous technology to its equipment.

Autonomous machines and equipment do not entirely remove human manpower. But Autonomous machines do re-position human roles making them safer. Safety training has always been extremely important in mining, at least on paper. It is:

- a) increasingly hard to hide inadequate safety procedures and;

- b) increasingly less difficult to implement effective safety measures.

As such having an up to date health and safety policy with metrics is not only paramount from a risk mitigation and reputation perspective, it also makes clear economic sense for company managers and enhances EVA for company owners (investors).

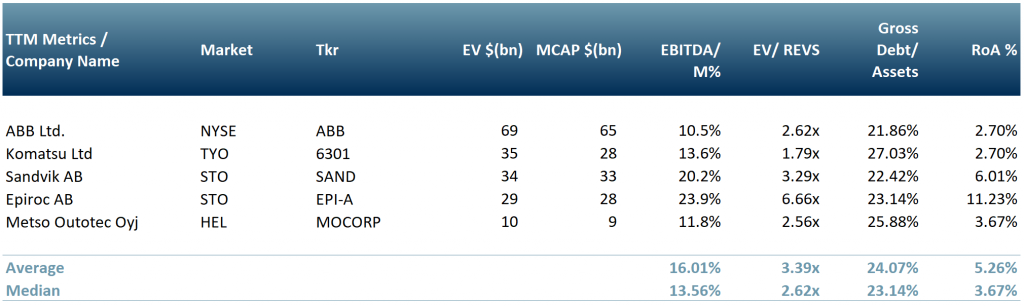

Exhibit 1 below shows five companies operating in the servicing and upgrading of existing mining equipment. ABB Ltd. (NYSE:ABB), Komatsu Ltd (6301:TYO), Sandvik AB (SAND:STO), Epiroc (EPI-A:STO) and Metso Outotect Oyj (MOCORP:HEX).

Exhibit 1 – Peer group table for mining companies involved in servicing and upgrading mining equipment

Sources: ACF Equity Research; Refinitiv

Sources: ACF Equity Research; Refinitiv

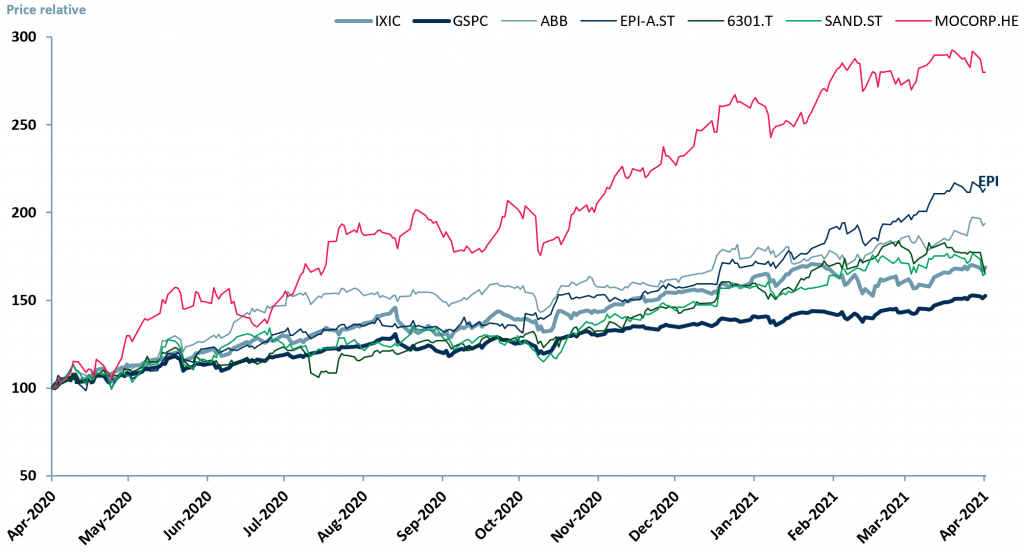

Exhibit 2 below, containing $ABB, $630, $SAND, $EPI-A and $MDCORP, shows the general relative outperformance of the mining equipment and servicing sector as defined by our peer group compared to Nasdaq ($IXIC) and the S&P 500 ($GSPC). Nasdaq and the S&P indexes have themselves performed strongly over the last 12 months.

Exhibit 2 – Mining Equipment peer group 12m price relative vs. Nasdaq ($IXIC) and S&P 500 ($GSPC) indices

Sources: ACF Equity Research; Refinitiv

Sources: ACF Equity Research; Refinitiv

Efficiency – a centralised system

Most mining companies utilise equipment from various manufactures and would therefore benefit from “mixed-fleet automation”. This process uses an automated centralised control system to manage all of the machinery and equipment on site.

Automation is probably most efficiently executed using live data sent to central locations with abundant cheap processing power and over which senior management could have oversight…such as HQ.

