EVs Part 2: Carbon Nanotubes – Charging Li-ion batteries

Carbon nanotubes (CNTs) have the potential to meaningfully raise the performance of lithium-ion batteries via enhanced electrical conductivity and mechanical strength. This represents a market opportunity for companies in the electric vehicles (EVs), battery manufacturing and material suppliers industries.

Carbon nanotube leader companies could gain a competitive advantage and a cost advantage if they can scale production of this CNT application(described below, thereby reducing costs.

In Part 1 of our electric vehicles (EV) blog series, we described the emergence of Manganese (Mn) as a replacement for cobalt in EV batteries. With EV sales projected to account for ~75% of the total automotive market by 2040E (BloombergNEF, 2023), the demand for alternative battery chemicals/advanced technology will only grow.

A carbon nanotube (CNT) is a carbon tube with a diameter in the nano meter rage (nanoscale). It was first discovered in 1991 by research scientist Sumio Iijima – a Japanese physicist and investor.

In addition to being good conductors of electricity and heat, CNTs are very strong elastic molecules (after the initial discovery of the extraordinary properties of CNTs there were articles about ‘ladders into space’ etc., to try and fire the collective imagination for potential uses of CNT)

Contemporary deployments of CNTs include their use in engineering materials as additives (3D printing) – capable of making plastic composites with enhanced electrical conductivity and mechanical strength. In biomedical applications, CNTs have the potential for targeted drug-delivery and nerve cell regeneration. Now, their potential is shifting to EV batteries.

Exhibit 1 – Carbon nanotube

Source: Nano Magazine.

Source: Nano Magazine.

The initial integration of CNTs into lithium-ion batteries may well, or perhaps inevitably, increase battery prices due to higher production costs – advances in production, economies of scale and market competition may well push prices back down to or reduce them below current EV battery prices (though metals prices may drown any production cost savings).

The impact of CNTs on Li-ion battery performance

- Improved Conductivity: When integrated into lithium-ion batteries, CNTs can improve the conductivity of the electrodes. This allows for faster electron transfer, which can lead to quicker charging times and more efficient discharge rates.

- Larger Surface Area: CNTs have a large surface area, which can increase the electrode’s ability to interact with the lithium ions. This can lead to improved capacity and efficiency of the battery.

- Enhanced Mechanical Strength: The strength and flexibility of CNTs can enhance the durability of battery components. This can lead to longer-lasting batteries as the electrodes would be less prone to degradation over time.

- Thermal Stability: CNTs can improve the thermal stability of batteries by making them safer and less prone to overheating, often referred to as thermal runaway.

- Potential Downside: The production of carbon nanotubes is currently more expensive than the production of traditional materials used in batteries.

The impact of CNTs on Li-ion battery prices

- Production Costs: Initially production costs and pricing of CNT-enhanced batteries will be higher than current EV batteries. CNTs are currently more expensive to produce than traditional battery materials.

- Performance Enhancements: CNTs can improve battery performance, including increased energy density, faster charging times and longer lifespans. These enhancements could justify a higher price point for consumers, especially in high-demand applications like EVs.

- Technological Advancements: As production techniques for CNTs improve and scale up, the cost of manufacturing CNTs is likely to decrease. Note that increases in the prices of relatively rare battery metals could push the cost contribution of CNTs to an immaterial cost impact.

- Market Competition: The battery market is very competitive. If CNT-enhanced batteries offer superior performance, other manufacturers may adopt similar or substitutable technologies to stay competitive.

- Supply Chain Dynamics: As the price of lithium-ion batteries is also influenced by the broader supply chain, particularly via the availability and cost of other raw materials, the introduction of CNTs could alter these dynamics, if they for example, reduce the required size of EV batteries via higher energy densities.

The Carbon nanotube market

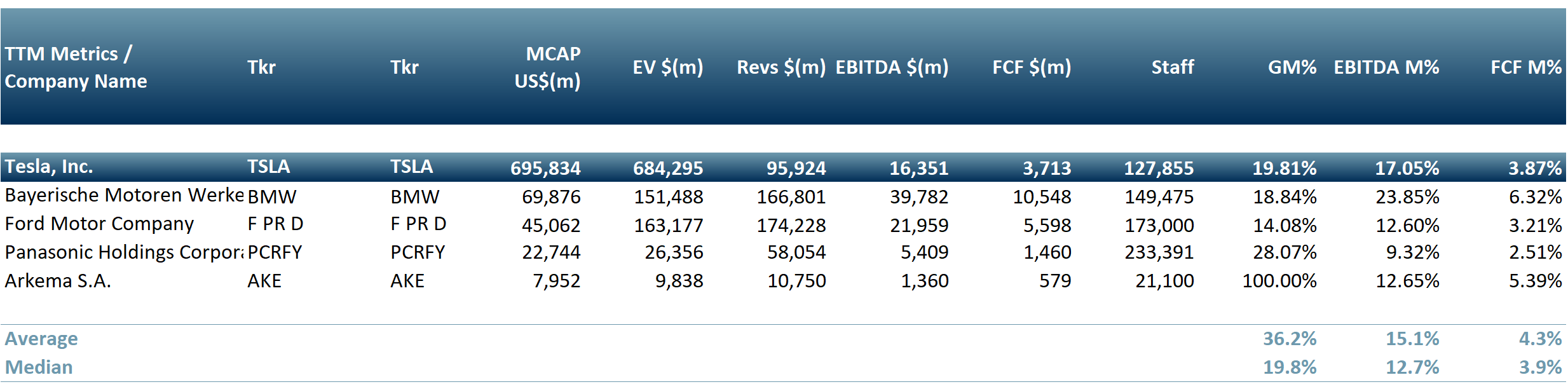

In exhibit 2 below we highlight companies that are in the CNT-enhanced battery space. Although these are large-cap companies, there is room in the market for other players, i.e. small caps, given the ever-increasing demand for EVs. Via the development of CNTs for use in EV batteries, we assess that there is an opportunity to either redefine the rules of this market or create a new market – both strategic opportunities can be highly attractive to investors.

For our peer group we have selected companies in the material suppliers, battery manufactures and automotive space.

Material Suppliers

- Arkema (AKE:PAR): Involved in the production of advanced materials, including those used in battery technologies.

Battery Manufacturers

- Tesla (Nasdaq:TSLA)/Panasonic (6752:TYO): Through their collaboration, Tesla and Panasonic have been at the forefront of advancing lithium-ion battery technology and are considering CNT enhancements.

Automotive

- Companies like BMW (BMW.DE), Ford (NYSE:F), and other automotive giants investing in electric vehicle technology are indirectly involved or interested in advancements in battery technologies, including CNT innovations.

Exhibit 2 – Peer group of companies involved in the development and commercialisation of CNT-enhanced lithium-ion batteries

Sources: ACF Equity Research Graphics; Refinitiv.

Sources: ACF Equity Research Graphics; Refinitiv.

The CNT market for EV batteries is still niche and therefore we can expect further R&D, developments, partnerships and patents related to CNT-enhanced lithium-ion batteries. Regulatory changes and other non CNT technological advancements will provide a more comprehensive understanding of the potential market opportunities.

The integration of CNTs in lithium-ion batteries could also redefine the global approach to long duration energy storage (LDES) utility scale and micro-grid markets.

Equity research plays an important role in market innovation via highly focussed insights into market incumbents. emerging startups and powerful new entrants into a market, thereby providing stakeholders and investors with updates on the latest developments and possible valuation impacts.

Author: Renas Sidahmed – Renas is Head of ESG and a Staff Analyst at ACF Equity Research. See Renas’s profile here