Healthcare’s digital revolution and FIT

Covid-19 has disrupted Healthcare, and has lead to a new era of innovation – improving diagnostics, lowering healthcare costs (Telemedicine, drug pricing reviews, investor interest reignited), and helping patients.

Key points:

- 3Q20 showed a boom in venture-capital-raising for medical innovation of US$ 8bn worldwide, double the amount from 3Q19.

- In 2018, global health spending accounted for 9.8% of GDP in the UK and 16.9% in the US. (OECD, 2019)

- Demand for digital health is booming. The share of remote visits at the Mayo Clinic, an American health provider, rose from 4% before the pandemic to 85% at the peak. Ping An Good Doctor, a Chinese portal, had 1.1bn visits during the height of the pandemic. (The Economist, 2020)

- On November 17th 2020, Amazon announced it will enter the online pharmacy market (positive read-through for the nutraceutical market).

- According to HolonIQ (a multinational research firm), the industry’s unlisted “unicorns”, which are worth US$ 1bn or more apiece, have a combined value of over US$ 110bn.

Covid-19 has forced a transformation upon a sector that was historically slow to adopt change.

Digital technology has established a shape changing role in the healthcare sector. Healthcare still lags many sectors in its adoption of digitization. At the end of 2018, the healthcare sector had ~25% level of digitalization – behind banking, retail, autos and packaged goods.

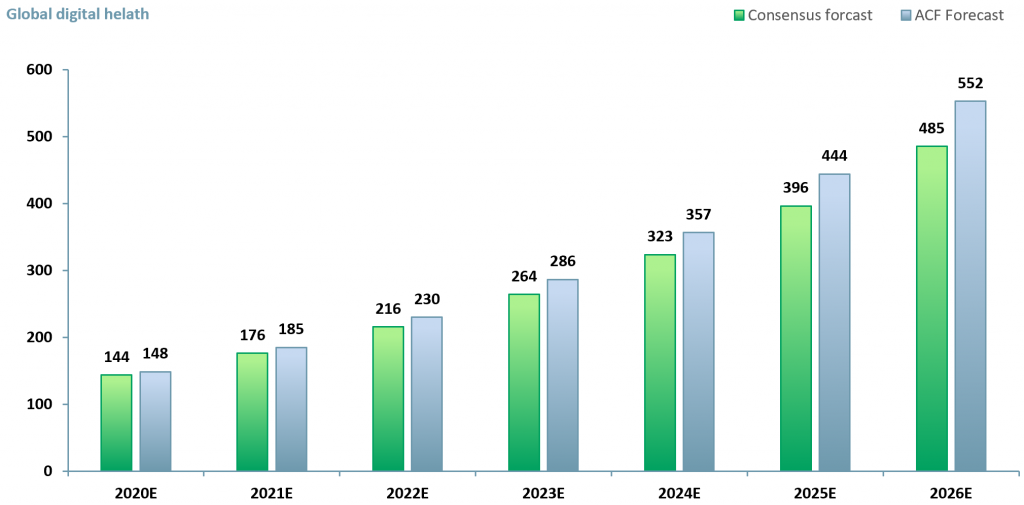

The global digital health market consensus forecast value is US$ 485bn by 2026E, a 5-yr CAGR of 22.5%.

In our view, the value of the healthcare market will exceed the consensus estimates. For ACF the drivers are innovation and a re-energised investor interest that is bringing the capital to fund innovation. ACF’s forecast CAGR for the global healthcare market by 2026E is 200 basis points higher at 5-yr CAGR 24.5% – leading to a global healthcare market value of US$ 552.5bn (exhibit 1 below).

Exhibit 1 – Forecast values for the global digital health market 2020E – 2026E

Sources: ACF Equity Research Estimates; Global Market Insights; Market Data Forecast; Grand View Research

Sources: ACF Equity Research Estimates; Global Market Insights; Market Data Forecast; Grand View Research

Covid-19 has disrupted the healthcare sector – several areas of healthcare have responded by finally embracing digital technologies. This has the potential to benefit many people, especially those who do not currently have access to healthcare.

Remote medical consultation services across the world are serving more ‘customers’. Doctolib, a private French firm, claims its video consultations in Europe have increased this year from 1,000 to 100,000 a day.

