Drugs affordability vs R&D development

The US wants to cap drug prices without affecting R&D in the biopharma industry.

- The biopharma / biotech sector is upping its R&D investment, according to an April 21 Congressional Budget Office report.

- R&D trend – in 2019 the US biopharma / biotech industry R&D spend was US$ 83bn, vs.~8bn p.a. in the 1980s, a 10x increase. The renewed focus on R&D gather significant additional momentum ~5 years ago.

- R&D vs. marketing spend – more money was probably invested in hard sales and marketing strategies (an estimated ~20% vs. 12.5% of revenues for R&D up to 2012, as inferred from an inspection of public company SGA numbers). However, R&D accounted for ~25% of revenues in 2019 vs. ~12.5% in 2000. Inferred marketing spend remains around 20% of revenues.

- Price trend – drug prices have increased every year by 10% – 20% across the board and the Biopharma sector argues with some credibility that drugs prices are high because of the need to reinvest in R&D to develop new indications from existing drugs or to develop the next generation of drugs. The cost to develop a new drug is <US$ 1bn – >US$2bn.

- Price cap effect – the Biopharma industry takes the view that a price cap on drugs would negatively affect its resources available for R&D. The math is straight forward – lower Biopharma returns mean less investor interest and less R&D, which means less product pipeline, which later on means lower revenues and less free cash flow and so the downward self-reinforcing cycle continues.

- GDP implication – because quality of health is so important to economic productivity, fewer biopharma drugs (and devices) in turn leads to lower GDP growth – that hurts everyone and politicians are acutely aware of this.

The conundrum is as follows – what works best for healthcare – price cap or pricing freedom? The answer is not straight forward.

In our view, drugs ‘price caps’ are possible to achieve without disincentivising big pharmaceutical or small biotech and biopharma companies from developing new drugs.

Unlike some other countries, the US government does not regulate or negotiate the price of drugs. This is part of what makes the US the most attractive market in the world for biopharma companies.

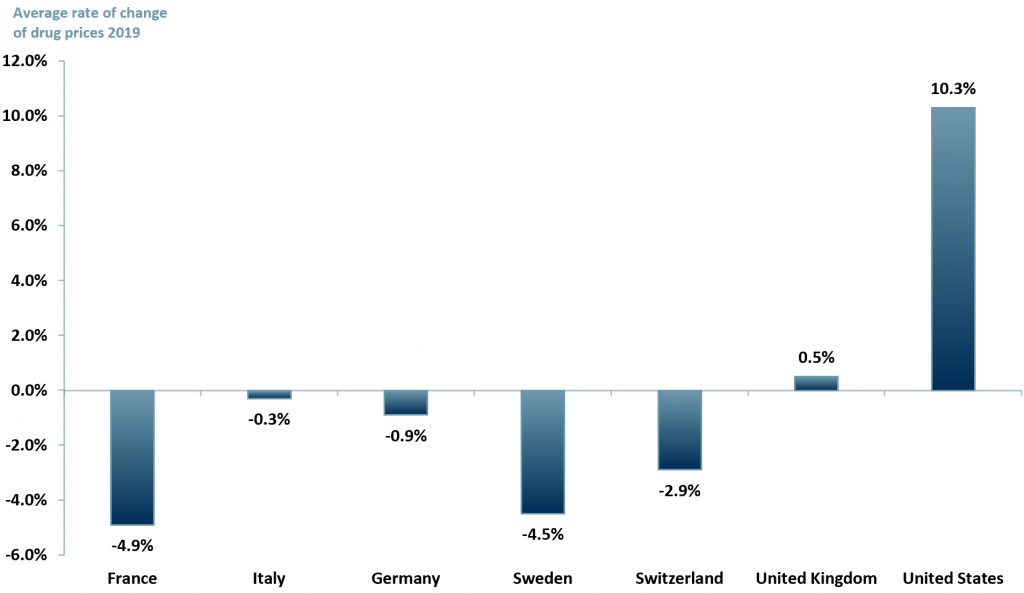

By way of illustration drug prices in the U.S, as shown in exhibit 1, in 2019 increased by more than 10%, whereas in important European markets, drugs prices declined in real terms (i.e. nominal price rise less inflation).

For a long time, at least in the US market, biopharma companies reinvested as much (or more) in sales and marketing, as they did in R&D. This trend began to reverse around 2012.

Exhibit 1 – Patented drugs average price changes in 2019, by country

Sources: ACF Equity Research Graphics; PMPRB

Sources: ACF Equity Research Graphics; PMPRB

The analytical and economic justification behind the no price cap argument is that if a society is unhealthy, its workforce will decline and its productivity will fall, and this will negatively impact its economy. This is even more true of knowledge economies than it is of manufacturing economies.

Productivity impact – arguably mechanisation can compensate for productivity losses in the human workforce in manufacturing. It is not yet true that AI can even approach human intelligence, in spite of the hype, we are a long way off from AI being any kind of challenge to human intelligence for all but the most repetitive of knowledge tasks.

Seat of disease – preventing a seat of disease developing within one’s society is critical. Covid has awakened that comprehension across societies, but a lack of new antibiotics was already creating pandemic conditions in homeless populations, acting as seats of disease, a long time before Covid.

Once banished, infections such as TB are re-emerging with a scary vengeance e.g. MDR-TB (multi drug resistant tuberculosis). The MDR-TB seat of disease is within homeless/poverty stricken populations.

New antibiotics R&D programs are few and far between – because biopharma cannot identify sufficient RoIC. Price caps, logically and practically, seem to mean fewer drugs come to market.

However, no price caps, taken to their logical extreme as underpinned by marginal pricing theory, mean that only the very wealthiest will be able to afford new drugs – in a private medical system the poorest, and even the middle classes eventually, are unable to afford insurance premiums (e.g. the US).

In state funded healthcare systems in hyper developed economies, governments begin to run scared of the demographic maths and budget implications of the costs of drugs and so limit their application and prescription.

In other words, no price caps could, in good time, kill the golden goose for the biopharma / biotech / large pharma sectors, but so could price capping by governments terrified of the implied costs of ageing populations and emotive pleas for treatment – ‘if a cure is available how can you be so heartless as to say no’.

Perhaps the solution is indirect, companies are allowed to set prices via a competitive market, but a moderating influence could be imposed by the state.

In France, for example, the sales & marketing budget in biopharma is tightly monitored and regulated by La Commission pour les medicament (CMH). By limiting sales and marketing budgets on a drug specific basis, companies would have to have more products to win comparable revenue growth – that means more R&D without limiting profitability as much as direct price caps limit profitability.

More R&D would also push down the cost of R&D – the economics of competition lead to innovation and scale up. Covid has already shown this effect in some areas of drug research and phase programs (remote patient monitoring and speed of vaccine development, for example).

Perhaps an indirect instrument, such as a variant on the French approach, is the road map not just for the US but across the world – after all, more competition lowers prices, speeds processes and creates new solutions (drugs) – all of which create new markets geographically and new target audiences within those geographies, which in turn creates greater value for investors – that is, in part, how competition works.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here