EU fuel taxation and aviation – the beginning

EU fuel taxation rule will extend to aviation from July 2021 – this is just the beginning. The revision of the fuel taxation rule is designed to help the EU meet its net-zero target by 2050. It affects the transport sector in different ways.

- The EU aviation industry has been exempt so far from fuel taxation. This is about to change with the EU’s proposed kerosene tax from July.

- Besides aviation, the EU is expected to extend the fuel taxation rule to capture the shipping industry.

- Aviation, shipping, and automotive industries will have to plan for further taxation. Besides the revision to EU fuel taxation, the European Emissions Trading Scheme (EU ETS) is slated for reform to capture these three high CO2 emitting transportation sub-sectors.

- Other currently exempt industries that could be targeted by the revised EU fuel taxation rule are agriculture, coal and diesel production. For the energy production sub-sectors at least, the EU intends to build a 10-yr ramp to gradually increase minimum fuel taxes.

- We expect the aviation industry to face continuing financial challenges post C-19. A fuel tax increase for aviation is a structural cost increase, and that is not a good sign for investors. Aviation companies are notoriously vulnerable to fixed costs – indeed, much of the emphasis in aviation has been to make costs variable rather than fixed.

We are not arguing that aviation should be exempted from the drive to green our energy consumption and reduce emissions. Aircraft account for ~2.5% of annual global CO2 emissions, according to some research groups (Our World in Data, 2021).

Climate change regulations are pushing for most sectors to achieve net zero emissions by 2050. In our view, these regulations have made a significant contribution to the surge in investor interest in rewarding sustainability as seen in the 2021 explosion in ESG interest. ACF ran a series of one-2-one briefings for c-suite executives during 2019 and 2020, providing counsel on how to prepare for this explosion in investor interest in ESG/sustainability).

The implications of the EU fuel taxation rule extension for the aviation and automotive industries are:

- Increasing travel costs to the end client – EU ticket prices for commercial flights could rise 10-30% as a result of increased fuel taxation plans. Without a compensating effect, such as substantial cuts in airport taxes, this will serve to create a new round of airline bankruptcies through: a) greater fixed costs and; b) lower traveller demand. European routes are under particular pressure as the train is both more environmentally effective and time efficient (you can work on a high-speed train).

- Adopting biofuels or alternative fuels instead of kerosene and diesel – the substitute fuel for aviation could be hydrogen. Biodiesel and or electricity seem the most obvious answer for the automotive industry and are already clearly baked into the business strategies of the large car manufacturers.

- Capex requirements – aviation engine makers are going to require substantive new capex to speed up production and innovation of aero engines. If the aviation industry, at least in terms of medium to short hall, is going to survive the sustainability drive, aero-engine manufacturers will have to make their contribution relatively And fast usually means more expensive. Aviation, in turn, will have to factor in longer payback times on their fleet orders and or lower margins on their operations.

In our assessment, trains are a substitute good, at least for short to mid-haul business travel flights. We see further stimulus to the high speed train industry and investment in railway infrastructure across Europe.

In the UK HS2 and related investments may look like a white elephant now, but as sustainability calculations come to the forefront, it may well be seen by future generations as one of the best investments the UK ever made (if it happens).

Though our research suggests the aviation industry is facing a period of significant upheaval, we do not discount the sectors’ drive to succeed and innovate.

Aviation body, Airlines for Europe (A4E), has € 169bn worth of investment plans for greener aircraft technologies over the next 10 years. A4E has aircraft in mind that should be 25% cleaner and less noisy than their predecessors. (International Tax Review, 2020).

EU structured programs to support both the airlines and automotive sectors could enable them to transition to green flights and trips without an industrial collapse.

In the UK, Ofgem has initiated a two-year £300m electric vehicle investment plan to deliver:

- more than 200 low carbon projects in electric transport;

- 1,800 new ultra-rapid charging points for the UK motorway network.

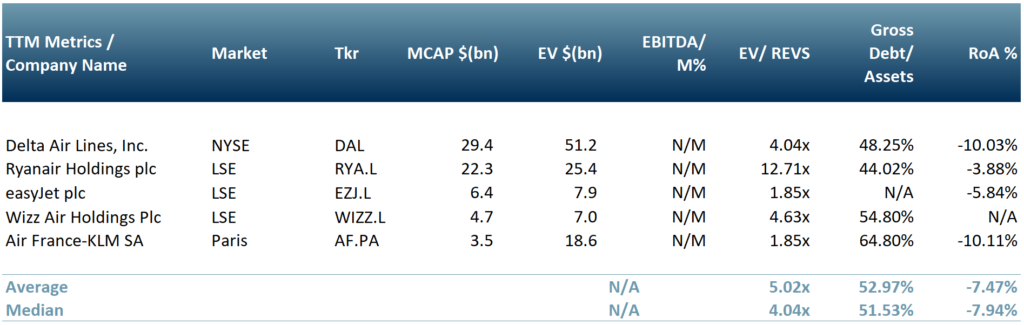

In Exhibit 1 and 2 (below) we show a peer group of commercial airline companies and their performance so far for YE20/21A. Note the decline in valuations between May and July, even though there is a push by governments to return or open travel economies.

Exhibit 1 – Peer group of US, EU and UK commercial flight airlines as of 24 May 2021

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com): GBP vs USD 1.4141; EUR vs USD 1.2183.

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com): GBP vs USD 1.4141; EUR vs USD 1.2183.