Currently data processing and automation is largely carried out at the site of exploitation due to the remote nature of many mining projects and commensurate lack of global connectivity. Satellite constellations planned and actual are changing this limitation.

Epiroc, for example, is currently undergoing a trial with ASI Mining (34% owned by Epiroc) at the Roy Hill mine in Western Australia. ASI will supply the technology that will convert Roy Hill’s fleet of 77 haul trucks to autonomous operations from manned. The expected completion date is 1H21.

Centralisation and automation is also expected to improve the overall safety of the mining industry. As a result of Covid, exposing the infection element of health and safety, mining sites, particularly underground mines, have had to either shut down or reduce the number of workers on site for extended periods.

Covid in 2020 and 2021 has damaged productivity and significantly decreased revenues, it may also, in part, be responsible for the inflation in raw materials prices through a tightening of the supply and demand schedule. It is certainly responsible for focus attention on green metals e.g. PGM miners such as Eurasia Mining, Norilsk ($GMKN.ME), Impala (IMP.JO), and Northam ($NHM.JO)

It is no surprise that companies are looking at automation with greater urgency, the drivers are manifest and increasing and the infrastructure required to undergo further automation is becoming both more available and so more affordable.

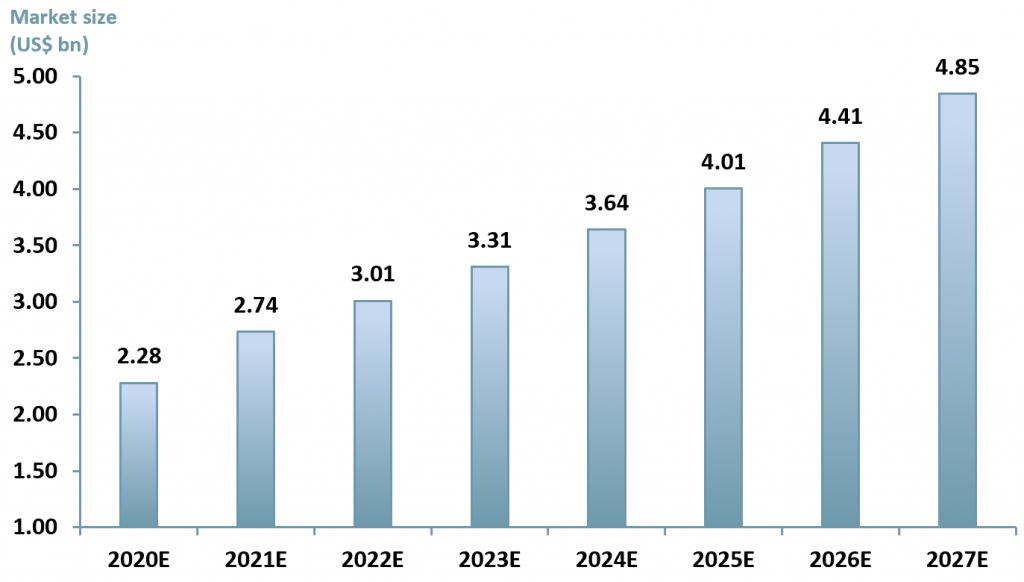

In exhibit 3 below, ACF forecasts that the global mining automation market will reach US$ 4.85bn by 2027E up from US$ 2.28bn in 2020E. We forecast that the mining automation market will initially grow at 20% p.a. during 2021E as mining companies across the globe resume operations that had been disrupted/closed due to C-19.

Once the market has recovered and normal operations have resumed, we forecast a CAGR of 10% between 2022E and 2027E as mining companies make longer term strategic decisions around the capex cycle but additionally informed by their global pandemic experiences.

Our reduced CAGR post 2022E to some extent captures our assumption that the sense of urgency may be less heightened post the pandemic, an inescapable human factor.

Exhibit 3 – Mining automation market value in the US from 2014 to 2027E US$ (bn)

Sources: ACF Equity Research Estimates; Reportlinker; Verified Market Research; PR Newswire; The Business Research Company

Sources: ACF Equity Research Estimates; Reportlinker; Verified Market Research; PR Newswire; The Business Research Company

Automation and advanced mining technology lead us to the inevitability of real-time big data processing in mining operations.

Collecting valuable mining data from remote locations and shipping it rapidly and cost-effectively to senior management teams/Head Quarters on the other side of the globe, to have it processed by inexpensive powerful computer banks, is a real game changer and essential upgrade for the whole sector.

Investment research ACF carried out at the start of the pandemic in relation to the changing behaviour of capital markets and the real economy has implications for mining.

In other ACF executive briefings we have analysed the C-19 market crash and recovery in comparison with other market crashes dating back to 1929. ACF’s investment research suggests that the time for markets to recover after a crash or severe down-turn is contracting. Two of the main driving factors in our research were declines in the cost of computations (chips and Moore’s law) and investments in telecom infrastructure and as we argue here, mining is not immune from these driving factors.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here