Future outperforming subsectors in pharma

Oncology, immunology & neurology will outperform the overall pharmaceutical sector over the coming decade. Innovation will drive this out-performance.

- IQVIA estimates annual spending on oncology and immunology will reach US$ 273bn and US$ 175bn respectively, with over 100 new oncology drugs launched by 2025E.

- A recent report by the IQVIA Institute for Human Data Science estimated that the oncology and immunology sectors would grow at a CAGR of 9-12%, compared with an average of 5% growth on many other diseases.

- Of the top 20 bestselling drugs in 2020, 13 were oncology and immunology drugs with the top sellers being Humira, Keytruda and Revlimid, produced by AbbVie (NYSE:ABBV), Merck (NYSE:MRK) and Bristol Myers Squibb (NYSE:BMY), respectively.

- Another area showing potential for large growth is neurology, with new potential treatments for Alzheimer’s and Parkinson’s disease causing a surge in spending.

With technology continuing to drive innovation, we assess that the Pharmaceuticals sector shows accelerated growth potential over the coming decade. Within this sector we highlight three expanding, stand out sub sectors for growth: oncology, immunology and neurology.

All three areas are showing an increase in the prevalence of the diseases associated with these specialist areas of treatment. These diseases and the means to treat them are associated with increases in life expectancy and growth of disposable income, itself a global trend (viz India and China).

Oncology Market:

Oncology is the study and treatment of cancer. This is a growing market and is the leading cause of deaths worldwide.

The main driver for the rapid growth in treatments in the oncology market is biomarker driven therapies, or precision medicine. Precision medicine focuses on individual variations in genetics to provide clinicians with information about which drug to prescribe and the most effective dosage for each individual patient.

Precision medicine is in contrast to the current “one size fits all” approach, which is less effective than was once hoped. For example, Keytruda (a treatment to help fight a number of cancers including lung, skin and colorectal cancer developed by Merck (NYSE:MRK)) benefits only one in six patients when prescribed using a “one size fits all” approach.

Driving precision medicine is a DNA sequencing technology referred to as Next Generation Sequencing (NGS). Rapid advances in NGS technology have led to sequencing of an entire human genome in one day vs the broadly 10 years taken to sequence the first human genome. The technology was first developed in the 1970s. With R&D investment continuing to grow, the cost of this technology is rapidly falling, allowing for the use of NGS in more areas and by more companies as the cost barrier to entry is lowered.

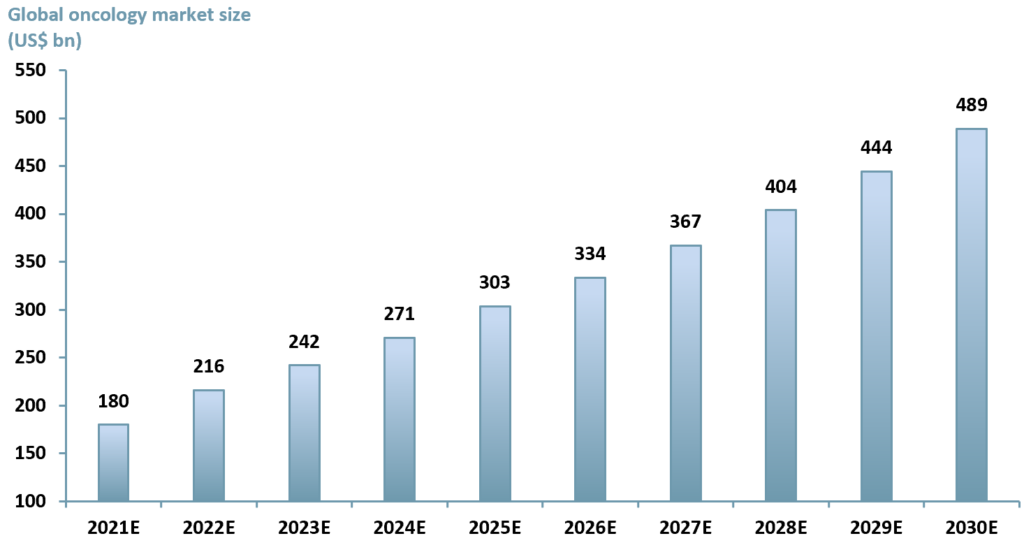

We estimate the global oncology market will grow to US$ 489bn by 2030E at a CAGR of 12.5% over the forecasted period. We have created a three-factor decelerating growth model in which initial growth in 2021E and 2022E is 20% as the market recovers from C-19 with clinical trials and research returning to pre-covid procedures (exhibit 1).

Between 2023E – 2025E we estimate a CAGR of 12% as the technology continues to expand the market and the effect of the C-19 pandemic passes. This is followed by a lower CAGR of 10% between 2026E – 2030E as the rate of new opportunity generation falls and consolidation (M&A) leaves the market with a smaller number of more dominant players delivering proven treatments.

