Hydrogen controversy

Reducing greenhouse gas emissions on a global scale is not an easy task – green hydrogen is one of the keys to a low emissions global economy. As a result of anti-natural gas bans in California and New York, over the past two years the US natural gas utilities have launched 24+ hydrogen projects.

Where substituting hydrogen for fossil fuels is an obvious choice for a cleaner carbon-free future, the controversy lies in the high costs of production of green H2. What is key is recognizing the long-term goals for atmospheric pollution / temperature change and the cost trends for H2 production. The long-term gains and the cost trends, in our assessment, mitigate controversy.

- Pilot programs in the US include Sempra subsidiaries San Diego Gas & Electric Co. and Southern California Gas Co. SoCalGas is developing the US’s first green hydrogen hub in Los Angeles.

- Using a blend of hydrogen and natural gas, is reassuring the large utilities companies that a transition to green hydrogen could be relatively painless, at least in part.

- Using hydrogen would prevent US gas utilities from trying to restrict business to only the least risky customers.

- Hydrogen could help ensure gas utilities can pay the dividends that are crucial to investors whilst raising capital for innovations, such as the infrastructure transition to a 100% green hydrogen network.

- Natural gas is increasingly subject to usage curtailments or bans (California anti-gas ban in 2021 and New York City in the same period has gnawed at natural gas companies’ confidence in their own futures).• Hydrogen, and green hydrogen in particular, is crucial to net zero targeting.

A controversy

According to BloombergNEF, hydrogen conversion will cost more than US $11trn in investment for production, storage, and transportation to meet about a quarter of global energy needs by 2050E.

Others take a glass is half full view: CPR Asset Management says that the global green hydrogen market is projected to be worth $11trn dollars by the same period.

On the other hand, approximately half of the world’s fossil fuel assets (estimated at ~$11trn) are in danger of becominh worthless by 2036E, as a result of the green energy transition (nature energy 2021). The incentive for utilities to divest from brown legacy assets is high.

In order to qualify as green (carbon-free) hydrogen, H2, must be split from water molecules by an electrolyser powered by renewable energy. Electrolysis is considered to be 70-80% efficient in extracting H2. The benefits and controversy of electrolysis include:

- Electrolysis of water (H2O) does not generate direct greenhouse gas emissions (Columbia, SIPA). Columbia | SIPA Center on Global Energy Policy | Hydrogen Fact Sheet: Production of Low-Carbon Hydrogen

- The electricity input must also come from a carbon free process, only then can hydrogen be called ‘Green’.

- The electrolysis approach will come at an increased cost, at least initially. Electricity provider Engie Green hydrogen production: how does it work? (engie.com) says that the design and build of electrolysers will have a direct impact on the cost of green hydrogen production. We accept this is true initially, but we also expect three drivers to lower costs:

a) Process and design innovation;

b) Marginal costs perhaps not tending to zero but certainly tending lower over time;

c) Economies of scale pushing down unit production costs.

The hydrogen blend solution

Blending hydrogen is another solution to carbon free emission and presents numerous advantages. It is less expensive than using pure hydrogen and blended hydrogen can be transported more easily using existing pipelines.

As pure hydrogen gas must be compressed at high pressures and is extremely combustible, to transport it would mean to rethink all the existing gas transportation and network delivery infrastructure.

But is a hydrogen blend compromise worthwhile?

Current hydrogen blends are composed of 80% natural gas and 20% hydrogen. A 20% hydrogen blend would still provide 6% to 7% total greenhouse gas emissions reduction (Bloomberg). Will Hydrogen Save U.S. Natural Gas Utilities? Investors Certainly Hope So – Bloomberg. However for blended hydrogen to make a difference to carbon emissions, the hydrogen element must come from a green hydrogen source.

6 – 7% does not seem like a lot, but if we do not start somewhere, we will not be engaging actively in the decarbonization of our planet. 20% of green hydrogen also creates a reduction of 7% emissions per year which, in our view, is a good start (Pardalote). Hydrogen in the Natural Gas Network | by Rosemary Barnes | Climate Conscious | Medium

