Flying cars – another fiction becomes reality

Lilium, a German developer of flying taxis, announced on 30th March 2021 that it had completed a reverse merger with a SPAC. The Lilium flying taxi business obtained a valuation of US$ 3.3bn.

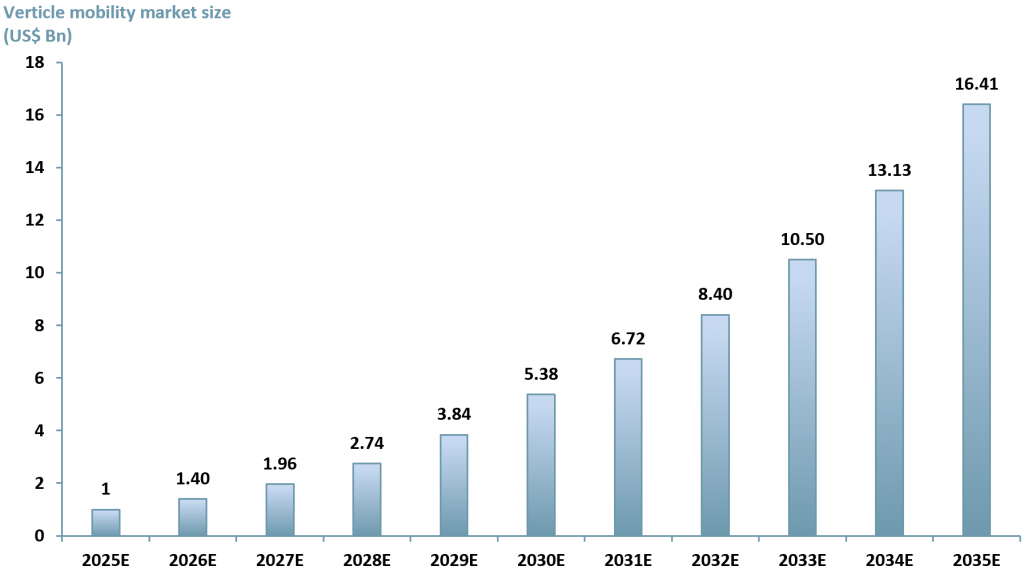

It is clear that those valuing flying taxis believe the market will be worth a lot more than ACF’s current investment research estimates suggest. We do not have an issue with the demand for the service or its usefulness, but we are cautious as to whether the size of the opportunity over the next two decades is sufficient for those manufacturing flying taxis (see exhibit 1 below).

- Currently ~300 companies are developing electric flying vehicles. Enhanced batteries and lightweight materials have increased the prospects for such flying taxi passenger vehicles.

- ~30 firms are engaged seeking approval / licences in the US with the Federal Aviation Administration (FAA).

- Lilium’s flying taxi business is not alone – other companies that have merged with SPACs are heading for the public markets.

- Joby Aviation (valuation US$ 7bn), which acquired Uber’s flying car business is backed by Toyota and is planning commercialisation for 2024.

- Archer (valuation US$ 4bn), also listing via a SPAC, intends to take off by 2024. The developer already has a US$ 1bn deal with United Airlines ($UAL:Nasdaq) for the provision of 200 five-seater ‘taxicrafts’.

- Other players include China’s eHang (EH: NasdaqGS) – close to certification, and Europe’s Volocopter – backed by Daimler ($DAI.DE, $DDAIF:OTC), Geely ($0175.HK, $GELYF:OTC), Intel ($INTC:Nasdaq) and DB Schenker – planning to fly by 2023. UK start-up Vertical Aerospace, Hyundai and Airbus are close behind.

Like autonomous robots, another fiction that was possible only on screen is coming to life. Once the first flying-cars take off commercially, the market will likely experience rapid expansion, but will it be enough for those manufacturing flying taxis? The benefits of VTOL taxis are manifest, and like autos and aircraft, the industry will very probably consolidate to only a few players globally.

Challenges – One of the challenges is likely to be infrastructure. Finding take-off and landing sites in cities will be a challenge, the older the city, the harder this will be. This suggests that the market for flying taxis will develop most aggressively in the US, China, India and parts of Africa and that Europe will be left behind.

Competition – In the flying taxi market, competition may come from passenger drones, which are likely to be more suitable for European cities. No doubt other competitive innovations for the flying taxi market will arrive in due course.

Risks – There is a significant fly in the ointment of this exciting new market – the cost of raw materials.

Our concern lies in the sustainability of these types of projects. Will the materials required to build and power an emerging flying taxi market opportunity remain affordable for any but the wealthiest? Will the price rise in green metals kill the flying taxi market opportunity before it actually materialises?

Unless flying taxi manufacturing companies can also innovate the material science required for such vehicles, current market drivers suggest that the type of green metals required for these vehicles will become too expensive.

A trillion-dollar market? ACF’s highly conservative forecast 5-yr CAGR for the global flying taxi market is 40% from 2025 to 2030 at which point we infer the global market will reach a value in excess of US$ 5bn (exhibit 1). In contrast to ACF’s investment research forecasts for the flying taxi market, the global aircraft market is forecast to reach ~US$ 3trn by 2026, according to European manufacturer, Airbus. The global autos market is expected to reach ~9trn by 2030 according to market consensus data from PwC.

If we assume 10% of global auto market revenues will come from the land based taxi market (in time), then a ~trillion dollar market for flying taxis still looks demanding. So, though we have been conservative in our forecasts, the trillion-dollar flying taxi market looks some way off.

Exhibit 1 – Projected global vertical mobility market size 2025 – 2035

Source: © ACF Equity Research; Porche Consulting

Source: © ACF Equity Research; Porche Consulting

Instead, in our forecasts between 2030 – 2035, ACF projects a much slower growth rate due to a rise in demand for basic materials (green metals) and so their prices. Flying taxi developers are going to compete against the electric vehicles production market both for sales and for basic materials (by 2035 automakers have to have substituted the existing range of petrol/diesel cars globally with EVs).

Although we reach a market value for flying cars of over $16bn by 2035, it might not be enough of an opportunity to keep the scale players interested for long. There also remains the question of infrastructure. The infrastructure that would allow for ubiquitous electric vehicles is still not in place and that is a market where regulation is indirectly imposing infrastructure targets – all new autos have to be electric by 2035.

Battery powered flying taxi infrastructure, would most likely use an extension of the EV charge grid – when it finally arrives.

The reality may well be that congestion in mega-cities, even with EVs, means that governments fund the flying-taxi market even if the private/free market opportunity is simply not attractive enough.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team. See Anda’s profile here