Exhibit 1 – ACF forecast for growth in the oncology sector 2021E – 2030E

Sources: ACF Equity Research Estimates; Business Wire; McKinsey & Co; The Business Research Company

Sources: ACF Equity Research Estimates; Business Wire; McKinsey & Co; The Business Research Company

Immunology

Immunology is the study of the immune system and focuses on developing treatments that assist the body’s immune system in fighting diseases. Immunology is used to treat autoimmune diseases, allergies and cancer, and to help improve the success rate of organ transplants.

There are two main areas that are driving growth in the immunology sector – Monoclonal antibodies (mAbs) and biosimilars:

- Monoclonal antibodies (mAbs) – growth driver is the increased adoption of mAbs and the new treatments under development. (A potential growth dampener in mAbs adoption is the growth in prevalence of biosimilar drugs, which we expect to continue over the next decade).

- mAbs are immune system proteins designed to work in a similar way to natural antibodies, one of the body’s main barriers of defence against disease, and make up ~75% of immunology drugs. They bind to diseased cells to either make them inactive or mark them for destruction by the immune system (immunotherapy). mAbs is an innovative technology (a type of precision medicine) that is allowing for the creation of products to treat a wide range of diseases and disorders such as numerous types of cancers, arthritis, skin disorders, lupus etc. This ability of mAbs to address new conditions and diseases is the major driver for growth in the sector.

- Biosimilars – these are biological drugs (drugs made from proteins in a living system such as bacteria or yeast) that are produced using the same starting material and same process as another, already licensed biological drug. The purpose of biosimilars is to make the process for drug production easier (i.e. by copying an existing treatment) and hence cheaper for producers and patients.

When a biological drug is first created, a company can apply for a patent as the drug meets the requirements of being new, inventive (not simply a modification of something) and capable of industrial application. In the UK and US these patents last 20 years with the option of a 5-year extension in the US. Once the patent expires, biosimilars can then be created. However, biosimilars themselves cannot be patented as they are simply a copy of an existing drug.

With patents of some of the largest immunology drugs due to expire soon (e.g., Humira in the US market in 2023) the number of biosimilars will increase. This is a potential growth restriction on the pace of mAbs development.

When the patent expires on a drug, revenues and the NPV of the drug typically fall by 80-85% in the first year after patent expiration. This revenue effect is sometimes referred to as the ‘patent cliff’.

Neurology Market

Neurology is a branch of medicine that looks to identify and treat disorders that affect the central nervous system (CNS). Common neurological disorders include Alzheimer’s and Parkinson’s disease.

Although currently a smaller subsector than oncology and immunology, neurology is showing signs of a potential ramp up in growth and value. A recent discovery by a research collaboration, co-led by University of Queensland, in Jan 2021 identified the structure of the protein which they believe causes many neurodegenerative diseases such as Parkinson’s and Alzheimer’s disease.

This Queensland led protein discovery will assist pharmaceutical companies in designing and manufacturing treatments, of which there are currently none, for preventing some or all of these well-known neurodegenerative diseases.

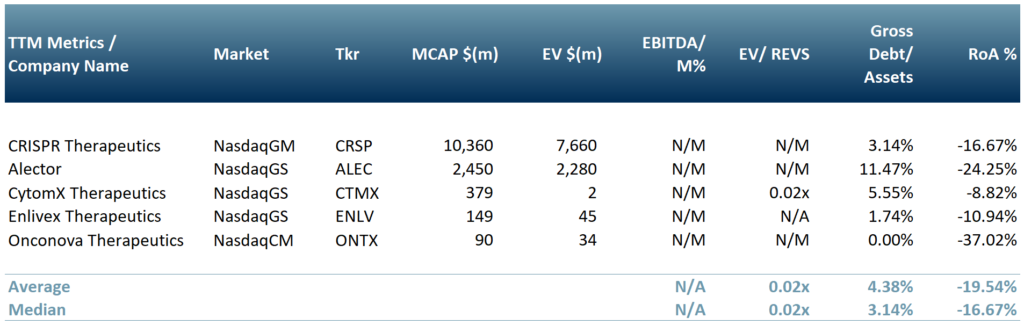

Exhibit 2 shows five companies currently working in the immunology, oncology or neurology sectors. This includes CRISPR Therapeutics (NasdaqGM:CRSP), Alector (NasdaqGS:ALEC), CytomX Therapeutics (NasdaqGS:CTMX), Onconova Therapeutics (NasdaqGS:ONTX) and Enlivex Therapeutics (NasdaqGS:ENLV).

Exhibit 2 – Peer group of companies currently operating in the oncology and immunology sectors $CRSP, $ALEC, $CTMX, $ONTX, $ENLV

Sources: ACF Equity Research Estimates; Fortune Business Insights

Sources: ACF Equity Research Estimates; Fortune Business Insights

We estimate the subsectors of oncology, immunology and neurology will be the areas which show the most growth and innovation over the coming decade. Investors might consider using a top-down research approach when attempting to identify investment candidates in these three pharma/biotech subsectors. In our assessment, these sectors show some potential for investment out-performance, possibly even supernormal returns over perhaps a decade.

Authors: Sam Butcher and Renas Sidahmed – Sam is a Junior Staff Analyst and Renas is a Staff Analyst and part of ACF’s Sales & Strategy Team at ACF Equity Research. See their profiles here