Exhibit 2 – Peer group of US, EU and UK commercial flight airlines as of 12 July 2021

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com): GBP vs USD 1.3858 EUR vs USD 1.1842

Source: ACF Equity Research Graphics; Exchange Rate: (Source: XE.com): GBP vs USD 1.3858 EUR vs USD 1.1842

Aviation recovery – it is not all economic gloom for transport. In spite of our concern for investors in the shorter term, both airlines and autos have shown incredible historical resilience – we are, for example, expecting a ‘change of names’ and business strategies rather than the disappearance of the short and mid-haul aviation industry.

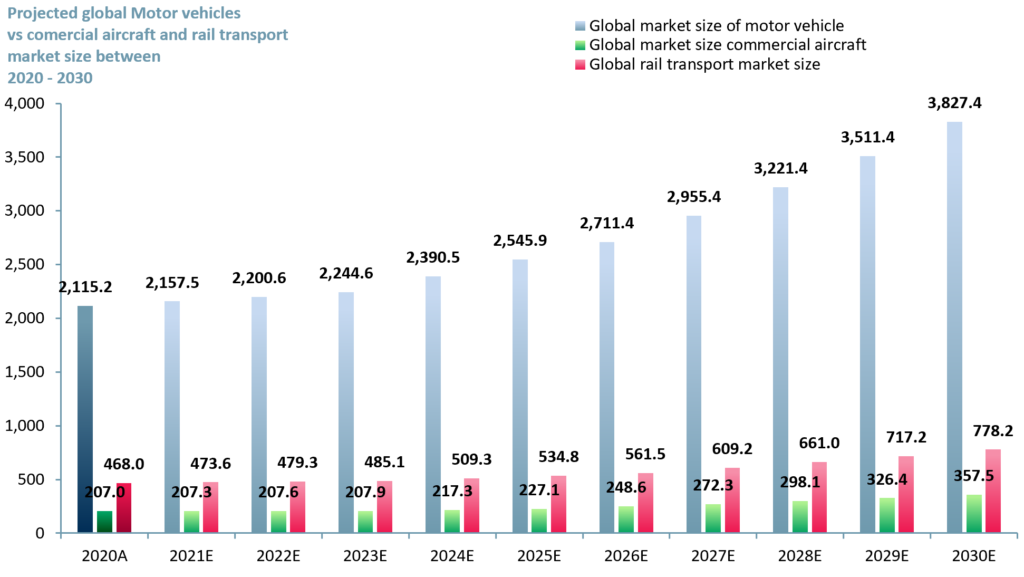

In spite of the short-run challengers and possible revolutionary forces in air and auto travel, we project the global commercial aircraft market will grow from US$ 207bn in 2020A to US$ 207.9bn in 2023E, up 0.15%.

We expect the aviation market to accelerate from 2024E to reach a value of US $357.5bn in 2030E, a CAGR of 5.62%. The high likelihood of the adoption of a ‘health’, ‘green card’ or ‘common pass‘ globally will most likely reinvigorate demand for both business and leisure travel. (see Exhibit 3 below)

Rail transport – no dent to the second golden age hypothesis – in the short run we expect rail to continue to suffer severe impacts due to C-19, at least until 2022. In the short run we also expect a degree of inertia based upon a fear of enclosed spaces and C-19 infections (vaccinated or not, Covid is at the very least a highly unpleasant condition).

We base our rail assumptions on pandemic rail statistics evidencing significant decreases in rail passenger numbers.

Due to pandemic lockdowns and travel restrictions, both national and international rail travel declined sharply. For example, in Sweden, rail passenger numbers dropped by 60% in Stockholm and 40% in other parts of the country. In the UK, rail passenger numbers declined more than 75%.

Nevertheless, we believe the railway industry can see the opportunity we can see as social, political and economic pressure mounts on aviation and autos. In the short run we forecast growth below GDP for the global rail transportation market, reaching US $485.1bn 2023E, a 2-yr CAGR of 1.2%.

Post 2023 we expect an inflexion point signalling the start of a more rapid growth phase underpinned by increasing capacity and speed, and a change in travel culture favouring rail transportation over short and long haul flying in particular, but also over autos.

Our forecast for the rail transportation market growth by 2030E is US $778.2bn. In the first phase we expect rail transportation to grow at a CAGR of 5% until 2026E followed by a CAGR of 8.5%. These stages are driven largely by the implementation and deployment of more and better high-speed train technology coupled with changing travel attitudes and changing travel economics. (see Exhibit 3 below)

Autos are not going away – we expect the global motor vehicles market (autos) to grow from US$ 2,115bn in 2020 to US$ 2244.6bn by 2023E, at a CAGR of 2%. We are modelling a) pent-up demand for new cars created as a result of lockdowns and travel restrictions vs. b) consumer uncertainty about whether to buy diesel, petrol, electric or hybrid or to delay capital purchases in autos.

It is likely that the current round of car and van fleet purchasing decisions marks the penultimate round before the choice, at least in Europe and China, is electric only.

ACF Equity Research estimates that the automotive market will reach US$ 3827.4bn by 2030E a 9-yr CAGR of 6.1%. (see Exhibit 3 below)

Exhibit 3 – Projected global motor vehicles market vs commercial aircraft vs rail transport market size between 2020 – 2030

Sources: ACF Equity Research Estimates; Research and Markets; * Note that average rail transport market size is based upon number of enterprises and average revenue per enterprise, and number of employees and average revenue per employee.

Sources: ACF Equity Research Estimates; Research and Markets; * Note that average rail transport market size is based upon number of enterprises and average revenue per enterprise, and number of employees and average revenue per employee.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team See Anda’s profile here