Doctolib raised US$ 170m in early 2019, after which it touted a unicorn valuation of US$ 1.13bn (EUR 1bn). Doctolib started as a ‘nearest doctor booking service) with the aim of moving into telemedicine, investors clearly thought it a good strategy and they have been proved right so far. Expect an IPO in 2021 – the attractions for management and early investors may be too much to resist.

Sensors, cloud computing and data analytics have become advanced enough to aid the healthcare sector. For example, Livongo Health Inc. (US) and Onduo (US) make devices to monitor diabetes and other ailments continuously.

Wearable tech is also seeing growing demand, as guided in our previous blog “Market opportunities in wearable tech”.

Big data is also trying to gain access to the market with Amazon and Alibaba announcing their entry into the online pharmacy market.

Google (IXIC:GOOG) is investing in the telemedicine company Amwell and has Verily, its life-science division. Apple (IXIC:AAPL) already has ~50,000 iPhone health apps along with its Apple Watch. Fitbit (NYSE:FIT) also has a large market share in wearable tech.

In Exhibit 2 below, we have created a peer group table of the most notable big tech companies that are attempting to enter the global digital healthcare market.

Amazon.com (Nasdaq: AMZN) is entering the online pharmacy market along with Alibaba (IXIC:BABA); Alphabet (IXIC:GOOG) is investing in the telemedicine market; Apple (IXIC:AAPL) is in the wearable tech market; Fitbit, Inc. (NYSE:FIT) is in the wearable tech market.

The winners and losers – Fitbit (FIT) in our peer group below is an interesting case – in 2014 its market share by units shipped of wearable technology was 37.9% and Apple’s (AAPL) was, well uncountably low.

By 2019 Fibit’s market share had fallen to 4.7% and Apple’s had risen to 31.7%.

Looking at the market in more detail it is a reasonable inference that Fitbit has been losing market share directly to Apple but also to almost every other player in the wearables market space.

Fitbit’s revenues YE14A were US$ 745m, they peaked at US$ ~2.2bn in YE16A and had fallen to US$ ~1.4bn by YE19A.

YE20E so far suggests to us [ACF] that revenues for FIT will fall below $1.4bn with an operating loss somewhere around the US$ 360-400k range. FIT has not delivered positive EBIT in the last 5 years.

FIT’s share price has never recovered its IPO highs and since early 2017 has become a trading stock in the range US$ ~5.5-7.0…with a few scary exceptions.

Nevertheless it is not necessarily a one way journey for FIT. The wearable market will continue to expand.

FIT, though it has been through a painful period for investors, is now operating in a much bigger market and can at this point leverage off Apple’s marketing spend and wearables awareness.

Remember mobile phone manufacturers…Nokia went from world domination in the mobile handset market in 2007 to selling its much diminished mobile handset unit to Microsoft (MSFT) in 2014. MSFT disposed of the Nokia unit within 24 months.

Apple and Google were at the heart of Nokia’s demise – but Apple has also had its own share of near death experiences. There is hope for Fitbit.

Exhibit 2 – Peer group table of the big tech companies looking to get into the global digital health market

Source: ACF Equity Research

Source: ACF Equity Research

Although big tech has great potential to improve the healthcare system, the sector can do more to improve the livelihoods of patients.

Big tech companies should work in cooperation with traditional healthcare companies to improve the systems already in place and boost patient access to healthcare. Management consultant Mckinsey estimates that the virtual urgent care offering in the US could replace approximately 20% of all emergency room visits.

We believe that C-19 was the ‘nudge’ that the healthcare sector needed to change its ways. Technology not only has the potential to help treat symptoms but also to help prevent them. It can lower the strain on hospitals and local GPs and speed up diagnosis times drastically with the assistance of data and accurate sensors in everyday devices.

Will this digital technology drive in healthcare simmer down once the world is over Covid-19 or will it continue to thrive to become a trillion-dollar industry? In our view the latter outcome is more likely.

Authors: Sam Butcher and Christopher Nicholson – Sam is a Junior Staff Analyst at ACF Equity Research. Christopher is a founding executive, MD and Head of Research at ACF Equity Research. See their profiles