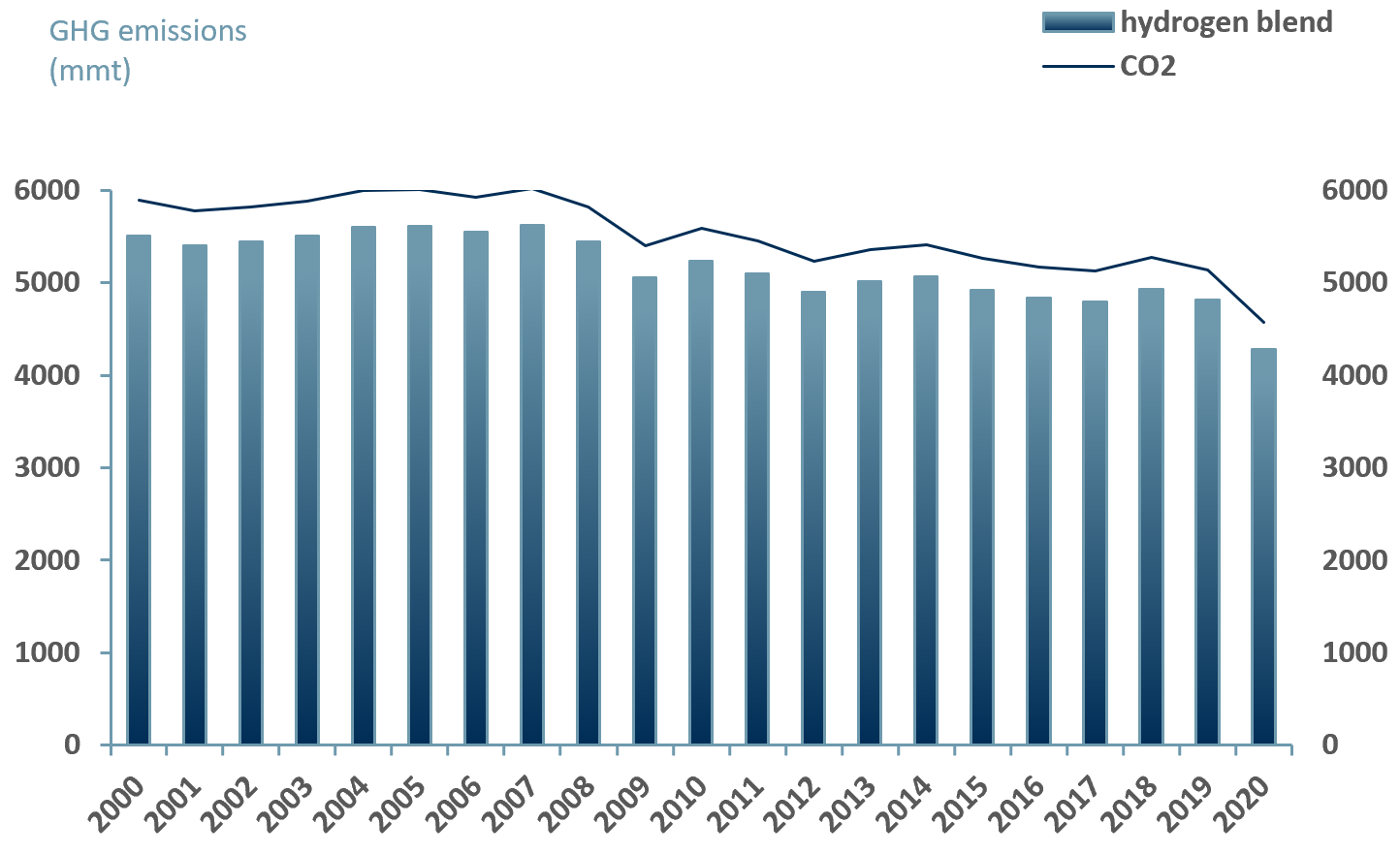

In Exhibit 1 we show what the greenhouse gas (GHG) emissions would have looked like if the world had started using an 80/20 hydrogen blend from the year 2000. On average, we projected a 6.5% decline in GHG gas emissions when a hydrogen blend is used versus CO2.

Exhibit 1- US greenhouse gas emissions: CO2 v. hypothetical hydrogen blend (mmt) 2000 – 2020

Source: ACF Equity Research Graphics; EIA.

Source: ACF Equity Research Graphics; EIA.

A small difference is still a difference

Using the simulation in exhibit 1 above we can see that the reduction in carbon dioxide emissions over 20 years would have been 7,551 mmt. The numbers may not look significant but at this late hour, a 7,551mmt reduction in CO2 looks like at least progress in the right direction.

The CO2 emissions reduction in the simulation amounts to ~76m cars off the road per year. In 2020A, there were ~108m registered cars in the US. The 76m makes up ~72% of the current number of cars on the road. This is significant.

Green hydrogen is currently not inexpensive, but solutions will emerge

Green hydrogen costs currently costs between $3/kg and $6.55/kg to produce, according to the European Commission’s July 2020 hydrogen strategy. We cannot ignore the current high production costs of green hydrogen (infrastructures costs, current production volume limits and how much can be blended into pipeline systems).

Nevertheless, governments and investors are awakening to hydrogen’s and particularly green hydrogen’s potential. President Joe Biden’s $1.2trn bipartisan infrastructure plan includes funding to build four hydrogen hubs in the US to test different ways to produce and use the gas.

BloombergNEF forecasts that green hydrogen electrolysis production process economics will improve and that by 2050E, green hydrogen production costs could fall to between $1 and $2/kg.

Rethink Energy estimates that the production cost of green hydrogen will fall from about $3.70/kg today to just over $1/kg in 2035E, and to around $0.75/kg by 2050E. We suspect the fall in production costs will be faster – we cite the development of solar panels and grid parity.

In the interim there is a very strong transition argument for using waste to energy (WTE) hydrogen generated from commercial and residential waste.

Hydrogen energy has enormous potential

The energy density of hydrogen is 142 MJ/kg makes the efficiency argument uncontroversial. H2 energy density is 3x greater than that of natural gas at 47.2 MJ/kg, methane at 55.5 MJ/kg and gasoline at 45.8 MJ/kg (The Geography of Transport Systems). https://transportgeography.org/contents/chapter4/transportation-and-energy/combustibles-energy-content/

Only by investing in the hydrogen industry, will we allow the sector to innovate and reduce green hydrogen and WTE hydrogen production and infrastructure costs.

Green hydrogen could help decarbonize heavy industry first, replace natural gas, and store renewable energy – this strategy represents a multitrillion-dollar market opportunity.

Investing now could deliver very significant returns on investment (RoI) over a decade and support the way to a net-zero future, with a commensurate RoI for humanity.

Authors: Anne Castagnede, Renas Sidahmed, Christopher Nicholson. Read their profiles here

Renas Sidahmed is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. Christopher Nicholson is a founding executive, MD and Head of Research at ACF Equity Research.

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)